Stock-to-Flow Reality

You may think the Stock-to-Flow Model fell short, but it's still directionally right, and here's why

Before we get going:

If you’ve enjoyed my articles or content on Twitter (@Croesus_BTC), be sure to subscribe to my weekly Bitcoin newsletter, “Once-in-a-Species.”

1-2 posts a week to help you understand why Bitcoin could be the key to growing your wealth this decade.

Get on the free email list to receive it: 👇👇👇

Thanks for your support! Okay, now on with our story…

The Stock-to-Flow Model extrapolated a stairway up to heaven. We all wanted it to be proven 100% right — I certainly did.

However, I also knew it would disappoint at some point. For this reason, I have long characterized it as “specifically wrong, directionally correct.”

The S2F Model defined the excitement and anticipation of the 2020-21 Bitcoin bull market. Fast forward a few years and the S2F Model has become deeply unpopular — the subject of derision — an example of overhyped statistical extrapolation that fell flat on its face.

This is understandable, but it is also unfortunate. And frankly, unwarranted.

By spurning the S2F Model, people toss out the baby with the bathwater.

A life-changing insight about Bitcoin as a savings vehicle is buried at the heart of the S2F Model. Understanding it could be the key to your financial future. That’s what this piece will explore.

What is the S2F Model

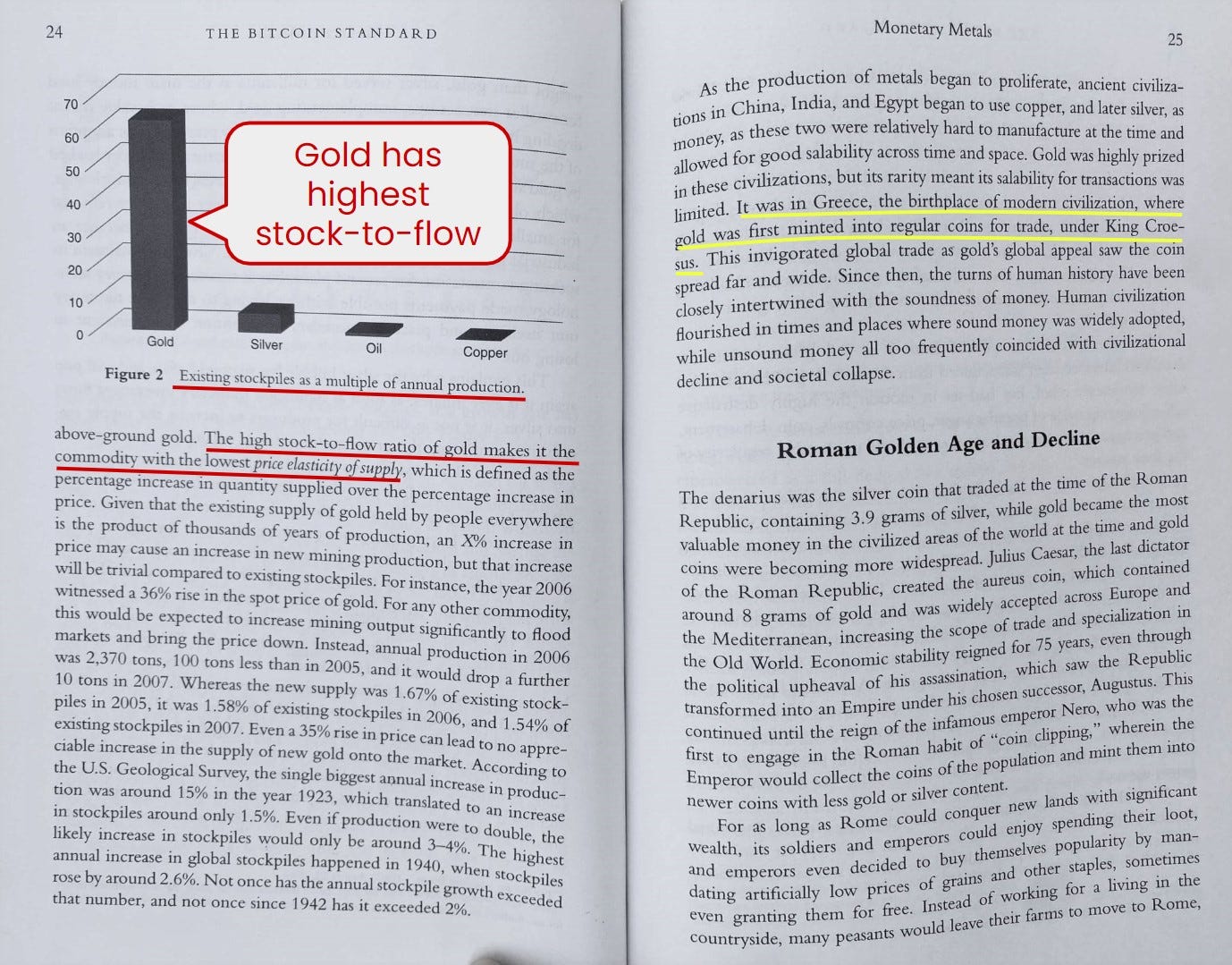

In 2019, a Dutch investment professional using the pseudonym of “PlanB” (B for Bitcoin) released a Bitcoin price forecasting model. This price model was directly inspired from a section included in Saifedean Ammous’ seminal book, The Bitcoin Standard.

Here is the relevant page that PlanB built upon… which happens to sit adjacent to the page where I took inspiration for my Bitcoin pseudonym, Croesus. (Thanks, Saifedean!)

The core idea is simple. Every commodity has a certain amount of circulating supply (stock) and an amount of new supply created every year (flow). Dividing these two numbers yields a stock-to-flow ratio for a given commodity.

