Bitcoin's halving is less than a year away - how high will the price go?

Why the halving makes Bitcoin's price go up & how high the price could go in 2024

Before we get going:

If you’ve enjoyed my articles or content on Twitter (@Croesus_BTC), be sure to subscribe to my free weekly Bitcoin newsletter, “Once-in-a-Species.”

1-2 posts a week to help you understand why Bitcoin could be the key to growing your wealth this decade.

Get on the free email list to receive it: 👇👇👇

Thanks for your support! Okay, now on with our story…

The most exciting property of Bitcoin (from an investment perspective) is “increasing scarcity.” Bitcoin is the first (and only) asset in history that offers a reliable guarantee of increasing scarcity in its supply issuance.

You’ve likely heard the old maxim that land is a good investment because “it’s the only thing they’re not making any more of.” This simple wisdom is true and surprisingly powerful – the global supply of land has “finite scarcity”.

But oddly enough, from an investment perspective, what’s even better is an asset they’re making less and less of. This is why a Michael Jordan rookie card is valuable, or a Van Gogh or a Picasso. Once upon a time, they used to make these items… and now, they don’t make any more of them. These are examples of all-or-nothing “increasing scarcity.”

Bitcoin harnesses “increasing scarcity” to drive a reliable appreciation in purchasing power over time. However, it doesn’t flip the scarcity switch in an all-or-nothing moment in time. Instead, this phenomenon is spaced out in an exponential decay of new supply issuance that we’re all watching play out before our eyes — from 2009, all the way to 2140.

This process is not a perfectly smooth trend running in the background – instead, it is characterized by punctuated equilibrium. Every four years, a very special event happens: the halving.

What is a Bitcoin halving?

