The Bust of Prime Trust

For ~1.5 years, leading crypto custodian Prime Trust kept a terrible secret. $82M in assets were missing and clients had no idea.

For ~1.5 years, leading crypto custodian Prime Trust kept a terrible secret. $82M in assets were missing and clients had no idea.

What’s more, these missing funds were the result of not one, but two incidents of colossal mismanagement. Court documents have now revealed the shamefully embarrassing details.

Intro to Prime Trust

Prime Trust is a crypto custodian company with the lofty regulatory designation as a Qualified Custodian. In other words, their entire business is to safekeep cryptocurrency assets on behalf of other companies. Some of Prime Trust’s clients included Binance US, Strike, Swan, and FTX.

But, as of June, the company is being wound down after it failed to recover from two fatal blunders.

“The Wallet Incident”

The first and biggest disaster was the mismanagement of cryptocurrency addresses that caused $76M in permanently lost Ethereum – referred to as “The Wallet Incident” in court documents.

This was the result of a stunning oversight. Between March 2018 and July 2019, Prime Trust used a particular set of cryptocurrency wallets. It then migrated to a new system.

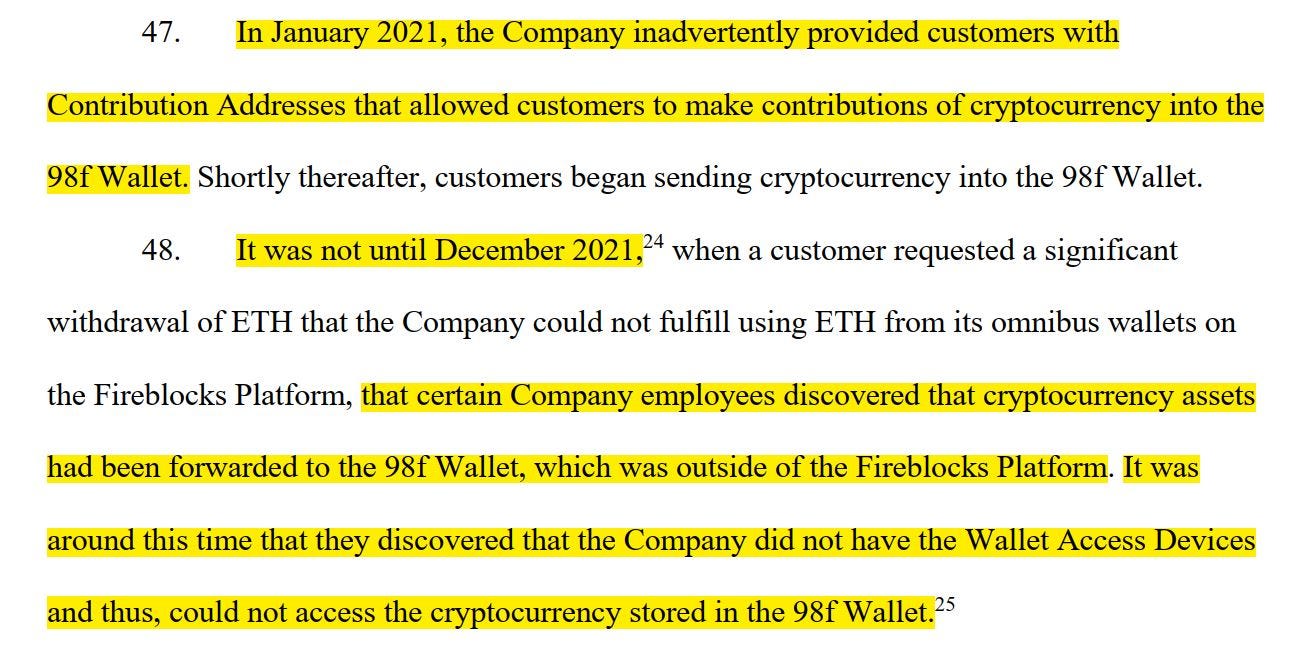

However, starting in January 2021, Prime Trust somehow started providing customers with the deposit addresses associated with the old wallet system. What’s most surprising is that this error was supposedly not noticed until December 2021.