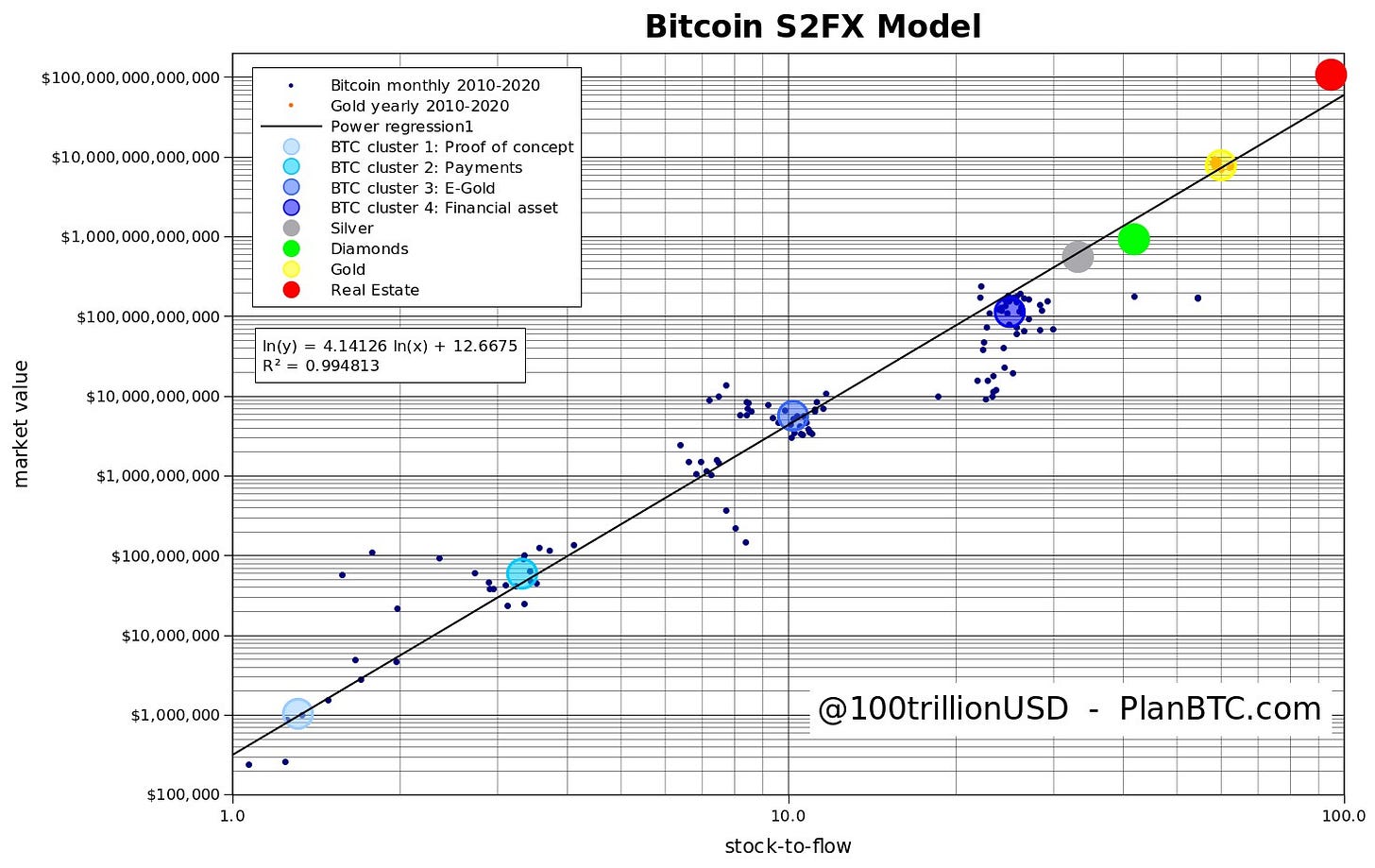

What PlanB did with this concept was novel and bold. He turned it into a predictive valuation model. To do this, he created a regression analysis to find a line-of-best-fit for the major store-of-value commodities. This was his result:

As you can see, the stock-to-flow ratio of a commodity is an excellent predictor of how valuable that commodity is. (Note: each axis is logarithmic, meaning exponential.)

To frame it differently, this chart suggests that a commodity with lower annual supply creation is a vastly better store-of-value asset and attracts exponentially more capital.

