Special update: Banking crisis in the crypto and tech sector

I banked with Silvergate and watched it collapse this week, along with Silicon Valley Bank. What happened & which big bank may be in trouble next

A crisis is brewing in the banking sector – and the credit market is flashing warning signs that contagion is on the way. As of this week, two big canaries lay dead in the banking industry coal mine – Silvergate Bank (the biggest name banking the crypto sector) and Silicon Valley Bank (the biggest name banking the tech sector).

In this special weekend update, I’ll explain what has happened, why it happened, what it means for the market, and which bank could be the next to go under (and the market knows it).

First, I should mention that I know part of this story as something of a front-row observer. When I started my cryptocurrency investment fund in 2017, there were only a few banks who were willing to touch a cryptocurrency business. The most prominent was Silvergate Bank. By 2017, they had already established themselves as the major bank for the crypto sector, and I was happy to bank with them.

I was a customer from November 2017 through December 2022, when concerns about the bank’s financial condition caused me to withdraw. Now, as of Wednesday, Silvergate Bank has collapsed. I will share what it was like as a fund manager and customer of Silvergate Bank to watch as the banking bulwark of the cryptocurrency industry slowly went under.

Let’s dig in to where it all went wrong for Silvergate Bank & Silicon Valley Bank…

Silvergate Bank

To understand this story, we have to first acknowledge the unique pressures of banking cryptocurrency businesses. We all know that crypto has had massive highs and crushing lows. When things run hot (as I’ve explained happens every four years because of Bitcoin’s supply issuance schedule), money comes pouring in to the crypto landscape. Businesses boom, VC funding flows, and most importantly… people send money to crypto exchanges like Coinbase, Kraken, Gemini, etc. Those funds are held as deposits in those respective companies’ bank accounts.

As such, crypto bank deposits boom in the bull markets. Business is good for the crypto banks.

But the reverse dynamic is true when cryptocurrency market crashes happen. Lots of speculators want their money out of the market. Bank deposits plummet.

Nobody was more aware of the cyclicality of the crypto banking business than Silvergate Bank. They had watched the tide go out in 2014, had weathered it as the leading crypto bank in 2018, and they were prepared to do so again in 2022.

But they made a fatal error. They banked Sam Bankman-Fried.

When FTX imploded in late 2022, revealing ~$10B in fraud, Silvergate lost one of its largest depositors. But much worse than that, the egregious banking malfeasance discovered by the bankruptcy team raised questions about the risk management and controls in place at Silvergate Bank.

In particular, it appears that billions of dollars sent by FTX customers were actually routed to the Silvergate Bank account for Alameda Research, a hedge fund 90% owned by Sam Bankman-Fried. That’s something of a cardinal sin in banking – this is why Know-Your-Customer (KYC) laws and Anti-Money Laundering (AML) regulatory requirements are in place, after all. Surely, somebody at Silvergate Bank should have noticed that a hedge fund was receiving deposits resembling what a large cryptocurrency exchange might receive (small $ amounts sent from many different sources)?

Personally, I actually think it’s most likely that Silvergate did technically fulfill its obligations when requesting information from FTX. However, even if they were responsible actors, they still fell short for two reasons. First, risk management at banks is a quantified process that inherently comes down to “check these boxes” – inevitably, this means that it’s possible to miss the qualitative big picture of suspicious banking activity inconsistent with what you would expect from a certain customer’s business model. Second, banks generally rely on customers providing honest representations and not committing $10B in fraud. (For more on this topic, see my podcast discussion with Daniel Prince and Andy Edstrom on March 6th.)

But ultimately it doesn’t even matter whether Silvergate fulfilled its obligations. The banking business is fundamentally a trust business. Customers trust banks to keep their money safe and accounted for. But in this case, suddenly, the trustworthiness of Silvergate Bank was in question. Furthermore, the extent of their exposure to FTX was unclear, and the bad publicity of angry banking regulators does little to inspire customer confidence.

As such, Silvergate Bank customers got spooked. As a reminder, most of these customers are crypto businesses run by seasoned crypto market participants. In the last year alone in crypto, we’ve seen BlockFi, Celsius, Alameda, FTX, and more go under as the result of a bank run.

Therefore, when Silvergate issued a statement on December 5th, 2022 asserting that “Silvergate conducted significant due diligence on FTX and its related entities including Alameda Research” and that the bank had “a resilient balance sheet and ample liquidity”… my concern spiked. This was the same “everything is fine” language we had heard from the prior casualties of the 2022 bear market, each in their late stages of collapse and desperate to stop the bleeding.

I acted accordingly, and evidently other Silvergate customers did the same (including Coinbase, Paxos, CBOE, Crypto dot com). In January, it was reported that Silvergate customers had withdrawn $8.1B in deposits in the wake of the FTX fiasco.

