Everyone gets caught in the weeds. We hear about Bitcoin and we question the details, then spend a great deal of energy exploring whether the multitude of projects claiming to be better than Bitcoin are the real deal. (After several hours of research, the answer appears to be “yes”; after thousands of hours of research, the invariable conclusion is unequivocally “no”.)

But in pondering all these details, we fail to take a step back and ask a few big questions that really matter:

What is causing Bitcoin’s value appreciation and volatility to-date, and will that driver continue into the future?

In short, increasing scarcity is Bitcoin’s growth engine and yes, it will continue, see my previous article for a full explanation

How high can it go? Where is the ceiling for Bitcoin?

This will be answered in this article

It’s such a simple line of questioning, but we forget to zoom out long enough to consider it. What is Bitcoin’s value proposition, really? What market is Bitcoin competing in? How big is that market?

And once we have a sense for that… how big can this thing get? What is the full potential valuation for Bitcoin?

What market is Bitcoin competing in?

Most people think of Bitcoin as a currency. While this is true, it causes confusion, because Bitcoin is much more than a currency. It is a “store-of-value” asset, like gold. In truth, Bitcoin is “digital gold” – designed to improve on gold’s strengths and solve for gold’s weaknesses.

This means that Bitcoin is competing against gold and other store-of-value assets – that’s its market: value itself.

We are unaccustomed to thinking about store-of-value assets as a market. We only ever talk about markets with respect to where companies are competing, so we automatically think in those terms. As such, we have to zoom out from trying to shoehorn Bitcoin into an industry (is it payments? is it banking? is it currency issuance?) in order to recognize that store-of-value is its own market, separate from companies competing in industries.

Bitcoin doesn’t compete in an industry. An industry is a specific need for a good or service that businesses offer and customers pay for. The sum total of all that economic activity across all industries is the economy (think GDP).

The economy produces value (profits), but then that value is stored somewhere. In store-of-value assets. These assets might be profit-producing assets, or they might simply be valued by people because they are useful, or beautiful, or scarce, or meaningful.

Different assets are valued for different reasons, and vary in their characteristics as store-of-value assets. Some appreciate in value, some maintain purchasing power, some shrink in value over time. (This is a topic that I explore more thoroughly in “Asset DNA”, if you’d like to understand the thinking behind the visualization shown here.)

Bitcoin is competing with store-of-value assets. That means gold, but also bonds, and real estate, and equities. In truth, it means that Bitcoin is competing with all assets, because all assets serve as store-of-value assets (with varying success, as shown in the graph above).

What sets the ceiling for asset valuations?

This is a piece of the puzzle that usually goes unaddressed. Different assets have different ceilings, meaning the % of the global asset pie they could ever realistically be. This is because the valuation of each asset category is constrained by key variables in their respective valuation equations.

The value of a company is determined by two major inputs: its expected future cash flows & the discount rate for those cash flows. In other words, how much money can a company realistically expect to pull in & how low are interest rates going to be in the future. (The lower the interest rates, the better for company valuations, as lower interest rates mean you are discounting the value of future cash flows less in the valuation equation.)

For real estate, it’s a similar story. Global real estate value is constrained by expected future cash flows (for rentals & commercial properties), mortgage rates (the lower the interest rates, the larger the debt burden a buyer can take on), and the amount of new supply being created (new housing starts tend to pick up when real estate bubbles form, as builders seek to create more supply to cash in on elevated prices).

Commodities are different in the sense that interest rates are not a primary input that helps to establish a ceiling for valuations. Instead, commodity valuations are primarily constrained by new supply.

For instance, with gold, global mining efforts collectively add ~2% per year to above-ground supply. This steady 2% annual supply growth has been true for the last century – as the low-hanging fruits of gold deposits have been plucked, technology has unlocked access to previously unreachable deposits. At ~$12T in total above-ground gold, this means the global market must absorb ~$240B in new supply every year just for the price of gold to remain where it is. This downward pressure on gold’s price acts like the force of gravity, keeping gold’s valuation constrained by the realities of supply and demand (granted, paper gold market manipulation by central banks also contributes).

