What caused the latest Bitcoin price drop?

Was Bitcoin's 11% drop the result of normal market forces... or Binance fighting to stay afloat?

Before we get going:

This post includes a paid section. 2/3rds of the analysis is free and I think you’ll get a lot out of it. 1/3rd is for paid subscribers and the motivation for me to write this in the first place. Thanks for your support!

If you’ve enjoyed my articles or content on Twitter (@Croesus_BTC), you’ll love my weekly Bitcoin newsletter, “Once-in-a-Species.”

1-2 posts a week to help you understand why Bitcoin could be the key to growing your wealth this decade.

Get on the free email list to receive it: 👇👇👇

Okay, now buckle in! Let’s get into our story…

Every time Bitcoin’s price drops sharply all of a sudden, the same questions pop up — what big news caused this? Is Bitcoin in some kind of danger?

These questions may have (quite understandably) popped into your mind as the Bitcoin price dropped ~11% over the last week.

And yet, seasoned Bitcoin holders barely batted an eye at this sharp sell-off. The truth is, for folks who have been holding 4+ years, this is nothing new — in fact, it’s business as usual for Bitcoin.

Volatility to the upside comes with volatility to the downside. And in the grand scheme, the short-term volatility smooths out and the long-term trend is what’s left — up and to the right, as increasing adoption and increasing scarcity play out, one halving at a time.

Let’s examine the set of possible explanations for what caused this sell-off. The range of possibilities is fairly representative for a Bitcoin price drop. Basically, we don’t know what caused it, because there are a few plausible explanations. But this time, there is a possibility that could be important to be aware of.

Possible reasons for this sharp sell-off

It’s natural

The counterintuitive explanation for why Bitcoin’s price sharply fell is usually “no particular reason.” It’s strange, but the longer a period of low volatility drags on, the more certain that it will end in a dramatic breakout (to the upside or downside). This is because leveraged positions pile up during that low volatility period – betting whether the top of the range or the bottom of the range will give way.

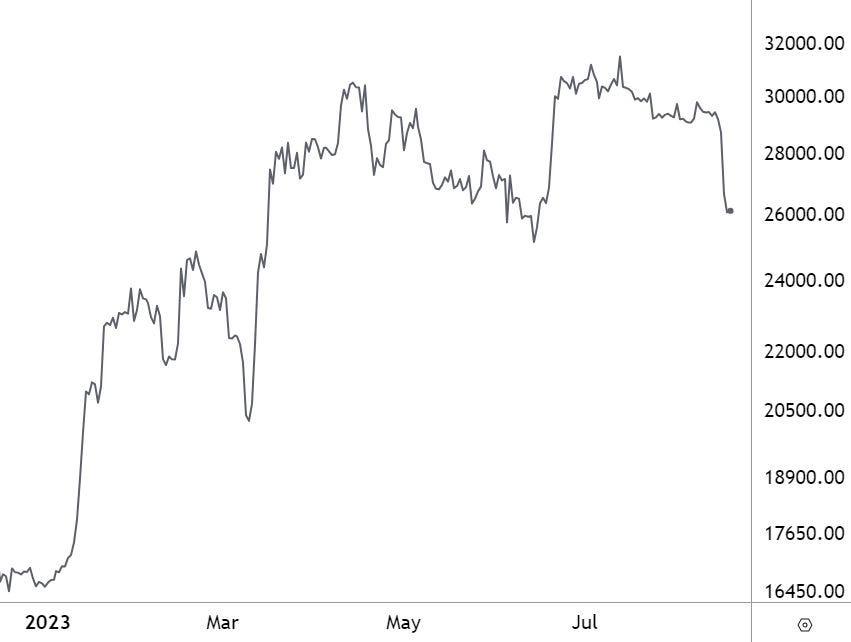

Over the last 2 months, Bitcoin’s price became stuck between $29k and $31k. That was plenty of time for leverage to accumulate – some traders betting that the price would break out to the upside; some betting to the downside. When the scales finally tip one way or another, the losing bets automatically get liquidated, accelerating the momentum of the price move. In this most recent example, that meant that once the price got below $29k, it quickly moved down to $26k.

