The Bitcoin Halving: 6 reasons why it matters A LOT

To get ready for April 2024, here are the 6 keys to understanding the Bitcoin halving & why it’s a huge deal

I celebrate Christmas and my birthday, but in my heart, what I’m really waiting for is the Bitcoin halving. This event happens once every four years and its magnitude is hard to overstate.

No other event comes close to the halving’s significance on the horizon, for the simple reason that each prior Bitcoin halving has launched Bitcoin’s price to new heights.

The hard part is understanding why & remaining steadfast on the long wait for the next halving.

Luckily, at this point, you don’t need to wait very long. The next Bitcoin halving is in April 2024. That’s just months away — which makes now the perfect time to learn why Christmas pales in comparison.

Here are the 6 keys to understanding the Bitcoin halving & why it’s a huge deal:

1. The Bitcoin halving means reduced supply issuance

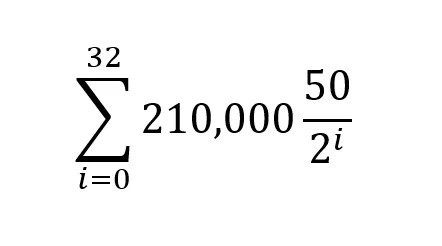

This is Bitcoin’s supply issuance schedule. What the hell does that mean? Well, the day that Bitcoin launched in January 2009… there were 0 Bitcoin in existence. Eventually, there will be a hardcapped, absolute maximum of 21M Bitcoin in existence. But how do you go from 0 to 21M?

The creator of Bitcoin implemented a very clever method – rewarding Bitcoin to whoever provides computational security to the network (“mining”). Even more clever, he designed this system to release half as much Bitcoin every four years.

That’s what a Bitcoin “halving” is — a moment in time when the rate of new Bitcoin issuance gets cut in half, permanently.

2. Immutable code means the halving is guaranteed

Hardcoded into Bitcoin’s protocol is this simple mathematical expression:

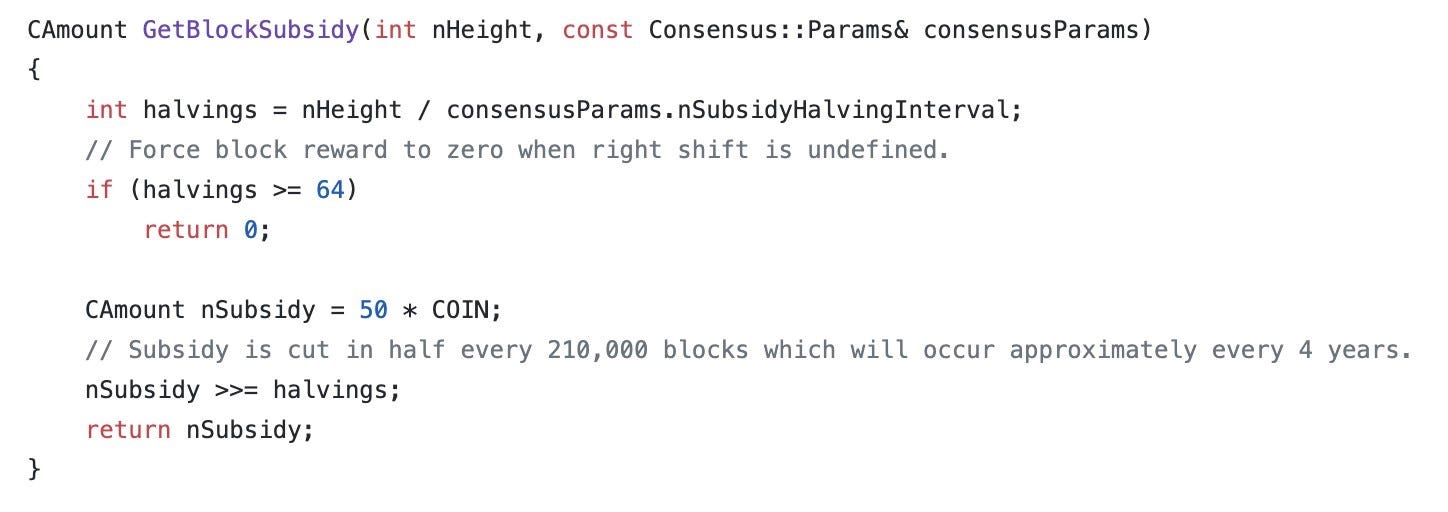

It doesn’t look like much, but it’s Bitcoin’s entire monetary policy — written in stone from Day 0. Here’s what this expression looks like in code.