What makes Bitcoin so different (as a store-of-value asset in general, and commodity in particular) is that the market has to absorb half as much new supply from “mining” every four years. In 2016 – 3.6% annual supply growth. Today – 1.8%. In 2024 – 0.9%. In 2028 – 0.45%, and so on. And nobody on earth can alter that relentless march, ever.

Metaphorically speaking, gravity gets cut in half every four years for Bitcoin. Therefore, the variable that typically constrains the valuation of commodities (new supply creation) shrinks to zero over time, meaning that Bitcoin’s price ceiling is ultimately set by something else: how attractive Bitcoin is, relative to other store-of-value assets.

Bitcoin has uniquely attractive properties as a store-of-value asset

When it comes to where people choose to park their value, it’s the properties of various asset classes that matter. Overall, you want an asset that can effectively store your purchasing power, propagate it through time undiluted, and hopefully grow that purchasing power along the way. The existing asset classes vary in their ability to deliver these properties.

But Bitcoin outshines them all.

It’s a claim worthy of skepticism. To start with, if Bitcoin is so great, why didn’t someone invent it sooner? The answer is simple: Bitcoin required the Internet to exist before it could be born.

You just happen to be living through one of the most remarkable periods of human history: the Digital Revolution. We have lived through the digitization of information (the Internet), and now Bitcoin has created the complementary digitization of value.

Bitcoin’s properties were never possible in the physical world – they could only happen in the digital realm. Before Bitcoin, it was always possible to copy & paste in the digital realm. It’s just information, after all. Bitcoin’s principal innovation was the invention of “digital scarcity” – a digital system where nobody could create more of something.

This breakthrough enabled Bitcoin to simultaneously implement two additional firsts in the global asset landscape: “increasing scarcity” and “absolute scarcity.” The core design of Bitcoin is that there is a finite supply that can ever exist and that can never be changed (absolute scarcity), and this supply is released into circulation at a rate that decreases exponentially over time (increasing scarcity).

To put it simply, there’s a fixed supply of them, and they’re getting more and more scarce.

Individuals who wrap their heads around Bitcoin’s design eventually arrive at the same logical conclusion: Bitcoin stashed away today will be worth more in the future, when there’s less Bitcoin being released every day. It’s the unavoidable supply-demand reality of increasing scarcity.

And of course, this effect is greatly compounded by the fact that very few people have wrapped their heads around this simple reality… so far. As time passes, more people learn about Bitcoin and its attractive properties as an asset (look at you reading this now).

Thus, it becomes a self-fulfilling game theoretic inevitability – a flywheel of human action – Bitcoin’s capacity to appreciate in value over time because of its increasing scarcity ensures that demand for Bitcoin will increase over time as more people learn about it. New supply issuance goes down while demand goes up.

The net of all of this? Bitcoin has an unthinkable property: it gets more valuable over time. Gold is good at storing purchasing power, but Bitcoin grows purchasing power. Value stored in Bitcoin becomes worth more over time because of Bitcoin’s design of increasing scarcity – you just have to outlast the (admittedly brutal) volatility along the way.

Incidentally, this is exactly the opposite of how the dollar is designed – exponential supply growth (money printing) drives exponential purchasing power decay for any dollars that you save now for future use. The dollar’s design makes it a bad savings technology, which is why everyone saves in stocks and real estate instead. But neither of these vaunted asset classes can match Bitcoin’s remarkable combination of increasing scarcity and early-stage adoption.

Bitcoin is an excellent savings technology for any value that is interested in being propagated undiluted through time and growing in purchasing power along the way (because of the remarkable properties of increasing scarcity). But how much value is out there looking for such a vehicle?

The global asset landscape

There’s a lot of wealth out there. All of it is sitting in assets of one kind or another. But what does the full picture of the global asset landscape look like? Incredibly, there doesn’t seem to be a simple, high-level view of this anywhere. So, I spent a day researching and gathering data points in 2021, and have updated that analysis for 2023 – here’s the result:

This undoubtedly overstates some categories and understates others, and may be missing some pieces altogether. Point is, this is a rough picture of all the world’s value. It’s something like $900T in total.