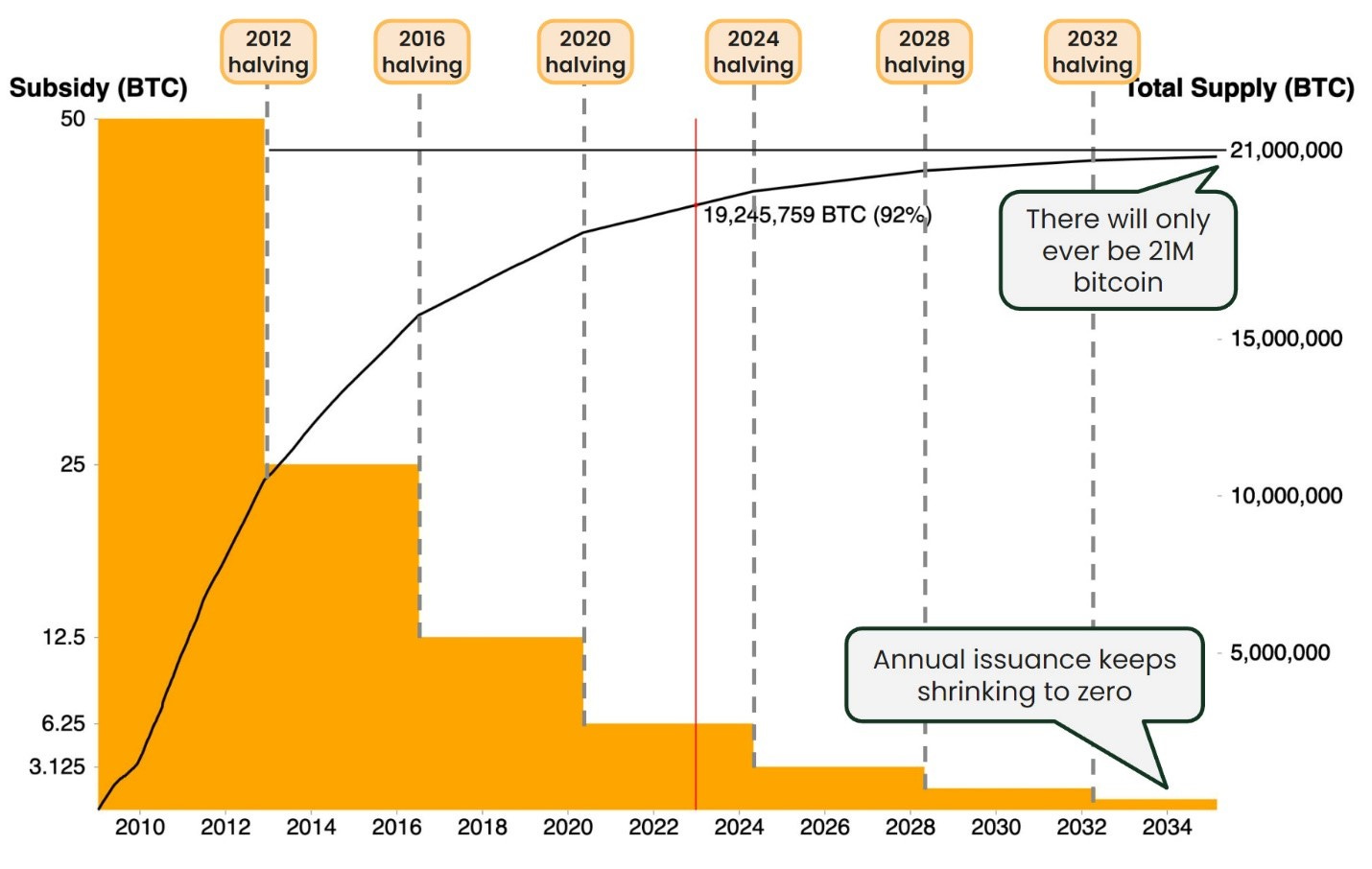

This is Bitcoin’s supply issuance schedule. What the hell does that mean? Well, the day that Bitcoin launched in January 2009… there were 0 Bitcoin in existence. Eventually, there will be a hardcapped, absolute maximum of 21M Bitcoin in existence. But how do you go from 0 to 21M?

The creator of Bitcoin implemented a very clever method – rewarding Bitcoin to whoever provides computational security to the network (“mining”). Even more clever, he designed this system to release half as much Bitcoin every four years. This creates an incredible attribute of increasing scarcity – something that no other asset in the physical realm has ever had before.

The result is an unthinkable property: Bitcoin gets more valuable over time.

The mechanical magic of this system plays out via the “halvings”. These are the moments in time when the supply issuance is cut in half – permanently. And it happens every four years. (See the dotted lines above.)

What’s incredible about this event is the supply/demand mechanics that it sets in motion.

Simple code – world-changing impact

Hardcoded into Bitcoin’s protocol is this simple function. It doesn’t look like much, but it’s Bitcoin’s entire monetary policy – written in stone from Day 0.