From that point until June 2023, the public was not aware that Prime Trust had a $76M hole on its balance sheet – in effect, $76M of customer assets entrusted to this Qualified Custodian were permanently lost.

Customer funds invested in a yield Ponzi

The second disaster that Prime Trust management oversaw was the loss of $6M of client funds (and a further $2M of Prime Trust’s corporate treasury) in crypto yield Ponzi scheme, Terra Luna.

For a refresher on Terra Luna, this was a cryptocurrency platform (Luna) with an associated programmatic stablecoin offering (Terra). The idea was that the massive Bitcoin treasury of Luna could be used to algorithmically maintain the value of each Terra unit at a steady $1.00/Terra token & generate guaranteed yield.

This worked… until it didn’t. Just a few months after launching, the inherent instability of this system was systematically attacked by opportunistic short-sellers with deep pockets. The result was Terra Luna collapsed, its founder became an international fugitive for a year, and was eventually arrested at an airport in Montenegro using a fake passport where he is now serving a jail sentence.

Little did customers of Prime Trust know, $6M of their funds were invested in Terra with the ill-advised goal of generating comfortable yield on these deposits. Instead, this decision generated an additional $6M hole on Prime Trust’s balance sheet.

New company, same people

One of the stranger aspects of this story is that the timeline is muddied by multiple changes in leadership. Who is responsible for these egregious errors in managerial oversight? Furthermore, who knew what, and when? These questions are impossible to answer with the available information.

What’s clear is that Scott Purcell, the founder and CEO of Prime Trust, left the company in August 2021 – seven months after the beginning of “the Wallet Incident.” Purcell then founded a new crypto custodian, Fortress Trust, with a very similar business model to Prime Trust.

It may be that Purcell and his team gained valuable experience in crypto custody and are better custodians for it. For that matter, Fortress Trust has the vote of confidence of some prominent corporate clients.

Reassessing custodian qualifications

The business of custody is all about trust. To ensure high standards among custodians, there is a formal designation that custody companies must seek: Qualified Custodian. This credential recognizes custodians that adhere to certain practices, standards, and regulatory oversight in their operations.

However, as the case of Prime Trust illustrates, these labels are not guarantees of professional competence. And this is especially true when it comes to the crypto landscape. As Michael Tanguma, my co-founder at Onramp, likes to say about digital asset custody, Qualified Custodians are sometimes unqualified custodians.

The truth is that the battle-tested regulatory standards for Qualified Custodians in the traditional financial asset world… don’t map perfectly to the idiosyncratic challenges of cryptocurrency custody. The case of Prime Trust is important because it is a perfect example of how Qualified Custodian regulatory status does not ensure crypto custodian competence.

The Best of Both Worlds: Qualified Custodians & Multisig Bitcoin Custody

Fortunately, Bitcoin makes it possible to leverage the strengths of the Qualified Custodian standards while protecting against the risks of trusting a single counterparty like Prime Trust.