But how much of that is relevant to Bitcoin? How big is the addressable market?

It’s worth remembering that when it comes to the store-of-value use case, investors are interested in parking their value in whatever asset can propagate their wealth into the future most effectively. So, any asset that does that better can attract capital from every other asset category.

In that sense, Bitcoin’s total addressable market (TAM) is the world’s balance sheet. All $900T of it. So long as Bitcoin has the most attractive characteristics as a store-of-value asset in the investable landscape, this will remain so. Bitcoin is a black hole on the world's balance sheet.

Any of the value stored in some particular asset could, theoretically, be re-allocated to Bitcoin instead. All it takes is for individuals to decide that Bitcoin is a better asset to hold than what they currently are holding.

Currently, the world’s collective allocation to Bitcoin is just 0.05%. $0.4T out of $900T. That’s 1/2000th of global asset value.

With that in mind, we have to ask ourselves an important question: when Bitcoin’s mechanics continue to play out (causing it to continue appreciating reliably in value every 4 years), will more than 0.05% of the world’s capital eventually realize it wants to be in an asset like that? I think the only logical conclusion is “yes.”

But how much capital can Bitcoin realistically attract? Where’s the ceiling for Bitcoin’s valuation?

Bitcoin’s full potential valuation

Bitcoin enthusiasts often make the mistake of concluding that Bitcoin’s potential valuation is infinite. This is true in dollar terms, since there is no limit to the amount of dollar debasement that can occur into the future (see Weimar Germany or recent Zimbabwe). But it is unrealistic in real terms, relative to other assets.

The truth is that Bitcoin stands in relative competition with other store-of-value assets, all of which have unique value propositions. A wealthy individual is not very likely to sell their mansion or their prized Rembrandt to buy Bitcoin, but is instead more likely to sell some of their bond portfolio, because they believe Bitcoin better fulfills the intended purpose of holding bonds (propagating value into the future and earning a modest nominal return to offset inflation).

Even if Bitcoin is the best asset out there, it is foolish to expect that everyone will eventually decide to be 100% Bitcoin. But it is also unrealistic to expect that Bitcoin will remain a 0.05% allocation on the world’s balance sheet.

By assessing each store-of-value asset bucket, it’s possible to estimate what % of the value stored in each will be re-allocated to Bitcoin once the world collectively understands Bitcoin’s unparalleled properties. This exercise ultimately yields a full potential valuation for Bitcoin, in today’s dollars. Here is what I think is a reasonable, even conservative estimate of Bitcoin’s full potential:

You can run your own numbers here for the “Bitcoin capture” column and see what you come up with. But for me, when I think about what Bitcoin’s properties are as a store-of-value asset and then compare those properties to the existing store-of-value assets out there… Bitcoin is by far the best.

For that matter, if Bitcoin continues to outperform because of its unparalleled properties (and the world begins to come to terms with the reasons for that performance), it is a real stretch to say that Bitcoin will only convince 30% of the money stored in bonds and fiat money to re-allocate to Bitcoin. Particularly because of the scale of inflationary money printing that will be necessary over the coming decade to service the mounting national debts and unfunded liabilities throughout the world.

Overall, my personal assessment of where the ceiling is for Bitcoin is simple… it’s very high. Almost to the point that I’m embarrassed to show my analysis. My conservative estimates suggest an outrageous full potential for Bitcoin’s price: $10m/Bitcoin, in today’s dollars.