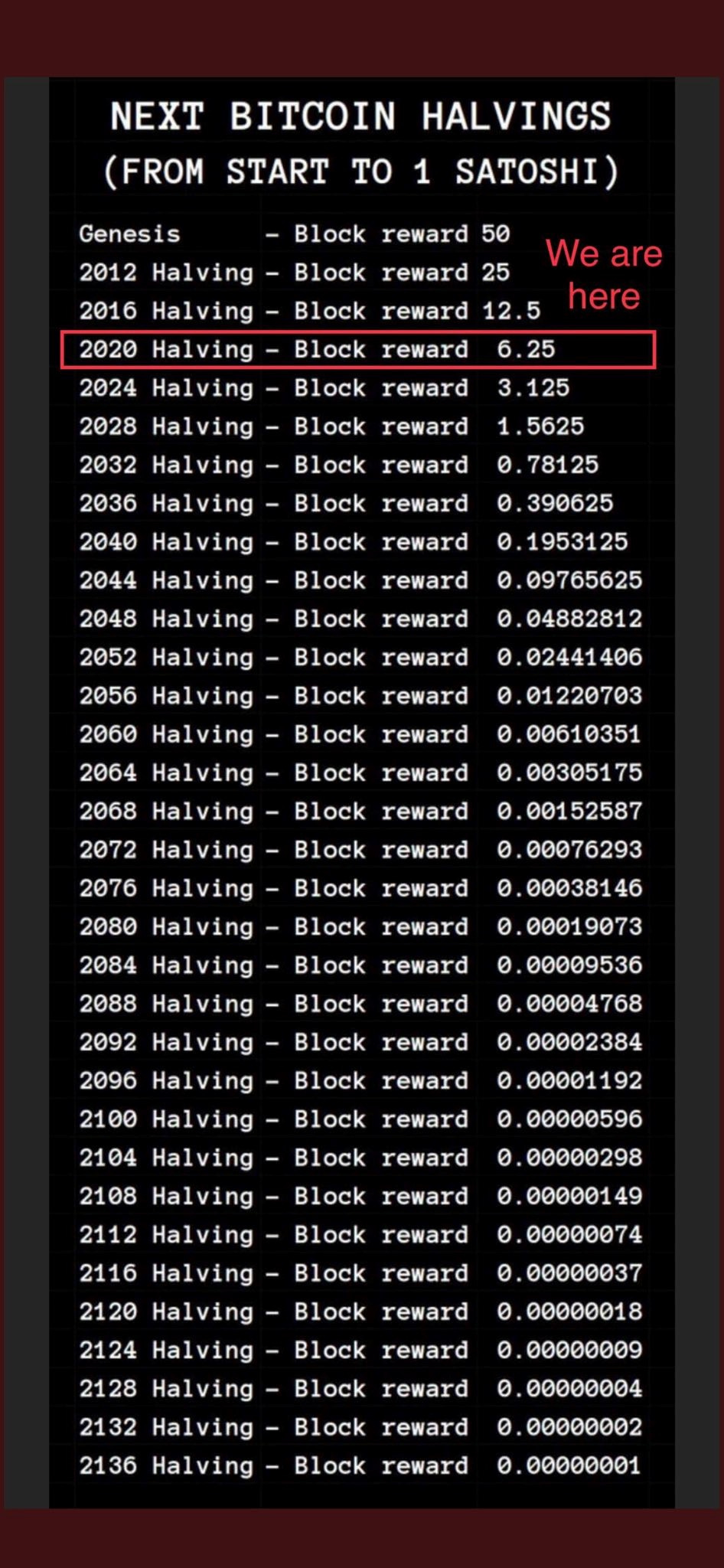

Here’s what it says. First, the code counts how many halvings have occurred. A halving is pre-set to occur every 210,000 blocks (~4 years, since there is a new block every 10 minutes on average).

Next, the amount of new Bitcoin to be issued for each new block is determined. This is calculated by dividing 50 by 2, for each halving that has occurred.

The result is that for the first 4 years, 50 new Bitcoin were issued to the miner of each block. After the first halving, 25 Bitcoin were issued per block until the next halving (4 years later), when it was cut to 12.5 Bitcoin per block.

And this pattern of decreasing Bitcoin issuance every 4 years continues until 2140, when no more Bitcoin will be issued ever again.

Right now, Bitcoin’s supply inflates by ~1.8% every year. In April 2024, the 4th halving will happen and suddenly, Bitcoin’s supply inflation will drop to 0.9% per year.

This will make Bitcoin a “harder” asset than gold, whose supply grows 1.5-2% every year from global gold mining efforts.

It’s all supply and demand

When new supply creation is cut in half, it creates a supply shock that upends the existing supply/demand price equilibrium. Suddenly there is not as much new supply going out into the market to meet demand.

