Why the FASB accounting guidance is very bullish for Bitcoin

The immediate impact for MicroStrategy is known, but the second- and third-order effects are huge for Bitcoin adoption as a treasury asset

Before we get going:

If you’ve enjoyed my articles or content on Twitter (@Croesus_BTC), you’ll love my weekly Bitcoin newsletter, “Once-in-a-Species.”

1 post a week revealing why Bitcoin could be the key to growing your wealth this decade.

Get on the free email list to receive it: 👇👇👇

Okay, now on with our story…

In 2022, Michael Saylor enumerated what he sees as the three biggest systemic developments that will catalyze Bitcoin’s price appreciation going forward:

Spot Bitcoin ETF approval

Traditional bank custody of Bitcoin

Fair value accounting rules for Bitcoin on corporate balance sheets

On the surface, the third item seems out of place, insignificant. But accounting is the foundation of finance! (Note: I have a Master’s in Accounting from UT-Austin, so I am biased and have long-appreciated the importance of clear accounting standards to enable corporate adoption of Bitcoin.)

With the Financial Accounting Standards Board’s (FASB) recent decision to update its guidance for digital asset accounting, I decided to quantify the exact impact this would have on MicroStrategy and others. In doing so, I discovered that this is a much bigger deal than people realize... for reasons just under the surface.

This article will explain why the second- and third-order effects of fair value accounting treatment for Bitcoin create huge tailwinds for the normalization and adoption of Bitcoin as a treasury reserve asset.

Now I see why Saylor views this as one of the big three, and in a few minutes, you will too.

Current accounting standard

To-date, the established accounting guidance for digital assets has been to treat them as “intangible assets,” much like trademarks, copyrights, and brand value. This only makes sense as far as the label is concerned – you can imagine the original logic from years ago when digital assets were still completely foreign to most: “you can’t touch Bitcoin, so let’s bucket it along with other intangible assets.”

The problem with this is that the accounting standards for “intangible assets” require unrealized losses to be recognized as asset impairment (losses) in earnings statements, but do not allow for unrealized gains to be recorded as profits. (Accounting standards like this often arise out of a desire to impose conservatism and limit creative accounting – for example, you don’t want companies to claim their brand got more valuable all of a sudden, when really, they are masking operating losses for a bad quarter.)

In other words, if a company buys $1B of Bitcoin and then the market price drops such that the Bitcoin is now worth $700m, the company has to recognize a $300m loss on its earnings report. If, in the next quarter, the value of the same Bitcoin holdings soars to $1.5B, the company does not get to recognize any gains – instead, the balance sheet shows $700m of Bitcoin and $800m of unrealized gains from Bitcoin.

Current MicroStrategy situation

The company on the forefront of wrestling with this issue is MicroStrategy. Three years ago, MicroStrategy adopted a Bitcoin treasury strategy – they converted all of their dollars and other instruments into Bitcoin holdings.

The strategy has been tremendously successful. As Bitcoin’s value has grown, the value of MicroStrategy’s balance sheet has grown. In addition, as a profit-generating company, MicroStrategy continues to convert its quarterly profits into new Bitcoin holdings.

In effect, MicroStrategy is a Bitcoin holding company that also runs a Bitcoin-generating operating business.

But, the success of this strategy has suffered from the optics of the existing accounting standards. When Bitcoin’s price drops, MicroStrategy has to record impairment losses from Bitcoin markdowns.