Here’s what this function says. First, the code counts how many halvings have occurred. A halving is pre-set to occur every 210,000 blocks (~4 years, since there is a new block every 10 minutes on average).

Next, the amount of new Bitcoin to be issued for each new block is determined. This is calculated by dividing 50 by 2, for each halving that has occurred.

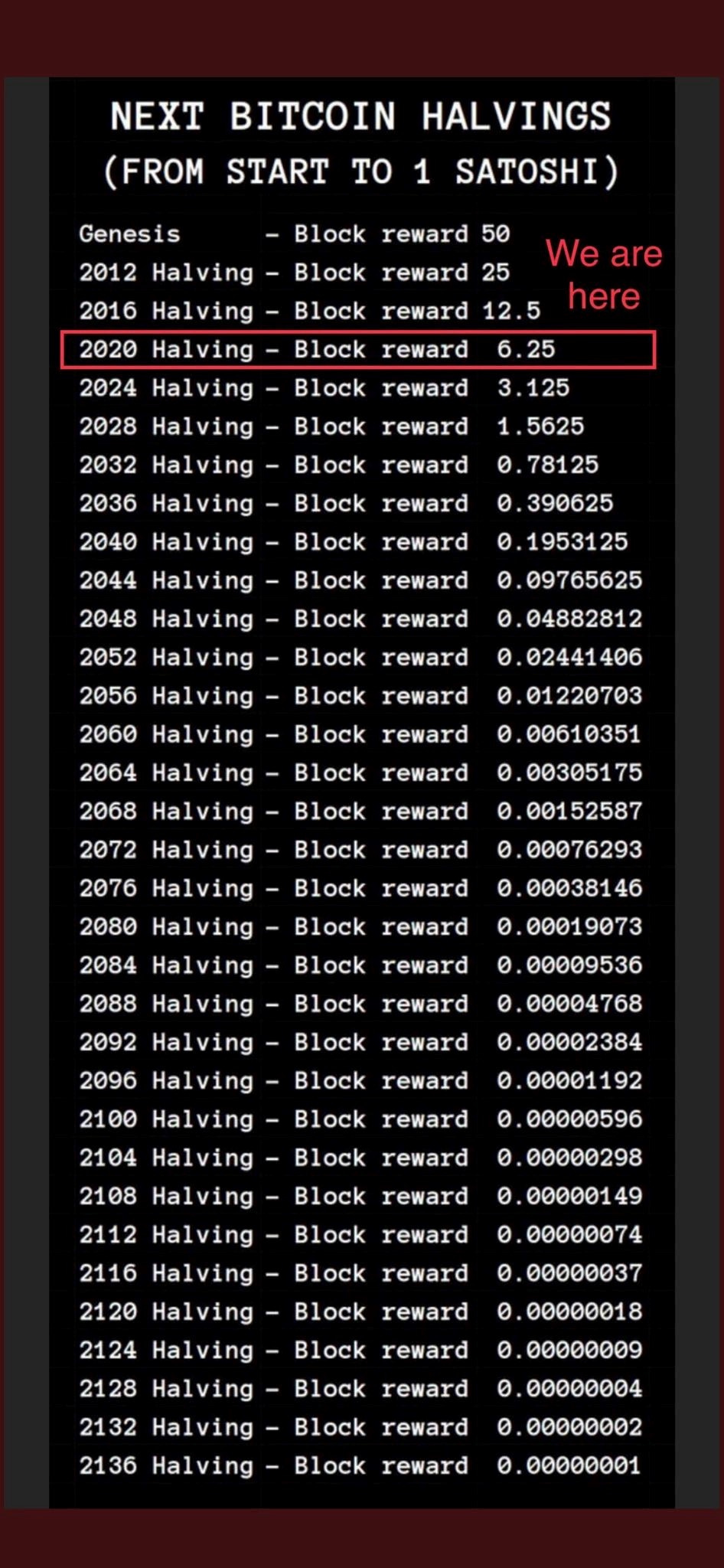

The result is that for the first 4 years, 50 new Bitcoin were issued to the miner of each block. After the first halving, 25 Bitcoin were issued per block until the next halving (4 years later), when it was cut to 12.5 Bitcoin per block.

And this pattern of decreasing Bitcoin issuance every 4 years continues until 2140, when no more Bitcoin will be issued ever again.

Right now, Bitcoin’s supply inflates by ~1.8% every year. In April 2024, the 4th halving will happen and suddenly, Bitcoin’s supply inflation will drop to 0.9% per year.

This will make Bitcoin a “harder” asset than gold, whose supply grows 1.5-2% every year from global gold mining efforts.

3. Perfectly inelastic supply

It’s one thing to say that Bitcoin is becoming a “harder” asset, one quadrennial “halving” at a time. But, it’s another thing to realize just how unwavering this is.

With every other commodity, you can always make more. If the price of diamonds, gold, silver, oil, or sugar were to 10x overnight, that would create massive incentive for producers to go mine, refine, or grow more of that commodity. (And indeed, that is what tends to happen when any particular commodity spikes in value, as the free market rises to the occasion.)

But this is not the case with Bitcoin. No matter how badly anyone wants to create more Bitcoin, they can’t.

The supply side of the supply-and-demand equation is completely indifferent to demand. To use the Econ 101 term, supply is “perfectly inelastic.”

What does that look like?