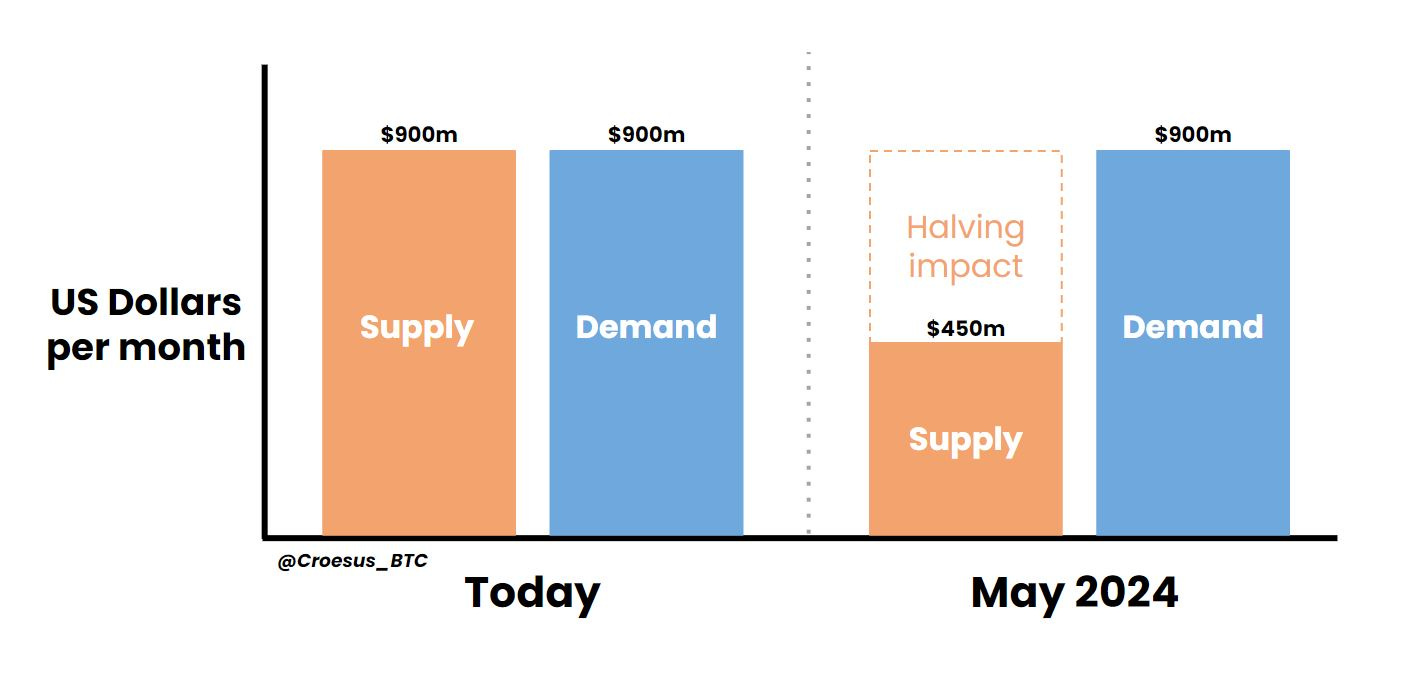

Right now, ~900 Bitcoin are released every day (6.25 BTC/block x 6 blocks/hour x 24 hours/day). With Bitcoin at ~$30k/coin, this means ~$27M of Bitcoin is created and issued to Bitcoin miners every day.

That adds up. Each month, ~$900M of new Bitcoin is being created. For the price to go sideways (as it has been), this means that average demand flowing into Bitcoin must also be ~$900M/month. If it was less than this, the price would drift downwards – if it was more, the price would drift upwards.

Which is why each halving is so exciting for Bitcoin holders.

Let’s assume that Bitcoin’s price stays at $30k/coin until the next halving in late April 2024. When the halving occurs at block 840,000, suddenly there will be half as much supply being created and going out into the market to meet incoming demand.

There will only be $450M of Bitcoin being created each month, but $900M of demand. This is a guaranteed, predictable, reliable supply shortage. It will begin in April 2024.

The only way for the free market to resolve this imbalance of supply and demand (since Bitcoin’s supply schedule is completely inelastic) is for price to go up. This supply shortage will accumulate, day after day, and naturally buyers will have to raise their bids in order to find willing sellers.