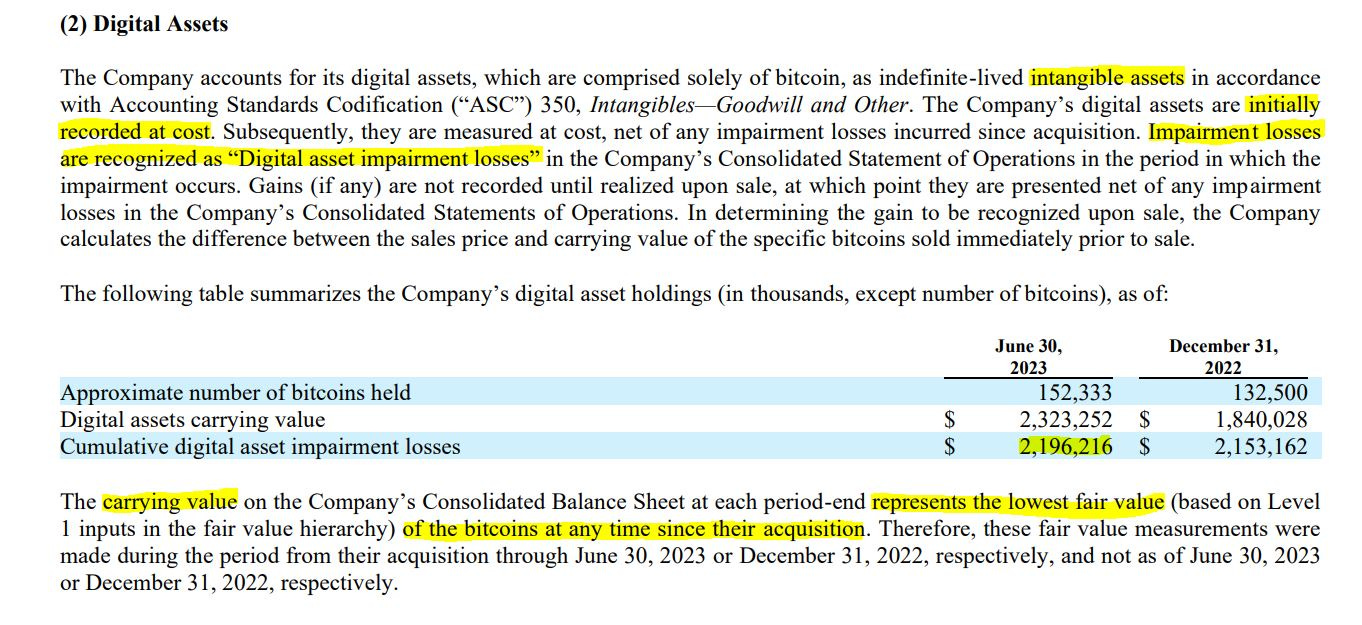

Cumulatively over the last three years, this has meant a ~$2B hit to earnings that isn’t real. It’s just from the one-sided accounting treatment of Bitcoin.

This image is page six from MicroStrategy’s most-recent 10-Q report. (The fun thing about accounting is that public companies tell you everything in their public filings. It’s all right there, but the only people who ever read quarterly reports are accountants and Wall Street equities analysts.)

This is where the second-order effects start to come in. These impairment losses from accounting treatment haven’t suppressed the stock price – the Wall Street analysts know how to adjust for them to properly value the underlying reality of MicroStrategy’s Bitcoin holdings. However, these impairment losses have still hurt in a different way.

Because of the way these impairment charges are calculated and flow to the earnings statement, MicroStrategy regularly reports quarterly and annual operating losses. In fact, here’s a Bloomberg headline from earlier this year: “MicroStrategy Posts Another Loss After Bitcoin Charge – Software firm has registered eight straight quarterly losses.”

The impact here is optics. In essence, the “intangible asset” accounting treatment of Bitcoin has forced MicroStrategy to look like a loser despite being one of the big winners of the last three years.

Long-awaited change to accounting standards

The big news is that the FASB, after years of petitioning from MicroStrategy and others, has voted unanimously to update its guidance for digital assets to require “fair value accounting”. This means that companies will recognize the unrealized losses and gains in their quarterly earnings reports.

