Why Did Satoshi Create Bitcoin?

A closer look at the motivations & psychology of the hidden genius: Satoshi Nakamoto

We spend a lot of our time talking about Bitcoin in terms of what it is, what it can do, and why it might be an attractive asset to include in a portfolio.

But for folks who are only just beginning to learn about Bitcoin (or your friends and family who have yet to begin), it’s worth looking at things from a different angle to ask… why was Bitcoin created?

This topic is always in the background, but at a moment like this — with the global financial system straining in such a way that will soon necessitate large-scale money printing — it’s time to bring it to the fore.

The man

When I first got into crypto, I spent a good chunk of my time trying to figure out the real identity of the pseudonym, Satoshi Nakamoto. I have my short list of likely candidates — some living, some dead. But there comes a point in your Bitcoin journey where you stop trying to identify who this person is that could become the world’s first trillionaire.

Instead, you slowly let go of that desire to know and start to understand that Satoshi never wanted to mine a million Bitcoin for himself… what he wanted was to provide consistent hashpower to the network in order for Bitcoin to attract the participation it needed.

Thankfully, Satoshi sowed just enough doubt about his identity that he achieved a plausible deniability. I couldn’t figure out definitively who Satoshi was, which means most won’t either. And that is a beautiful gift to Bitcoin and to the world.

We could have had a figurehead. A person whose words the press and general public would place significance on that would be countervailing to Bitcoin’s essential governance model of decentralized consensus. Someone whose politics, affiliations, and past speeding tickets would be used against Bitcoin, to undermine and besmirch Bitcoin’s merit. I think Satoshi was smart enough to realize this, which is why he chose to veil his identity in the pseudonym of Satoshi Nakamoto.

What’s more, I think all his choices in creating this pseudonymous identity were meant to obfuscate and confuse. Satoshi writes with British spelling and slang, worked on Bitcoin during American working hours, and chose a Japanese name.

He knew what he was doing — he was fighting to keep his identity unknown, not for his own benefit, but for our benefit. He wanted Bitcoin to succeed, as he knew it could massively benefit everyone on Earth (with the possible exception of the current political & financial ruling class), and he knew that Bitcoin needed to be leaderless to do it.

Sometimes I think about how Satoshi must have been a big fan of V for Vendetta. You can picture him, at home on his couch in 2005 (three years before announcing Bitcoin), being moved by the film but inspired on a deeper level than the rest of us. He must have seen a path — a model to leverage — in the protagonist’s determination to cloak his identity behind a mask and in doing so, become more than a man — the manifestation of a cause, a mission, an idea.

At some point I stopped trying to find out who Satoshi is. I remember deciding instead to accept the mythos of Satoshi as no longer here, dead and gone. In time, this morphed into realizing this is something of a responsibility for all of us to propagate — to refer to him as dead — to participate in Satoshi’s desire to be gone.

I would later come to find that this is something of a mark of a true Bitcoiner — a milestone deep in the rabbit hole. We are all Spartacus, so that he is not.

The motive

To understand why Bitcoin was created, we have to establish the context of that time, and the history that led up to that moment.