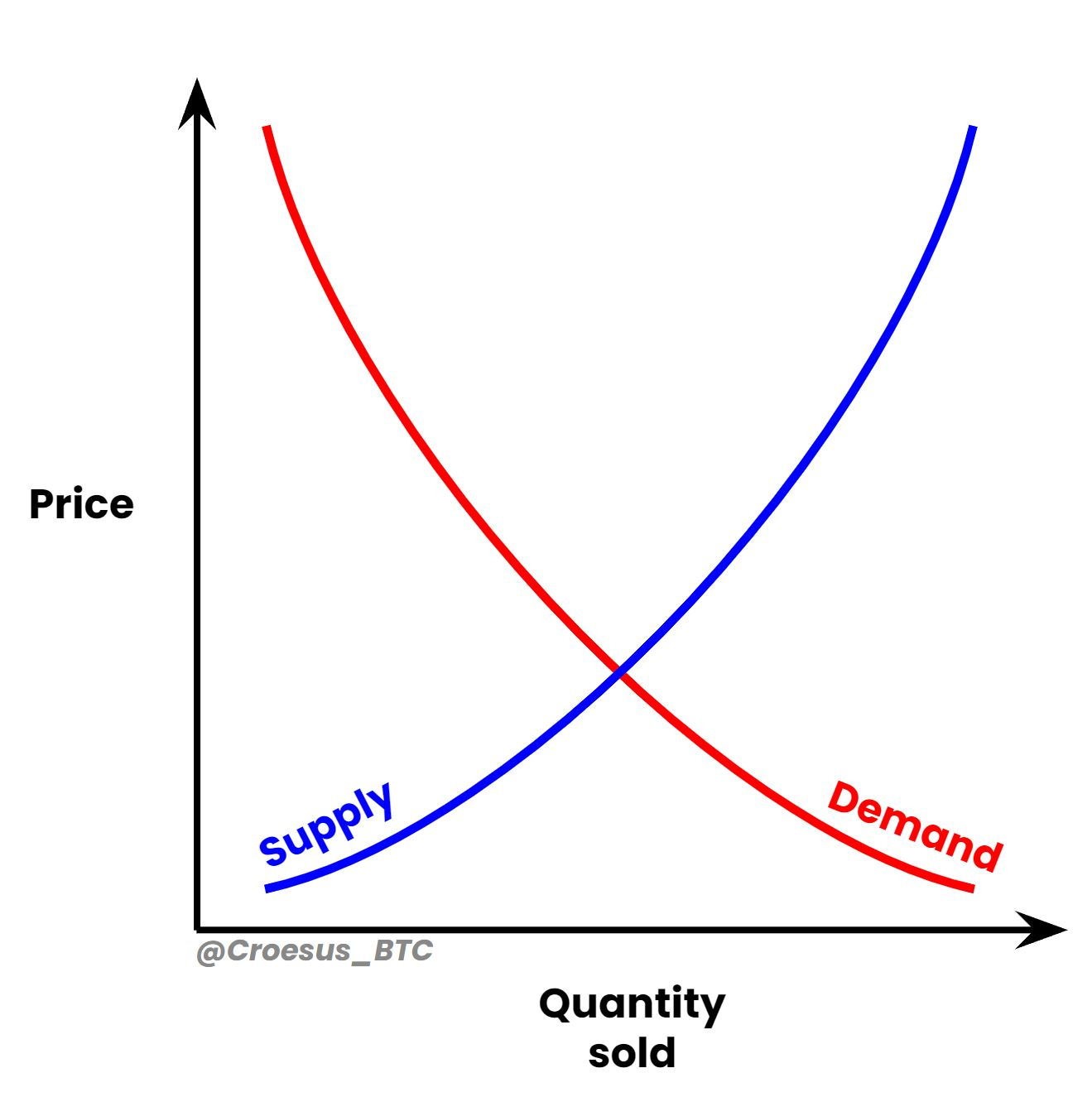

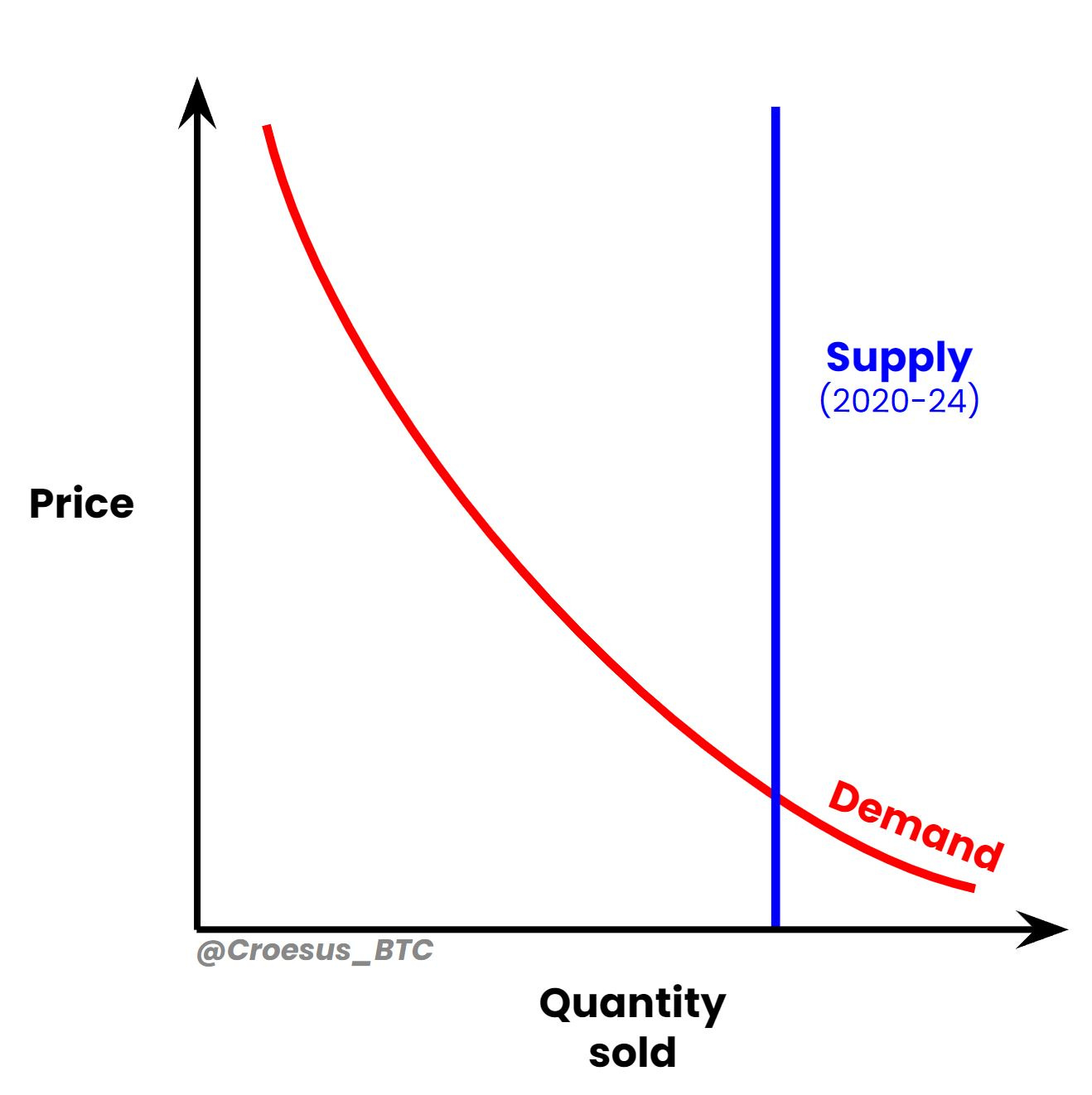

Well, here’s a typical supply-and-demand chart:

Price equilibrium is set where the two lines cross – where supply and demand meet.

And here’s what Bitcoin’s supply-and-demand chart looks like right now (note that new supply creation is completely indifferent to price):