It’s opportunistic liquidation-hunting

The result of the accumulation of leveraged bets described above creates an opportunity for large market participants: liquidation-hunting. For example, with the natural liquidation levels of $29k and $31k known to all, a large trader could sell in order to push the price below the $29k threshold, knowing that this would likely send the price much lower, where they could rebuy their coins for cheaper. It’s quite possible that this was the kind of action that tipped the scales that triggered this most recent sell-off.

It’s the last functioning fire alarm in global markets

Another more obscure possibility is that Bitcoin’s sell-off is a leading indicator to stock market turmoil on the immediate horizon. In March 2020, when the Covid crash struck, Bitcoin was the first asset to plummet – reaching a price bottom ~2 weeks before the stock market.

Because Bitcoin is a highly liquid asset with 24/7 trading, it is the easiest asset in many portfolios to sell. There are also no “circuit breakers” that halt trading if the price drops too precipitously. In that sense, Bitcoin is sometimes referred to as the only true free market today – the last functioning fire alarm in global markets.

It's possible that the recent sell-off is a harbinger of a sell-off to come for traditional markets. However, in the lead-up to the Covid crash in March 2020, there were ample concerns about margin calls and a need to increase cash positions. There has not been any chatter like that in markets at the moment.

It’s big players selling to buy GBTC

One fairly exotic possibility is that this most recent sell-off was driven by insiders selling Bitcoin in order to purchase shares of GBTC. Grayscale Bitcoin Trust is a pool of Bitcoin whose collective value currently trades at 26% less than the value of the underlying Bitcoin in the trust. This is up from the 48% discount that it traded at in December 2022.

The reason that this discount is narrowing is the growing possibility that Grayscale wins its court battle against the SEC as it seeks approval to convert from its existing Trust into a true ETF, which would enable market participants to arbitrage trade to effectively eliminate the GBTC discount entirely. In other words, if Grayscale wins its court case or the SEC allows another Bitcoin ETF (from BlackRock, for example), there’s a high likelihood of the current GBTC discount shrinking further.

And of course, if such a thing were to happen, it would be a great opportunity for speculators to scoop up exposure to Bitcoin at a discounted rate. For that reason, it’s possible that the latest Bitcoin sell-off is some large trader selling Bitcoin in order to purchase discounted GBTC shares, in anticipation of some good news for GBTC on the near horizon. An unlikely driver, but possible.

It’s Binance trying not to collapse like FTX or Terra/Luna

Finally, there’s a possible explanation that could amount to a repeat of the FTX implosion causing short-term turmoil for Bitcoin but especially for the rest of “crypto.” Except this time, instead of FTX, it could be Binance.

Binance could be in trouble

You may recall that the killing blow that unraveled the ~$10B fraud at FTX was a sell-off of their own cryptocurrency, FTT. FTX had created this currency out of thin air and borrowed against their portion of the supply. This meant that they took on leverage, and that meant they had a liquidation price point. If the price of FTT dropped to a certain level, they would have their collateral liquidated to cover the cost of their outstanding loan.

When it became apparent that FTX was in trouble, FTT holders dumped their positions on the market. This forced FTX to attempt to defend this ailing position by selling clients’ Bitcoin in order to purchase FTT and prop up the market. In hindsight, it’s obvious where that kind of desperation would ultimately lead. Eventually, the house of cards gave way and the FTX empire that had rapidly ascended out of nowhere came tumbling down.

Well, there’s another, even larger name that has risen at an incredible rate over the last 6 years to become the largest crypto exchange in the world: Binance. This crypto exchange was founded by a daring Chinese national, Changpeng Zhao (known as CZ), who has built his empire through speedy product development and skirting regulators by frequently moving the company’s headquarters.

