Coming out as a Bitcoin maximalist

"Hi, my name is Croesus"

I have been living a double life. On the surface, I have remained Jesse Myers, Stanford MBA and former Bain consultant. But for the last six years, my time and intellectual energy has been spent somewhere very different. The journey has taken me down a long and twisting rabbit hole to wrestle with unexpected conflicts between truths we take for granted and realities long-forgotten.

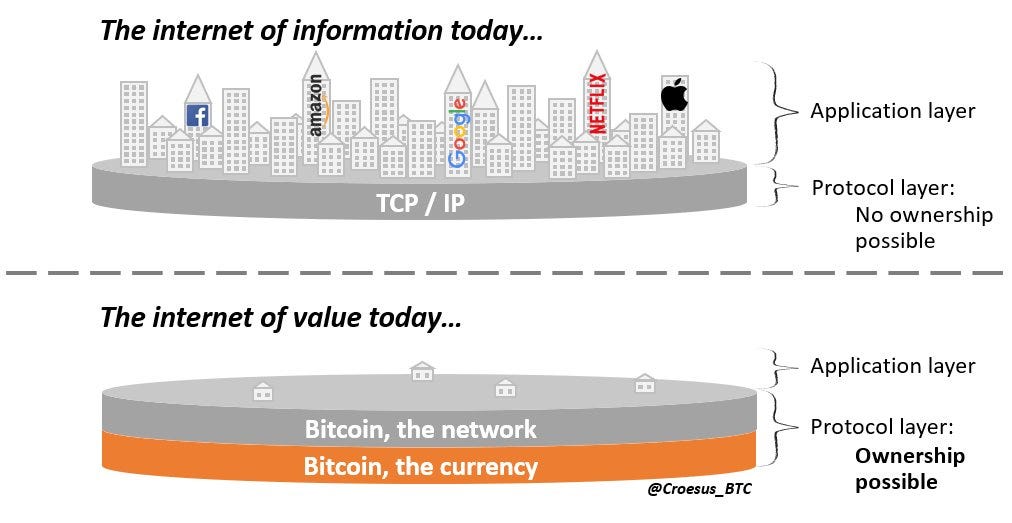

The rabbit hole was taking an interest in the value proposition of cryptocurrencies. The result was emerging a Bitcoin maximalist.

Getting to this destination was a terrible surprise – I never set out to become one of those Bitcoin fanatics. You know the type – once or twice you’ve been stuck in an otherwise pleasant social context, half-listening to the zealous ravings of a Bitcoin believer while primarily looking for a graceful way out.

I may have never wanted to be that guy, but my curiosity compelled me to get to the bottom of the promise and potential of cryptocurrencies. For years, my focus was on the exciting innovations after Bitcoin, but certain things didn’t add up. To resolve this dissonance, my path led me deeper, much deeper, into monetary history, decentralized systems, and the study of scarcity. There was no way around it, everything I was finding, all the pieces of the puzzle, they all pointed back to one simple conclusion: Bitcoin is the most important asset of the 21st century.

Without meaning to or wanting to, I had become one of those crazies.

For three years now, I have existed in this intellectual state known as “Bitcoin maximalism”. I found myself among a relatively small but passionate cohort of individuals who had each, through their own personal journeys of persistent curiosity and study, reached the same conclusion as me. Our forum is Twitter, our frontier is Bitcoin.

Under a pseudonym to protect my privacy, I contributed what skills I have to illuminate the path for others. Without intending to, I made something of a name for myself as a Bitcoin educator.

For some time now, I have been stuck, however. I put out content on Twitter for those who were actively searching for knowledge about Bitcoin. It has been deeply rewarding, but has kept me fundamentally constrained to keeping my work disconnected from my real identity.

In truth, I’ve been scared to make my views public. Believing in Bitcoin means believing that there is something very wrong in the world as we know it. We all sense that, but we also have already decided what we believe is needed to make the world a better place. Bitcoin is a different path, which automatically makes it a threat to our preferred panaceas. And, well, that is unpopular with everyone.

It’s also a path readily championed by scoundrels and scammers, by the disagreeable and despicable. But such is the nature of any frontier, where opportunity exists not only for those decent, honest folk who dare to seize it – but also for those who are pushed to the fringes of society because they are unsuited for success within the mainstream. Bitcoin is still the Wild West, which is exactly why there is tremendous opportunity for those who take interest in it now, rather than in the future when it’s commonplace.

I realize in that last statement there is a level of certainty that borders on arrogant delusion. But that’s the matter-of-fact result of digging deep enough for long enough into understanding this strange new asset. Bitcoin is on a deterministic path to become the world’s preferred store-of-value asset. And fundamentally, that means Bitcoin doesn’t require that you believe in it; it will succeed because of its inherent properties, regardless of your opinion of it.

If this assertion is true, it puts you, the reader, in a rather uncomfortable predicament. You can either add this warning to your mental list of positive endorsements of Bitcoin that, at some threshold of critical mass, will spur you to learn more about Bitcoin, however begrudgingly… OR you can dismiss this as delusion without merit, despite the fact that you have been interested enough to read this far.

Since both of those options are unpalatable, I’ll offer a third option: defer judgment. I will be putting out more content exploring all the important aspects of Bitcoin, and you can decide after reading more whether Bitcoin is worth your time or if this Stanford MBA has lost his mind. This way, there’s only upside – either you learn something potentially important to your financial prosperity, or you get to savor the Schadenfreude. Win-win. All you have to do is click “Follow” on LinkedIn.

Love this! So well written. Thank you for sharing. This is powerful and compelling.

Please Share the link. When searching on LinkedIn i can find 273 Jesse Meyers