Strange Tides in Global Macro

Everything is weird out there, because the Fed's rate hikes have done their damage and the wreckage is now slowly unfolding

Before we get going:

This post includes a paid section. 1/2 of the analysis is free and I think you’ll get a lot out of it. 1/2 is for paid subscribers and the motivation for me to write this in the first place. Thanks for your support!

If you’ve enjoyed my articles or content on Twitter (@Croesus_BTC), you’ll love my weekly Bitcoin newsletter, “Once-in-a-Species.”

1-2 posts a week to help you understand why Bitcoin could be the key to growing your wealth this decade.

Get on the free email list to receive it: 👇👇👇

Okay, now buckle in! Let’s get into our story…

For the last few months, things have felt a little weird out there. Is there a recession coming? Are we in a recession already, but it’s just not clear? What is the Fed going to do?

We find ourselves on strange tides in global macro, perhaps best summarized by this tweet today taking inventory of the odd coincidence of economic trends:

These trends are bizarre, but that’s because the underlying macroeconomic conditions are bizarre.

When things break in the financial system, it doesn’t happen overnight. We remember late 2008 as a crisis that materialized overnight, just like we remember the 2020 Covid stimulus as an emergency intervention. But we easily forget that in both cases, things were weird in the financial system ~6 months earlier. In early 2008, Bear Stearns went under; in 2019, repo market utilization spiked and the entire financial system began to wobble.

In macro analyst Luke Gromen’s opinion, “the beatings in [sovereign debt] will continue… until we get a repo rate September 2019 spike, except in Western sovereign bond markets. Then, everyone’s going to say, ‘how did nobody know the Fed had broken something?’ And I’m telling you, they’ve already broken something.”

That’s the key piece. The weirdness out there is because the Fed has hiked rates from ~0% to ~5.5% in record time. That takes the oxygen out of the room. It just takes some time for the inevitable to unfold.

The rest of this article will take a look at the factors at play that point towards the simple thesis that the Fed’s rate hikes have already broken something, it’s just slowly materializing.

US National Debt setting new records

You probably heard the headline from last week: the US National Debt officially passed $33T. That means that since the debt-ceiling debate was resolved in May, the National Debt has grown at a blistering 18.5% annualized rate. To put that in perspective, if that pace continues for a full year, we will have added $6T to the National Debt.

And indeed, in the one week since the $33T mark was breached, we have now already reached $33.1T. Including nights and weekends, we are racking up federal debt at an incredible rate of $10M every single minute.

US Treasury considers Japanification

Tucked into a recent Bloomberg discussion with US Treasury Department assistant secretary, Josh Frost, there was something new. A statement framed as business-as-usual that is anything but: “The Treasury is expected in 2024 to start regularly purchasing its bonds” with the dual objective “to bolster liquidity in some pockets of the market and to smooth the volatility of bill issuance as it manages its cash balance.”

The subtext here is that there are not enough buyers to absorb the amount of US Federal debt issuance that will be coming on to the market. This means that the US Treasury is prepared to step in as a “buyer of last resort” in the Treasury bond market. This is the playbook that Japan has been running for the last few decades, stepping in with a blank check to effectively nationalize the assets that nobody in the marketplace wants to buy.

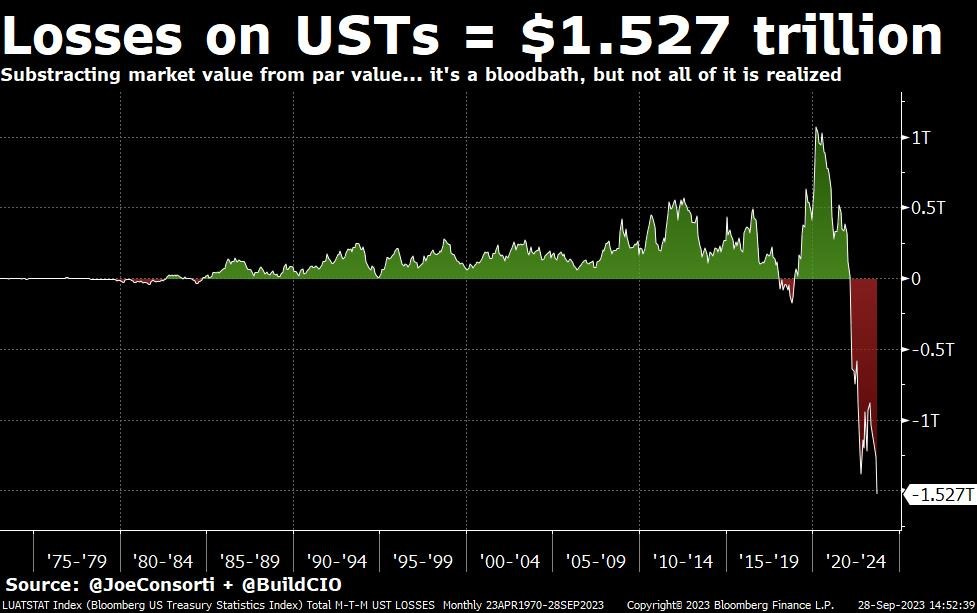

To date, the US Government has softened the impact of the bond sell-off by backstopping the private sector with the BTFP, which is effectively a blank check program to cover the considerable unrealized losses that have accrued for financial institutions holding US Treasuries, as this chart from Joe Consorti highlights.

But now, the US Government is preparing to take on the problem more directly.

In terms of major milestones in the ongoing erosion of the US fiscal position, this stands out as a major threshold. But of course, it is being framed as just a small program that will not be used during times of crisis.

Again, reading between the lines, this is more likely a sign that the US Treasury realizes that it needs to quietly position itself to become a “buyer of last resort” in order to prop up the Treasury bond market as interest expense on the National Debt continues to soar, driving greater deficits and the need for more debt issuance.

From the circumstances of the US National Debt and the behavior of the Treasury, it’s evident that the sovereign debt situation is headed for more pain.

As for why a recession hasn’t materialized yet & when it may be coming, there are some clues.

For paid subscribers, let’s dig into:

the major drivers of the lag effect that investors should be aware of, and

why the Fed’s Reverse Repo operations are the key to understanding why the recession hasn’t hit yet, but is on the way.

Keep reading with a 7-day free trial

Subscribe to Once-in-a-Species to keep reading this post and get 7 days of free access to the full post archives.