From Bloomberg: “Under new rules expected to be published by year end, companies that hold or invest in cryptocurrency will be required to report their holdings at fair value, a measurement that aims to capture the most up-to-date value of an asset—including rebounds in value after prices dip. While the new standard will inject volatility into the earnings of companies that are heavily invested in crypto, the ability to record recoveries will be an improvement over the current practice.”

First-order effect: What this means for MicroStrategy

The obvious and immediate impact of this updated FASB guidance is that companies with Bitcoin treasury holdings get to mark up the value of their positions. Practically speaking, this means MicroStrategy will get to recognize ~$2B in gains to offset the cumulative impairment losses to-date.

It’s not clear if MicroStrategy will need to recognize this gain immediately, or if they can amortize the recognized gains over several quarters. If it was me and I had the option, I would opt to recognize $500M in gains for four quarters in a row… specifically because of what it would add to the second- and third-order effects.

Second-order effect: MicroStrategy narrative soars

If MicroStrategy is able to amortize their Bitcoin mark-ups over several quarters, they guarantee a string of strong earnings reports. Again, this won’t change anything in terms of their stock valuation – equities analysts know how to account for reality. However, it will change the narrative around MicroStrategy’s performance.

Imagine the buzz that will build if MicroStrategy reports a $500M gain for not just Q1 2024, but again for Q2, Q3, and Q4. Even though it will be clear that it’s because of a one-off Bitcoin accounting change, we can’t help but register a pattern of success.

Here’s where it gets crazy. Let’s say that the 2024 Bitcoin halving catalyzes a 2024-25 bull market, as I continue to expect will happen. If the price soars to ~$150k/Bitcoin (which I think is very possible), that would mean a ~6x in the value of MicroStrategy’s Bitcoin holdings.

With the new accounting standards, MicroStrategy would mark-up the value of their holdings accordingly each quarter. With ~$4B in Bitcoin holdings today, this could mean recording an average mark-up of $4B for five quarters in a row.

Depending on the timing of the bull market, this could mean MicroStrategy reporting an outrageous string of quarterly profits. MicroStrategy has a ~$5B market cap today. In this scenario, they could deliver ~8 quarters in a row of profits in the billions.

There’s no way around it, that becomes a big story. The financial media loves a splashy narrative, and MicroStrategy’s winning ways would be a magnet for attention. Everyone loves a winner, and everyone wants to copy winners.

Third-order effect: MicroStrategy’s Bitcoin treasury strategy becomes popular

If you’re a public company CFO or a CEO, you want to deliver added performance. It can cement your career and deliver you a fortune in performance bonuses.

Over the last three years, you’ve watched MicroStrategy suffer impairment losses. Their Bitcoin treasury strategy has looked a little crazy (even though it has worked to deliver stock performance).

But now, with the new FASB accounting standards combined with a Bitcoin bull market, MicroStrategy is suddenly a relentless winner. What is their edge? Can we copy that?

I don’t think that MicroStrategy’s approach will suddenly inspire a bunch of converts, but some will dip a toe. Depending on how loud and public MicroStrategy’s success is, it may even become a topic that CFOs and CEOs are pressured to consider.

What a change that would be from how Bitcoin has historically been viewed!

This shift would be a massive victory for Bitcoin – all because the FASB updated its accounting standards for Bitcoin from “intangible asset” to “fair value accounting.” And this would just be the latest chapter in Bitcoin’s ongoing journey to mainstream adoption.

Did you find that Bitcoin analysis informative? You have a choice now:

Leave this page & forget how to find my work again, OR

Receive 1 post like this a week on Bitcoin & the macro landscape: 👇👇👇

Feel free to share this post with friends, colleagues, or social media.

Fascinating insights on how this might play out for Saylor, and by extension the rest of corporate America. This to me is more interesting than the spot ETF and halving, because it could result in so much more potent psychological impact on that small demographic of corporate CEOs. It seems like this could potentially orange pill a lot of them... or at least, as you put it, pressure them to consider a bitcoin strategy much more seriously.

Thanks for clarifying this, I never fully understood what this meant!