On March 3rd, Silvergate promptly halted its Silvergate Exchange Network (SEN). That was the moment I knew they were in dire straits. SEN was the feather in Silvergate’s cap, enabling rapid dollar transfers between crypto companies – it was key to Silvergate’s network effect advantage in the crypto ecosystem, and its reliability and uptime were crucial features they proudly marketed. And here they were, after stock markets had closed on a Friday, unceremoniously dumping that crown jewel initiative.

When I first started banking with Silvergate, they didn’t charge a monthly service fee and they didn’t require a minimum average balance. Over the years, a $500 monthly fee was added and a $100k expected minimum balance crept in. (I ignored that latter condition, but they never pressed the issue.) I wondered if these changes were because the bank was struggling to make the risk and volatility of crypto make sense from a business model perspective. Now I see their lack of minimum balance enforcement as perhaps the more telling indicator that Silvergate had grown too fast to closely monitor its customers’ account activity – and perhaps it was that hole that the suspicious FTX-Alameda activity slipped through.

At any rate, on March 8th, Silvergate Bank announced its “intent to wind down operations and voluntarily liquidate Silvergate Bank.” The bank’s stock price now looks like a cautionary tale of growing too big, too fast – peaking at $240/share in 2021 before a brutal decline to just $2.52 as of close-of-market on Friday:

In truth, Silvergate’s demise amounts to the classic challenge that fractional reserve banks always face: how to invest customer deposits while always having enough cash on hand to meet withdrawals. For a sensible breakdown of these risks, and how they are amplified in a volatile industry like crypto, I recommend this Wall Street Journal piece.

In terms of what it means for the crypto ecosystem, in the short-term it will cause uncertainty and a scramble from Silvergate clients to find a new banking home. In the medium- and long-term, this will actually be a good thing for the crypto ecosystem. Silvergate Bank was a tiny regional bank that embraced crypto and achieved massive growth unconstrained by their small territorial footprint confined to branches in San Diego alone. Yes, they probably grew too big, too fast, and they might have done more to protect themselves from enabling massive fraud by FTX. However, every small regional bank has watched Silvergate’s meteoric ascent. Those with growth ambitions will see this moment as an opportunity to grab some of the market that Silvergate has just coughed up. I expect we will see competition from a dozen small regional banks to absorb the crypto client base, which will ultimately be a positive for distributing concentration risk. Yet another test of the anti-fragility of crypto, which the ecosystem will emerge stronger for.

Silicon Valley Bank

SVB has long been the gold-standard in tech entrepreneurship. When I was at Stanford Business School, it was the only bank that entrepreneurs would boastfully namedrop – a seal of approval for a fledgling tech startup hoping to open the right doors to be taken seriously. The bank was the dominant player in the Silicon Valley tech scene, reaching a 25.9% share of deposits in the region in 2016.

After 40 years of success, SVB got themselves into trouble by a simple mistake in the heady days of the pandemic stimulus bull market. At EOY 2019, SVB had $62B in deposits. At EOY 2021, SVB had $189B in deposits. This massive increase in deposits at the bank had to be put to work – that’s the entire banking business model, after all.

However, SVB couldn’t possibly find worthy borrowers for $127B in capital. As a result, they invested $80B of it in 10-year-duration mortgage-backed securities at 1.56% yields.

This decision only makes sense if you don’t expect the Fed to raise interest rates to 5% in the next year, as has now happened. The Fed’s aggressive tightening cycle had a two-part effect. First, those mortgage-backed securities dropped significantly in value. Second, the entire tech sector has contracted dramatically, causing lean times and layoffs for companies, and a huge influx of net withdrawals from the banks that serve them.

The combination of these two factors pushed SVB into dangerous territory. To meet the spike in withdrawals, they were forced to sell 25% of their underwater mortgage-backed securities, realizing a $1.8B loss on the sale, which was announced on March 8th.

Just like with Silvergate’s story, this concerning news betrayed the weakness of SVB and accelerated the run on the bank. Customers and investors ran for the exit. The bank’s stock dropped 62% on March 9th, and an additional 66% on March 10th. The same day, the bank was shut down and handed over to the FDIC to handle.