It’s pure supply & demand. And yet, 99%+ of people don’t know this will happen next year – they’ve never even heard about Bitcoin’s halvings.

The fact that you are reading this means that you are now in that 1%. That’s called information asymmetry — you have an edge on the rest of the world.

Okay great, but what have halvings done to Bitcoin’s price in the past?

Bitcoin’s performance after past halvings

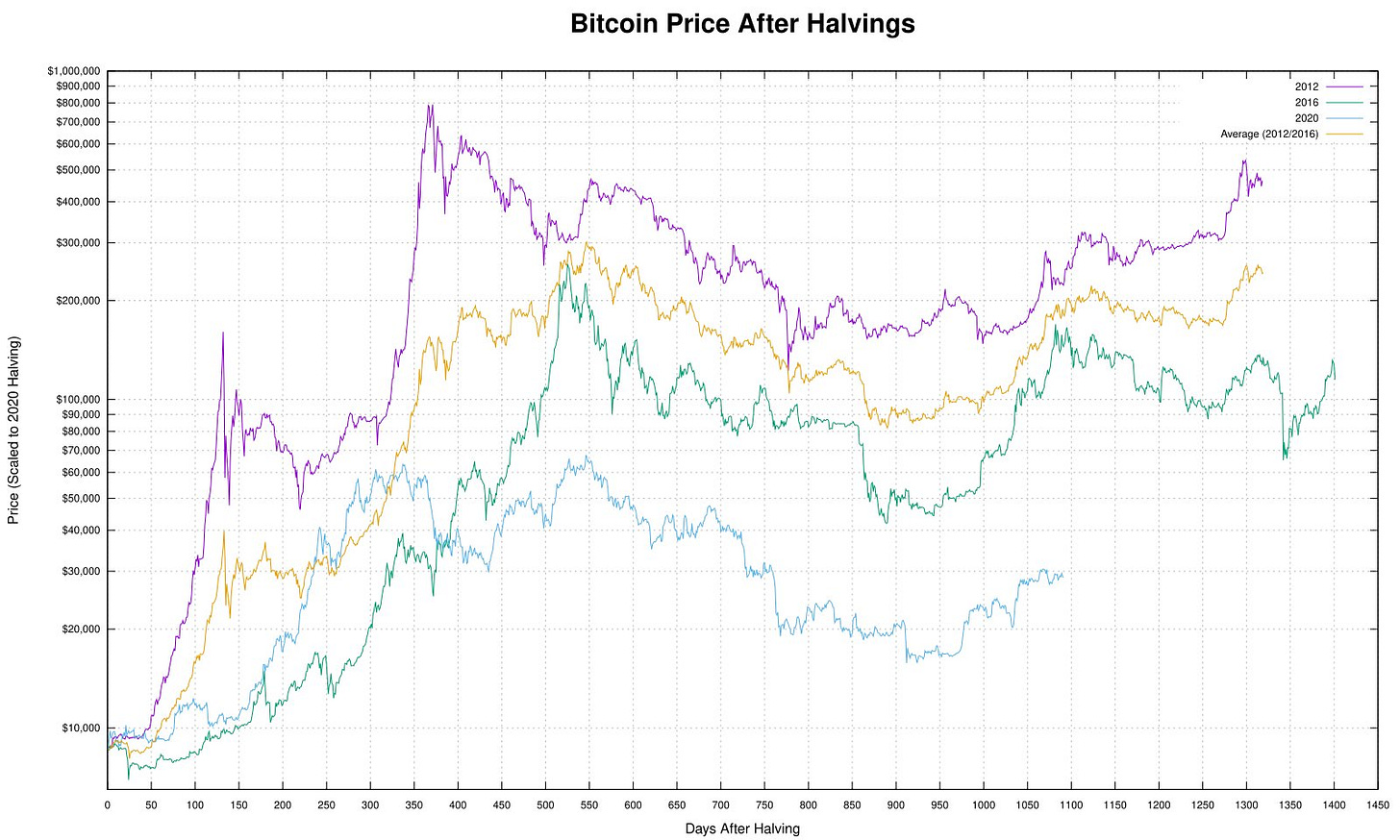

Well, Bitcoin has had three halvings in its 14-year lifetime — in 2012, 2016, and 2020. And in the 12-18 months that followed each of those events… Bitcoin has seen its major bull markets. (You likely first heard about Bitcoin during its crazy 2013 rally, then were surprised to see it happen again in 2017, and again in 2021.)