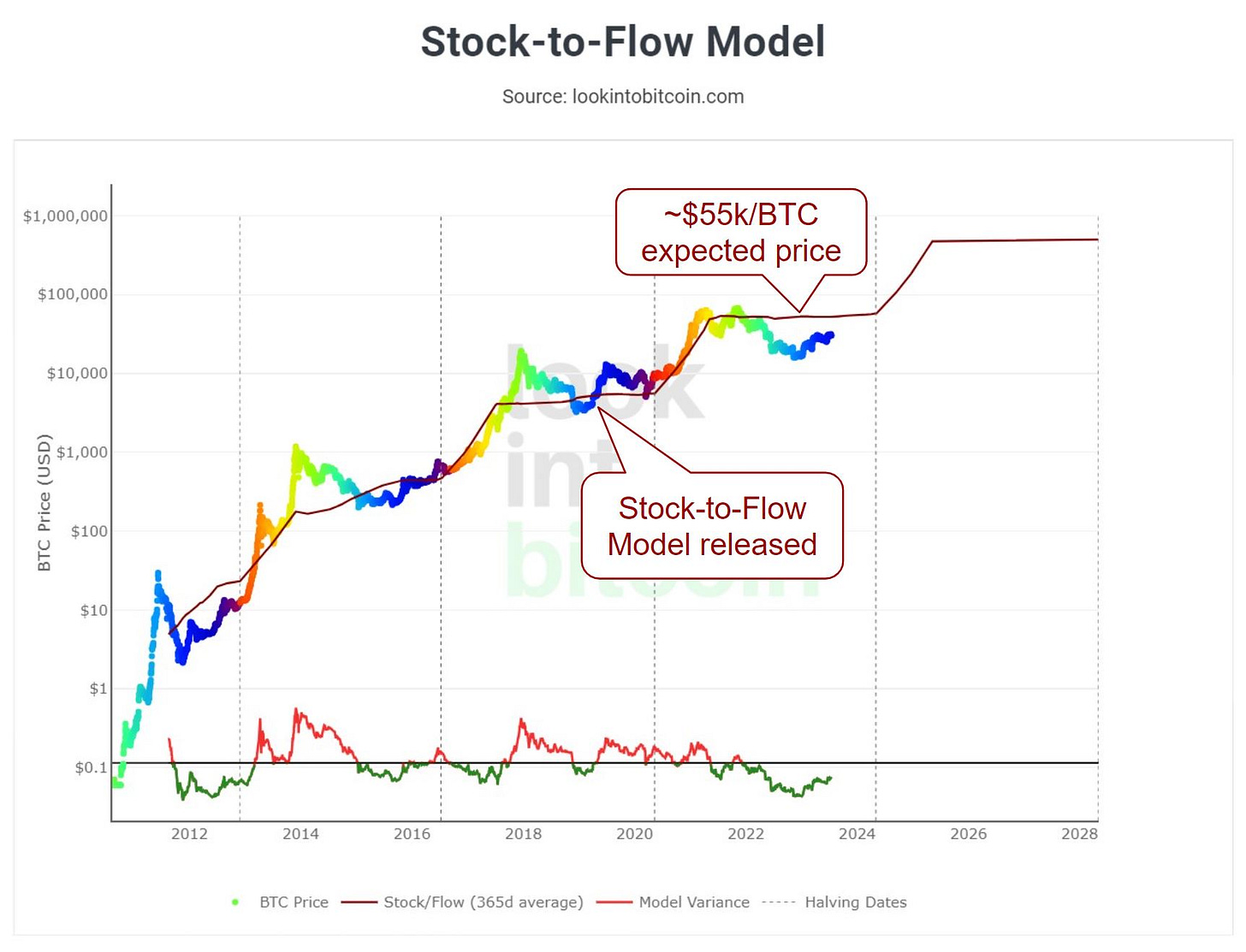

The reason that PlanB’s work got so much attention and catapulted him to millions of Twitter followers is that he projected this observed statistical regression forward to create a Bitcoin price forecast. This Stock-to-Flow Model predicted a stair-stepping of Bitcoin’s value every four years.

It’s worth remembering that when the S2F Model was first released, Bitcoin’s price was $4k. Bitcoin had just spent the prior year crashing from its $20k peak in 2017. Most of the world was confident that Bitcoin was headed to zero. Despite this prevailing gloom, PlanB released his audacious model suggesting that the 2020 halving would send Bitcoin’s price rocketing towards a $55k price equilibrium.

Here’s how the Bitcoin price has performed versus this original version of the S2F Model (the stair-stepping line) since its March 2019 release. Pretty darn good!

Despite the objectively strong performance of V1 of the S2F Model over the last four years, the S2F Model has fallen from favor. In fact, expressing support or praise for the S2F Model now invites mockery and contempt. (I will get a lot of shit for writing this piece.)

What happened?

Set up for disappointment

In my view, the S2F Model and its creator made two missteps:

Set specific price targets

Raised those targets

First, PlanB designed the visual output of the S2F Model as a specific price line, rather than a probabilistic range. This was a double-edged sword. On one hand, the simple line very effectively communicated the model’s predictions. However, people wanted to believe in PlanB’s astonishing price predictions so badly that they turned them into promises.

Second, the biggest mistake that PlanB made was that he revised the S2F Model upwards – not once, but twice. V1 of the S2F Model predicted that Bitcoin’s price would gravitate to $55k/BTC in this halving era (2020-2024), then the model’s inputs were revised for V2 and that price prediction was upped to $100k. PlanB later released the even-more-bullish S2FX price model.