To put this development into context, SVB is the largest bank failure since 2008, and the second-largest in U.S. history. It may not be the last in 2023…

Credit Suisse may be in trouble

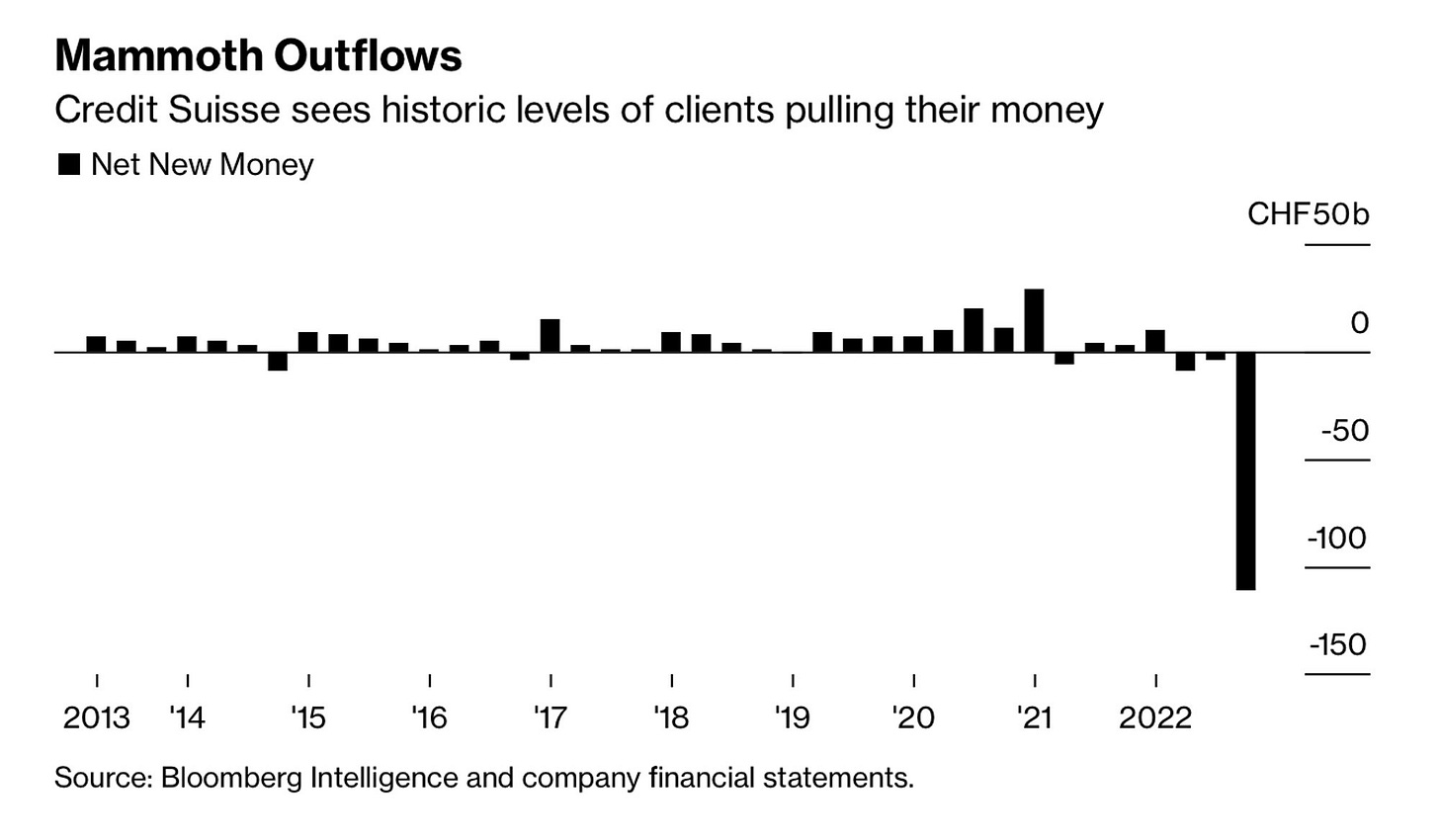

Venerable banking institution, Credit Suisse, may be the next to suffer from eroding trust in its financial position. A bank run has been underway for months now, and the only question is whether it will snowball beyond the scale of outflows that the bank can handle (as was the case with Silvergate and with SVB). While we don’t know where that magic threshold is, we do know that the scale of outflows has been extreme:

As a result of this bank run, the price of Credit Default Swaps (contracts that pay off if an entity goes under) have surged for Credit Suisse. The market is betting that the Swiss giant is next on the chopping block. And if that big domino goes, the contagion of bank runs may spread much further still.

And now, the latest news as of Thursday is that Credit Suisse has delayed filing their 2022 annual report – the same announcement that Silvergate Bank made about a week before they went under. We shall see what this next week may bring in this growing banking sector deposits crisis.

Unless the Fed eases monetary conditions, it seems more likely than not than not that these won’t be the last banks to fall victim to a bank run this year.

Love the content Jesse - thank you for your front row perspective on this. So glad I finally stumbled across your newsletter.

Great article Jesse. Thanks for sharing.