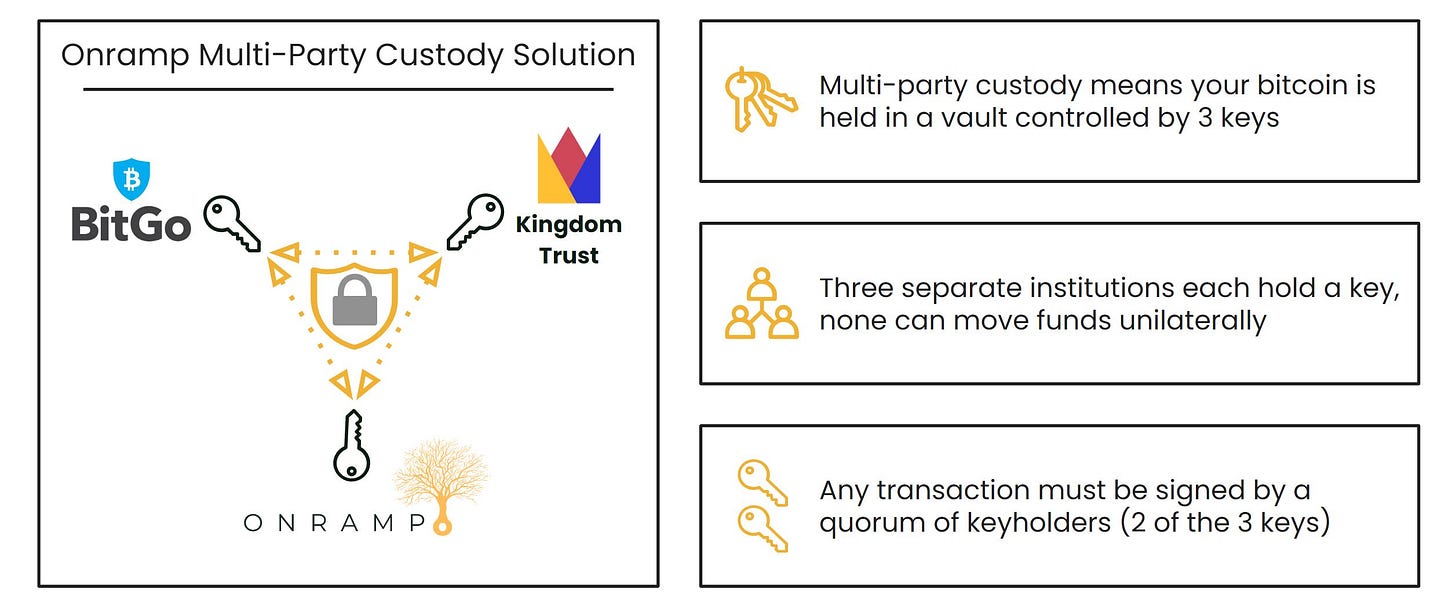

Because of Bitcoin’s native properties, it is possible to custody Bitcoin in vaults controlled by a quorum of several institutions — which can include multiple Qualified Custodians. These are known as “multisig” vaults, because they require the cryptographic signature of multiple keys to control the assets in the vault.

With multi-institutional multisig vaults, custody becomes fault tolerant & immune to unilateral control by a single keyholder. Together, these attributes solve for the two weaknesses that doomed client assets at Prime Trust: incompetent key management by a singular keyholder & misappropriation of assets by a keyholder with unilateral control.

This custody approach is like a metal alloy, stronger than each of its constituent parts. Bronze is stronger than copper or tin. Steel is stronger than iron or carbon. In my view, multi-institutional Bitcoin custody combines the strengths of Qualified Custodians with the strengths of multisig Bitcoin vaults.

And indeed, this is the type of Bitcoin custody solution that we are pioneering at Onramp.

If you’re a HNWI or Institution looking for a Bitcoin custody solution that minimizes counterparty risk while maximizing security, schedule a chat with us to learn more.

Did you find that Bitcoin analysis informative? You have a choice now:

Leave this page & forget how to find my work again, OR

Sign up for this free weekly Bitcoin newsletter to receive posts like this. My goal is to help you understand why Bitcoin could be the key to growing your wealth this decade: 👇👇👇

This post is public, so feel free to share it with friends, family, or social media.

I have been DCA with Swan for over two years. I started another DCA with Coinbits. In May/June time frame Swan pulls out of Prime and moves to Fortress, yet Coinbits does not. The bitcoin from Swan on PRIME was moved to Fortress and I was able to self custody it. My bitcoin at Coinbits is locked and I can’t move it. Is it lost forever?