All in all, millions of people were expecting a specific price, and for most of them, that number was $100k. When that number wasn’t reached, the mob turned angry.

Why the S2F Model fell short

Models aren’t promises. They are math applied to an existing data set to offer a probabilistic representation of the future. Importantly, these models generally assume all other conditions will remain constant. But that’s not reality.

Here are a few real-world forces that could have caused the S2F Model to underperform expectations:

Macroeconomic headwinds

Last bull market was characterized by a combination of major headwinds that, in my opinion, prevented Bitcoin’s price from extending into a blow-off top in the ~$125k range.

Had these headwinds not existed, maybe we would have reached six figures. Would there still be so much bitter hate for the S2F Model then?

For what it’s worth, I believe that last cycle’s headwinds are turning into next cycle’s tailwinds. Check out the full analysis in this recent piece.

Asset class inertia

When all the Bitcoin in the world was worth $1B, it was very easy for Bitcoin’s total valuation to double. A single investor could decide to make a sizable allocation. At $1T in valuation, it will be much harder for Bitcoin’s total valuation to double.

In other words, the larger that Bitcoin becomes, the more inertia its valuation will have to change.

Greater inertia doesn’t prevent something from getting to where its going, it just causes it to take longer to get there. It may be that as Bitcoin gets larger, it takes longer than four years for the changed stock-to-flow reality of each halving to be fully digested by the world, for human behaviors to adjust accordingly, and the Bitcoin price to reflect this process.