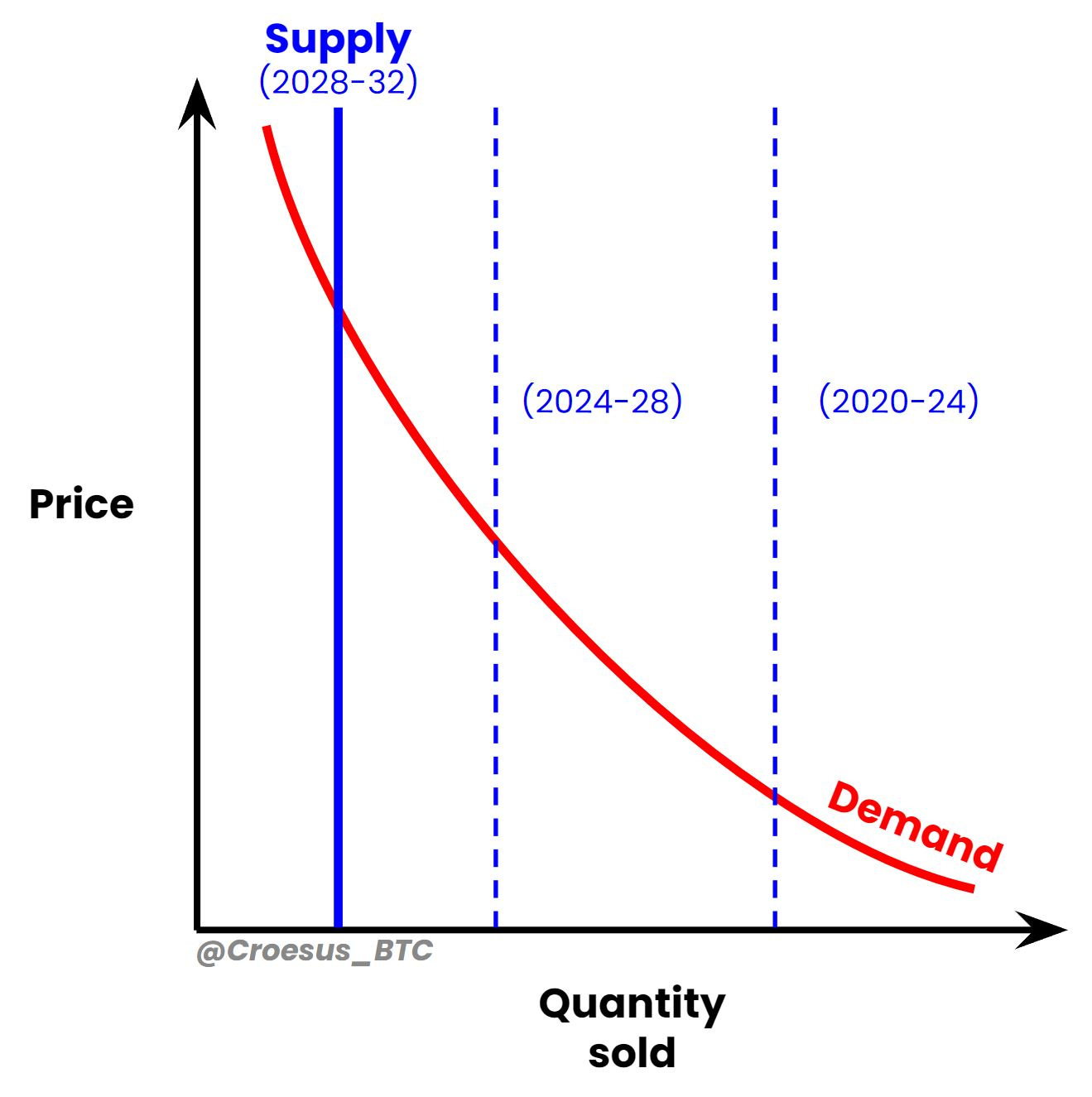

Where it gets interesting is when the next halving comes along. Suddenly, half as much new supply is being created, and there’s nothing anybody can do to change that.

As you can see, this shifts the point on the graph where supply and demand meet. Suddenly, that equilibrium is set at a higher point on the y-axis, which is the market price for each unit. And the same thing happens again at the next halving, in 2028:

Importantly, this view leaves out that as the supply line moves to the left, the demand curve arguably moves to the right. This is because Bitcoin becomes more attractive as time goes on, more people learn about it and adopt it, and the network effect grows stronger.

4. Price is where net demand = net supply creation

This is all well and good in theory, but let’s see what it looks like in practical terms.

A common mistake that people make when considering the potential impact of the halving is comparing the traded volume of Bitcoin vs. the reduced supply issuance from the halving.

This is a mistake because traded volume necessarily nets out. When buyers and sellers are in equilibrium, the price of an asset goes sideways. What does the price of Bitcoin do in the ~12 months before the next halving? It goes (more or less) sideways.

It doesn’t matter that there’s been $12B of traded volume in Bitcoin markets in the last 24 hours. It could be $100B and the price would still go sideways if buyers and sellers were in balance.

But, what does matter is that, above and beyond the back-and-forth of traded volume, there’s a steady net inflow of demand every day. Because new Bitcoin supply is issued on a daily basis, the market needs to absorb this supply via net demand flowing into Bitcoin.

Right now, ~900 Bitcoin are released every day (6.25 BTC/block x 6 blocks/hour x 24 hours/day). With Bitcoin at ~$30k/coin (as of the time of writing), this means ~$27M of Bitcoin is created and issued to Bitcoin miners every day.

That adds up. Each month, ~$900M of new Bitcoin is being created. For the price to go sideways (as it has been), this means that average demand flowing into Bitcoin must also be ~$900M/month. If it was less than this, the price would drift downwards – if it was more, the price would drift upwards.

Which is why each halving is so exciting for Bitcoin holders.