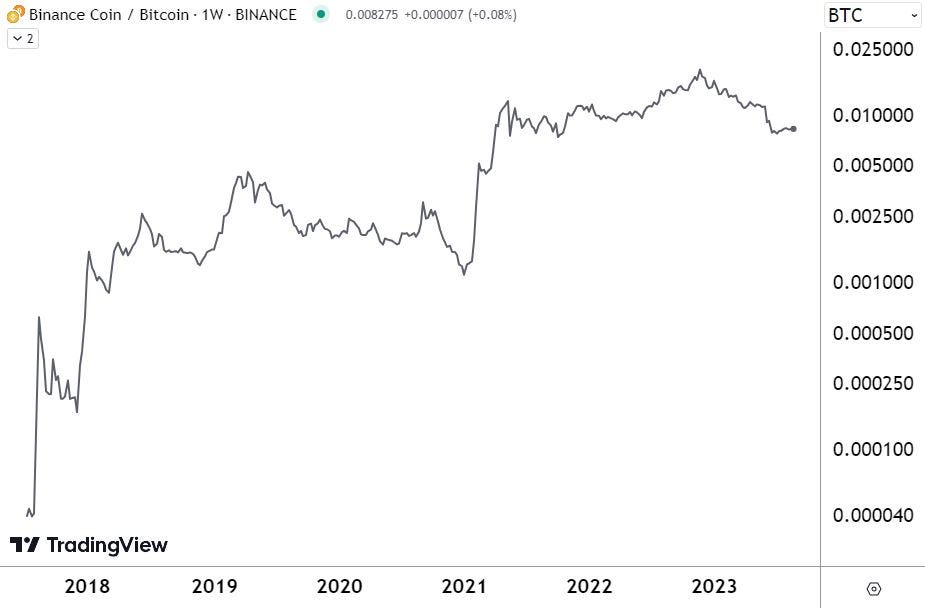

Like FTX, Binance also has its own cryptocurrency, BNB. This coin has defied gravity and reason over its life. In fact, it is the only token that I am aware of that has dramatically outperformed Bitcoin over the last 6 years…