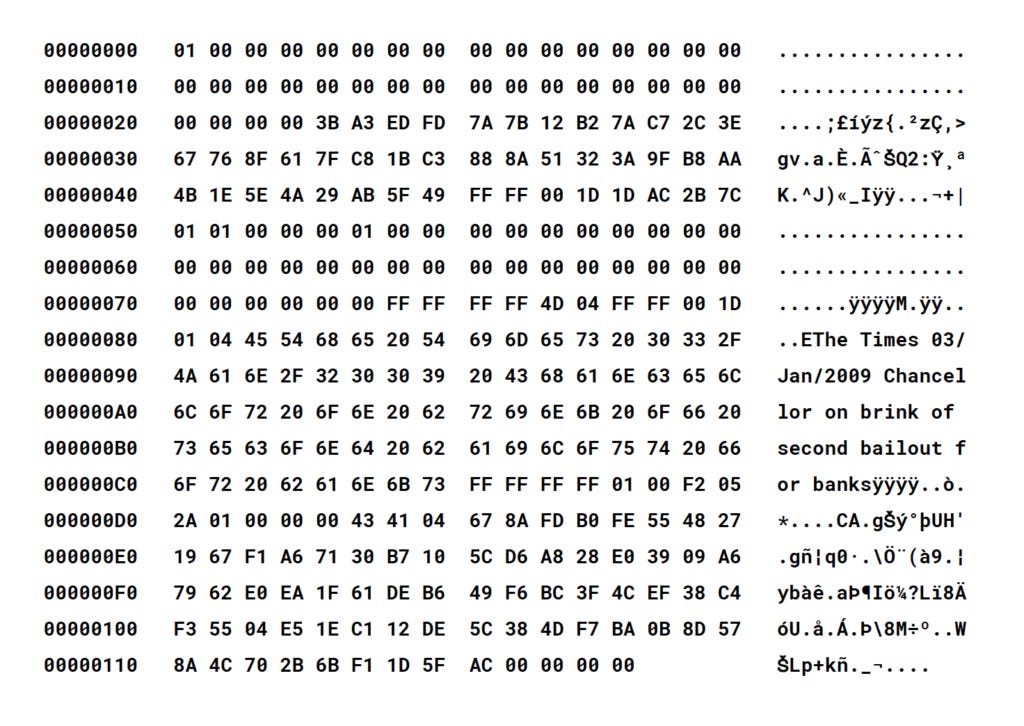

Bitcoin was launched on January 9th, 2009. In the very first Bitcoin block, Satoshi deliberately embedded a newspaper headline from that week: “Chancellor on brink of second bailout for banks”.

This was the Great Financial Crisis, the largest market calamity in generations. And the answer that politicians and experts landed on? Bailouts. Certain banks were deemed “too big to fail” and so they had to be saved, by printing money and handing it to these banks.

On the surface, that all seems reasonable. But what it actually meant was that certain mega corporations were granted protection by a select few in power from the consequences of their own business decisions. No more level playing field — privatized profits and socialized losses. Capitalism sullied.

What’s more, money is never simply printed out of thin air. Instead, what happens is that the purchasing power of all the existing money is redistributed. If there are 1000 dollars in the world, and you print 100 more, you take the existing purchasing power of that 1000 and now spread it over 1100 dollars. The original 1000 dollars now has the same purchasing power that 910 dollars used to have. In effect, printing that extra 100 dollars directly costs the existing holders 9% of their purchasing power.

That’s what new dollars are made of: purchasing power quietly stolen from ordinary people.

Whereas the Occupy Wall Street movement was an outraged reaction to the inequity and indirect theft of bank bailouts, Satoshi must have seen this coming. Bitcoin may have launched a few months into the Great Financial Crisis, but he had undoubtedly been working on this solution for years by that point. His was not a reactionary protest demanding change, transparency, and fairness. Instead, Satoshi’s was a proactive preparation of a system that would enforce change, transparency, and fairness by creating superior financial incentives for ordinary savers vs. the existing system.

The goal

Through Bitcoin, Satoshi aimed to end the unfairness of selective bank bailouts by making no bailouts possible at all, ever. In place of faux-capitalism, he would create a radical system of uncompromising and unflinching capitalism. Yes, it’s harsh, but the only way to prevent the abuse of preferential power is by making sure that nobody has that kind of power, Satoshi included.

In place of a system that benefitted those who are closest to the policymakers that control the money spigot (Cantillonaires, as they’ve been termed, in reference to Richard Cantillon, the 18th century economist who first described this phenomenon), Satoshi would have a system where the money spigot was pre-defined, finite, and distributed through an objectively fair global competition.

In place of a system that rewards those who gain access to more than their fair share of newly printed money, Satoshi would have a system that rewards those who simply hold their money over time. To actually reward savers! Truly, a revolutionary notion (and simultaneously shameful that it took humanity this long to come up with).

What this amounts to is a new paradigm — one where deflation is in the driver’s seat, rather than the inflationary rat race that we’ve been told is in all of our best interest (by those who benefit the most from inflationary money printing). A new system where money saved and safely stashed away actually grows in purchasing power over time (because of that money’s remarkable properties of increasing scarcity).

A money not for bankers and political insiders, but for hardworking everyday people. That’s what Satoshi wanted for the world. And that’s why Satoshi created Bitcoin.

Now all you have to do is choose which system you want to store your money in.

You can share this post with your friends, colleagues, or social media. Click here!

Did someone forward you this post? You have a choice now:

Leave this page & forget how to find my work again, OR

Sign up for this weekly Bitcoin newsletter to receive posts like this. My goal is to help you understand why Bitcoin could be the key to growing your wealth this decade: 👇👇👇

Fantastic article! Thank you! I think it's slowly catching on and the wave of central bank and (US) federal spending spree instigated inflation ought to wake people up to real sound money ₿.

Wonderful short article.