Let’s assume that Bitcoin’s price stays at $30k/coin until the next halving in late April 2024. When the halving occurs at block 840,000, suddenly there will be half as much supply being created and going out into the market to meet incoming demand.

There will only be $450M of Bitcoin being created each month, but $900M of demand. This is a guaranteed, predictable, reliable supply shortage. It will begin in April 2024.

The only way for the free market to resolve this imbalance of supply and demand (since Bitcoin’s supply schedule is completely inelastic) is for price to go up. This supply shortage will accumulate, day after day, and naturally buyers will have to raise their bids in order to find willing sellers.

It’s pure supply & demand.

5. Increasing scarcity leads to absolute scarcity

Perhaps the best way to drive home the impact of the halving is to think about this phenomenon from the perspective of someone trying to buy some Bitcoin.

From this point of view, Bitcoin’s “halvings” make new coins harder to come by. In fact, this issuance schedule creates an incredible attribute of “increasing scarcity.”

Remarkably, no other asset in the physical realm has ever provided this guarantee before.

The result is an unthinkable property: Bitcoin gets more valuable over time. This sounds like an impossible claim to make. And yet, we’ve already explored the mechanics at work.

For a deeper dive into how Bitcoin’s “increasing scarcity” leads to increasing value, check out this thorough explanation of all of the mechanics along the way:

What’s more, the effect of each halving is cumulative and compounding. When viewed on a sufficiently zoomed-out timeline, the process of Bitcoin’s increasing scarcity reveals a sequence of market cycles, with a clear overall trend of Bitcoin’s value heading up-and-to-the-right.

Nothing can stop Bitcoin’s inexorable march of increasing scarcity, culminating in terminal, absolute scarcity.

What’s crazy is what happens to the price of an asset when there is zero new supply creation. There simply has never been a monetary good whose valuation is unconstrained by the market having to absorb new supply creation every year.

As a result of this, Bitcoin’s full potential valuation in the long-term is staggering. Here’s my effort to quantify the potential end-state for Bitcoin:

6. Bitcoin’s marketing department & self-fulfilling psychology

Ultimately, the halvings are Bitcoin’s marketing department. Gradual processes become normalized. But calm equilibrium periodically punctuated by abrupt change creates excitement, buzz, anticipation.

As the halving draws nearer, Bitcoiners will talk more and more loudly. We can’t help it — the 1000x better Olympics are finally here.

With all of this buzz, some investors will wonder, “is this supply shock going to catalyze another bull market? Do I want to get ahead of it?”

In this way, the halvings create a psychological event. A reliable, recurring market opportunity where demand increases because of speculative anticipation.

As a result, this shift in behavior helps make the post-halving bull market a self-fulfilling prophecy.

It’s all just human nature interacting with increasing scarcity. We’re simply unfamiliar with these dynamics because there’s never been an asset with these properties in history.

Despite all the incredible reasons to eagerly look forward to the Bitcoin halvings… 99%+ of people don’t know this event will happen next year. In fact, shockingly few people have ever heard about Bitcoin’s halvings!

The fact that you are reading this means that you are now in that 1%. That’s called information asymmetry — you have an edge on the rest of the world.

You can share this post with your friends, colleagues, or social media. Click here!

Did someone forward you this post? You have a choice now:

Leave this page & forget how to find my work again, OR

Sign up for this free weekly Bitcoin newsletter to receive posts like this. My goal is to help you understand why Bitcoin could be the key to growing your wealth this decade: 👇👇👇

Great post, Jesse. Exciting stuff.

I remember watching the 2020 halving live. Back then I expected the price to explode upward within a few days.

If I would have reviewed past patterns, I would have noticed it required about 1 year for the price to peak after the 1st halving and about 17 months after the next 2 halvings.

If the pattern repeats, the price will peak sometime in September of 2025.

Make sure your seat backs and tray tables are in their upright and locked positions. We're close to take off.

I really enjoyed today's Newletter. The supply-demand curves were so nice.

Can't wait for another Christmas! (April 2024)