In some ways, I think we’re already seeing this effect. Right now, Bitcoin’s stock-to-flow ratio is roughly equal to gold’s. However, gold’s total valuation is 20x greater. This gap isn’t because gold is a better store-of-value, but instead because it is a familiar and trusted store-of-value. It would take a generation or even two before Bitcoin’s valuation caught up to gold’s if they continued to have equal stock-to-flow ratios. (But, luckily, that is not the case. Bitcoin’s stock-to-flow ratio will continue to get 2x better every 4 years.)

In both of these scenarios, it’s not that the S2F Model was wrong, it’s that the S2F Model did not assume interference from any extraneous forces. It worked in a vacuum, but not in the messiness of reality.

That’s not the fault of the S2F Model — that’s on us for expecting the clean and prompt actualization of theoretical math.

Long live the Stock-to-Flow Reality

With a few big caveats added, I believe the stock-to-flow conceptual model is still valid.

Of course, these party-pooper caveats take away the splashy marketing flair that made S2F such a viral hit. (That’s why I have nowhere near PlanB’s 2m Twitter followers!)

Here they are:

No specific price targets

Yes, I understand that specific price targets were the whole allure of the S2F Model. But it’s also why you turned on it.

The truth is, we don’t know what Bitcoin’s price “should” be. PlanB gave you a statistical midpoint in a probabilistic range, but you interpreted it as a promise.

There is a ceiling

Part of what was mesmerizing about the S2F Model was that it dispassionately projected the ~10x stair-stepping of value every 4 years without end.

Of course that’s not going to happen in real terms. It could happen in a Weimar hyperinflation scenario, but then fiat pricing loses its meaning anyway.

Let it go, there is a ceiling. But that’s fine, because the ceiling for Bitcoin is still so incredibly high.

This might take a long time

Part of the appeal of the S2F Model was that it predicted a snappy adjustment to the changed stock-to-flow economic reality after each halving. The data reflected that in the early years, but it may not be reasonable to expect such rapid change as Bitcoin grows larger.

Instead, allow yourself to accept that Bitcoin can only grow in valuation at whatever rate the bell-curve of technology adopters progresses.

At the end of the day, Bitcoin’s price is a reflection of human behavior reacting to changed economic reality. And that process could take a generation or two.

What are we left with? Well, a much less sexy version of the stock-to-flow model. Something that looks like this:

But, at the heart of this version — the Stock-to-Flow Reality — lies the core idea from the original model. This is the secret to Bitcoin & why it is the best savings vehicle ever created.

Increasing scarcity means value stored in Bitcoin grows in purchasing power over time.

Additionally, this stripped-down Stock-to-Flow Reality also helps to explain why gold’s value is still 20x greater than Bitcoin’s — in fact, it suggests that there’s just a lag between the moment when Bitcoin became gold’s equal (the 2020 halving) and the eventual result of the world adjusting its behavior to properly value Bitcoin as gold’s equal.

In other words, Bitcoin is already as good of a store-of-value asset as gold — and yet, you still have time to front-run the rest of the world figuring that out.

New to Once-in-a-Species? You have a choice now:

Leave this page & forget how to find my work again, OR

Gain access to next week’s post. My goal is to help you understand why Bitcoin could be the key to growing your wealth this decade: 👇👇👇

Share this with friends, family, Bitcoin skeptics, and S2F haters…

Once-in-a-Species is not investment advice.

Twitter: @Croesus_BTC

Great piece, love the more realistic take on near term price movements but bullish on the long term. New innovations always have long lead/lag times - electricity took 30 years to be fully utilized and become widespread. The internet was much quicker, but it's still wreaking change in the real economy. Much better to think about Bitcoin in decades, not months or even years

Come on, stock to flow was always ridiculous as a model from a practical, let's-actually-use-this-thing-to-make-money standpoint. Bitcoin should be between 20,000 and 200,000 in x number of years. Great. Thanks for that.

Sure, there were a few great insights about scarcity and valuation, but it all just comes down to relative gearing against planned, systematic dollar depreciation.

If there is a bitcoin model, it would have to be 1) gearing to fiat depreciation -- liquidity creation, monetary inflation -- combined with 2) asset allocation into bitcoin from other assets, as you've cataloged so well.

Those would be your 2 variables. Right now bitcoin is something like 90% correlated with liquidity creation and destruction. So that's the real "flow" -- liquidity flow, mostly from Fed and PBoC.

Not hard to see the correlation with liquidity, it's nearly exact: https://www.tradingview.com/x/rsVtX4rT/