Here is what those rallies looked like (note: the y-axis here is logarithmic, meaning that the visual space between $1 and $10 is the same as $1,000 and $10,000):

This picture tells the whole story. But it’s a bit overwhelming, trying to make sense of all this data and the noise within it. So, let’s keep it simple – here’s all you need to know:

Each colored line is what happened to the price in the four years following the halving (in % terms relative to the price when that halving occurred)

As you can see, each colored line went up aggressively in the first 1/3 of the chart, down in the next 1/3 of the chart, and then back up (less aggressively) in the last 1/3 of the chart

That’s the pattern. It’s that simple.

People who aren’t knowledgeable about Bitcoin will dismiss a pattern like this as chance and think it foolish to expect it to happen again. (After all, “past performance is not indicative of future results.”) The thing is, in this case… it will happen again, when the 840,000th block on April 27th, 2024, sets the supply/demand mechanics in motion.

So, what will happen to Bitcoin’s price?

My base case for Bitcoin’s price action in 2024-25

First of all, the volatility and noise in Bitcoin ensures that everyone is often wrong in their expectations of what Bitcoin will do — myself included. However, despite the noise, it is possible to develop ballpark estimates about where Bitcoin is headed.

Here’s the performance from halving date to price peak, following each of the three Bitcoin halvings to-date:

A couple things jump out:

Time from halving to price peak is fairly consistent in the 12-18 month range

Amplitude of price growth diminishes each subsequent halving

However, it’s worth noting that the 2021 price peak was the first Bitcoin cycle that did not have a blow-off-top price peak (instead, it was a two-part rounded top). This was because of the combination of three forces that caused the price peak to be lower than it would have been otherwise:

High degree of leveraged long positions (this dampens upside price action)

China mining ban in Summer 2021 caused large-scale fear and Bitcoin selling to fund Chinese miners’ relocations

The Federal Reserve pivoting to Quantitative Tightening in Q4 2021

As a result, I still believe that Bitcoin’s price might have peaked considerably higher if any of these circumstances had not occurred.

All in all, my expectation is that Bitcoin peaks somewhere between 12 and 18 months after the April 2024 halving. This would mean a bull market price peak sometime between April 2025 and October 2025.

In terms of price, my base case is that this price peak will be 4-8x higher than the price at the halving. Assuming that price is $30k (it could easily be higher), that would mean a bull market price peak of $120k-$240k per Bitcoin.

If that sounds crazy to you… it’s really not. See how unextraordinary that looks, in comparison to recent halving eras’ performance:

What would follow is another bear market, then a period of settling in at a price equilibrium, only for the 2028 Bitcoin halving to arrive and start the process all over again.

My conviction in these mechanics is why I believe that Bitcoin is the best savings vehicle — as Paul Tudor Jones puts it, “the fastest horse” — for the next decade.

And yet, most people have no idea what will happen when the next halving arrives in a little less than a year.

But you do.

Did you find that Bitcoin analysis informative? You have a choice now:

Leave this page & forget how to find my work again, OR

Sign up for this free weekly Bitcoin newsletter to receive posts like this. My goal is to help you understand why Bitcoin could be the key to growing your wealth this decade: 👇👇👇

Big fan, great work, highly appreciated. But global supply (and global demand), at any given time, don't consist only of the daily new issued Bitcoins, do they? Moreover, there are much more BTC already in existence, vs daily issued BTC, that might be / are offered for trade = much larger lever for supply than the daily new BTC? Global trading volume far exceeds 900M per month, anyway. So what am I not getting here?

Great article. Very clear and straight forward. Thanks 👍