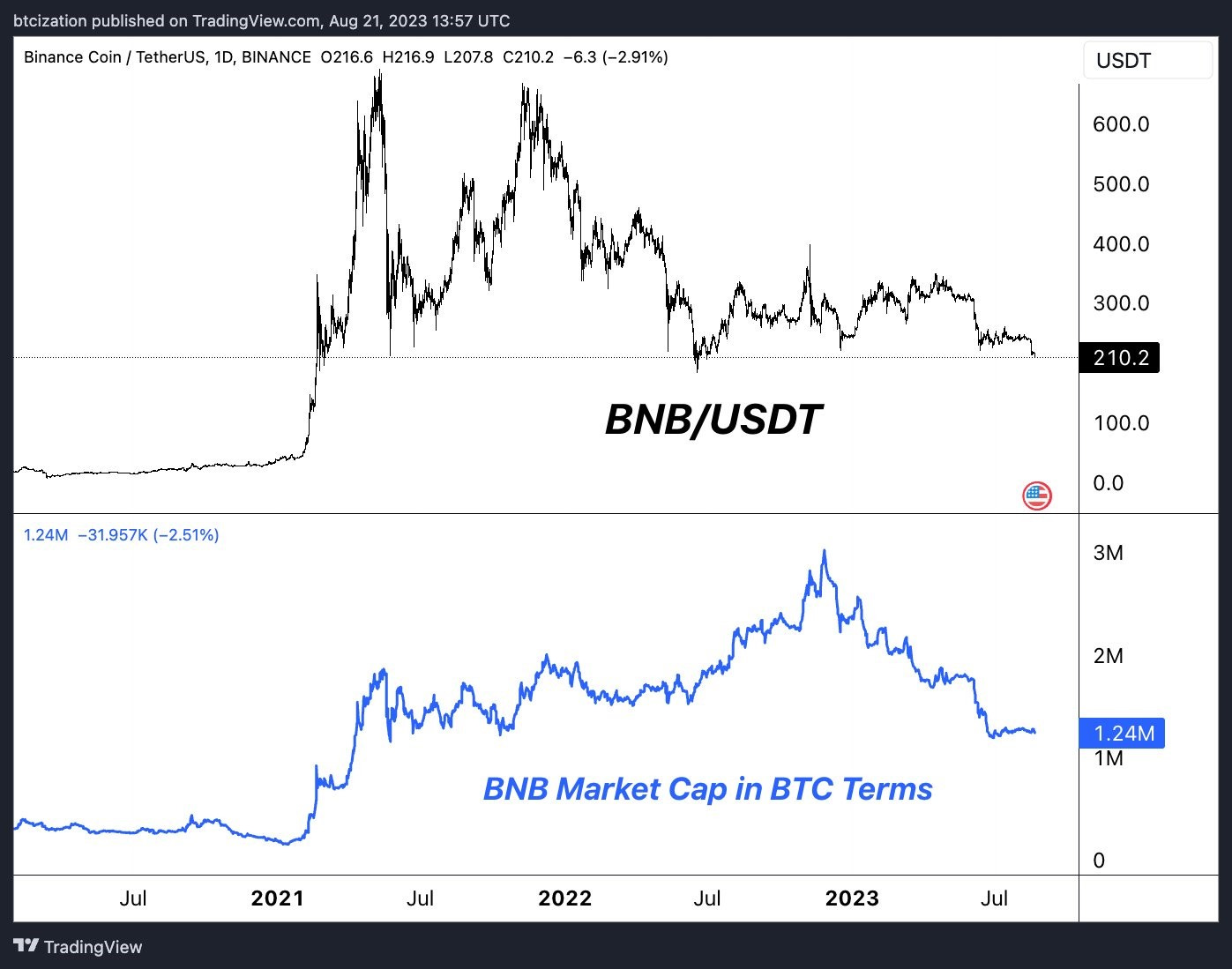

But zooming in on the last 3 years reveals a different story emerging. Here is the BNB chart shown in dollar terms and in Bitcoin terms over this timeframe.

As you can see, BNB’s price peaked at $650 in 2021 and is currently in the low-$200s — seemingly on the brink of falling out of the range it has enjoyed since mid-2021. This raises an interesting question: could Binance be in trouble if the price drops out of this range?

Since June, the crypto market supersleuths have been taking note of unusual activity on Binance’s platform. It seems that there have been periods where Bitcoin’s price has fallen to a discount relative to the rest of the market while BNB’s price has simultaneously surged.

The speculation is that Binance has been selling Bitcoin in order to buy their own token in an attempt to prevent BNB’s price from falling below a liquidation point at $220, which Binance may have reduced to ~$200. What raised suspicions further is that CZ has gone out of his way to deny these rumors on multiple occasions (1, 2).

It may be that Binance has fueled their meteoric ascent through genuine business savvy. But it may be that Binance, the only crypto company whose dramatic success dwarfs that of FTX, has engaged in the same sort of playbook as FTX. This speculation is furthered by Binance’s avoidance of having a standard financial audit performed, instead congratulating itself for its willingness to provide a “Proof of Reserves” that amounts to highlighting the firm’s assets without saying anything about its liabilities.

That’s the situation as it stands — only time will tell whether Binance is in the early stages of an FTX collapse or this is a nothingburger.

Did you find that Bitcoin analysis informative? You have a choice now:

Leave this page & forget how to find my work again, OR

Sign up for this free weekly Bitcoin newsletter to receive posts like this. My goal is to help you understand why Bitcoin could be the key to growing your wealth this decade: 👇👇👇

Have a friend who might find this explanation of recent market events helpful? Send them this article!

For paid subscribers, let’s dig in to what a Binance collapse would mean for Bitcoin and for “crypto” — the bad, the ugly, and the very good…

Keep reading with a 7-day free trial

Subscribe to Once-in-a-Species to keep reading this post and get 7 days of free access to the full post archives.