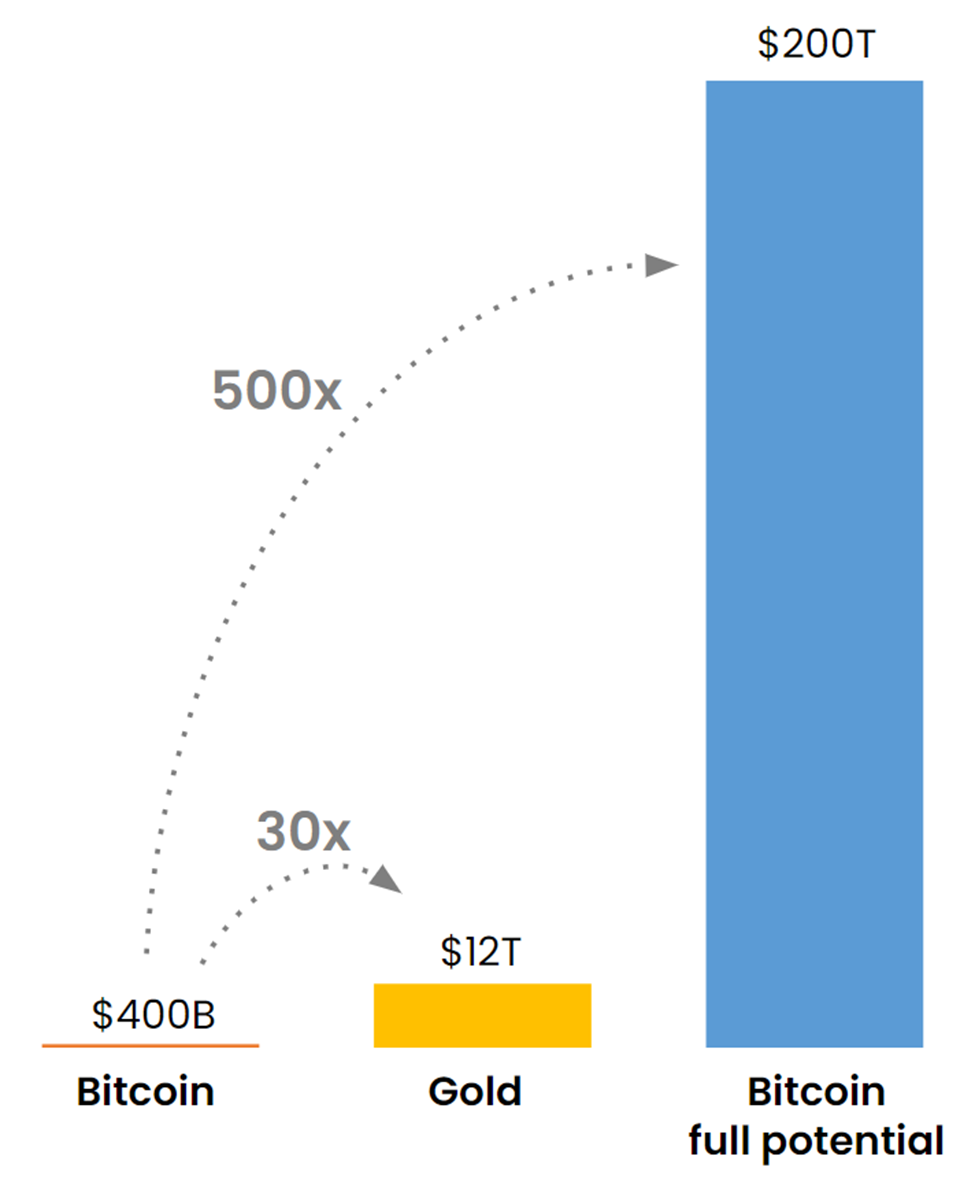

To put this another way, I believe Bitcoin’s full potential is to eat ~25% of the world’s value… while today it constitutes just 0.05%. That’s absurd. That means that I believe Bitcoin could 500x over the coming decades, in real (inflation-adjusted) terms.

This is by no means guaranteed, but I think it is more likely than not… which makes Bitcoin the most attractive asset in the investable landscape, in terms of expected value. (Even if you think there’s only a 10% chance that the analysis here is accurate, that means your expected value for Bitcoin is a 50x.) If this all sounds crazy (and it probably does), it might be worth adjusting my numbers to come up with your own.

When you’ve got your answer, remember to step back and ask yourself: “do I have enough Bitcoin?”

Did you find that Bitcoin analysis informative? You have a choice now:

Leave this page & forget how to find my work again, OR

Gain access to this free weekly Bitcoin newsletter to receive posts like this. My goal is to help you understand why Bitcoin could be the key to growing your wealth this decade: 👇👇👇

Wow, keep up the great work. None of us own enough bitcoin

Excellent post, Jesse. Great one to share with TradFi folks.