Bitcoin: This Is The Moment You've Been Waiting For

Why this may be the lowest Bitcoin price you ever see again

Before we get going:

I’ve been writing these updates for investors in my hedge fund since 2017. Now I’m sending them weekly to Substack subscribers.

To receive future posts like this (for free), add your email to the subscriber list:

Looking forward to sharing more of my Bitcoin analysis with you! Okay, now on with our story…

Nobody buys the bottom. That’s because the bottom feels like a disaster – the culmination of a year’s-worth of snowballing fear that overwhelms us. We see a red trend for 12 months and our animal instincts start to believe that it will continue forever. Nobody wants to touch Bitcoin at the bottom – everyone is too freaked out about how low the crash will go, and we all end up watching – frozen like deer in headlights.

You may have wanted to buy Bitcoin for cheap and you were waiting for the right moment. But, when Bitcoin crashed down to $15k in November 2022, you watched and waited for lower, thinking you might get a chance to buy at whatever magic price you regret not buying at years ago.

Everyone watches the bottom go by, thinking it will still go lower. So, don’t be hard on yourself - you’re in great company.

You may have dreamed of catching the exact price bottom, but this is actually the moment you can seize. Forget about that recent price bottom – it’s gone, peak fear has passed. In its place, we now have greater clarity – about where the price is relative to the bottom (not far above it), and more importantly… that the trend for the next ~2 years will (almost certainly) be positive.

In my opinion, right now is the best time to accumulate Bitcoin that you will likely ever see again.

The last time I felt this bullish about Bitcoin on a risk-adjusted basis was May 2020 when the price was $9k. Over the next 18 months it soared to $69k (~7x).

This bullish sentiment isn’t arbitrary. This is based on Bitcoin’s supply/demand mechanics. Those mechanics create a golden opportunity – a window in time, every four years. A chance for people to lean in to Bitcoin as a part of their portfolio, to trust their instincts that Bitcoin is something they don’t want to miss out on… again. And this is that window.

Here’s why…

The halving cycle

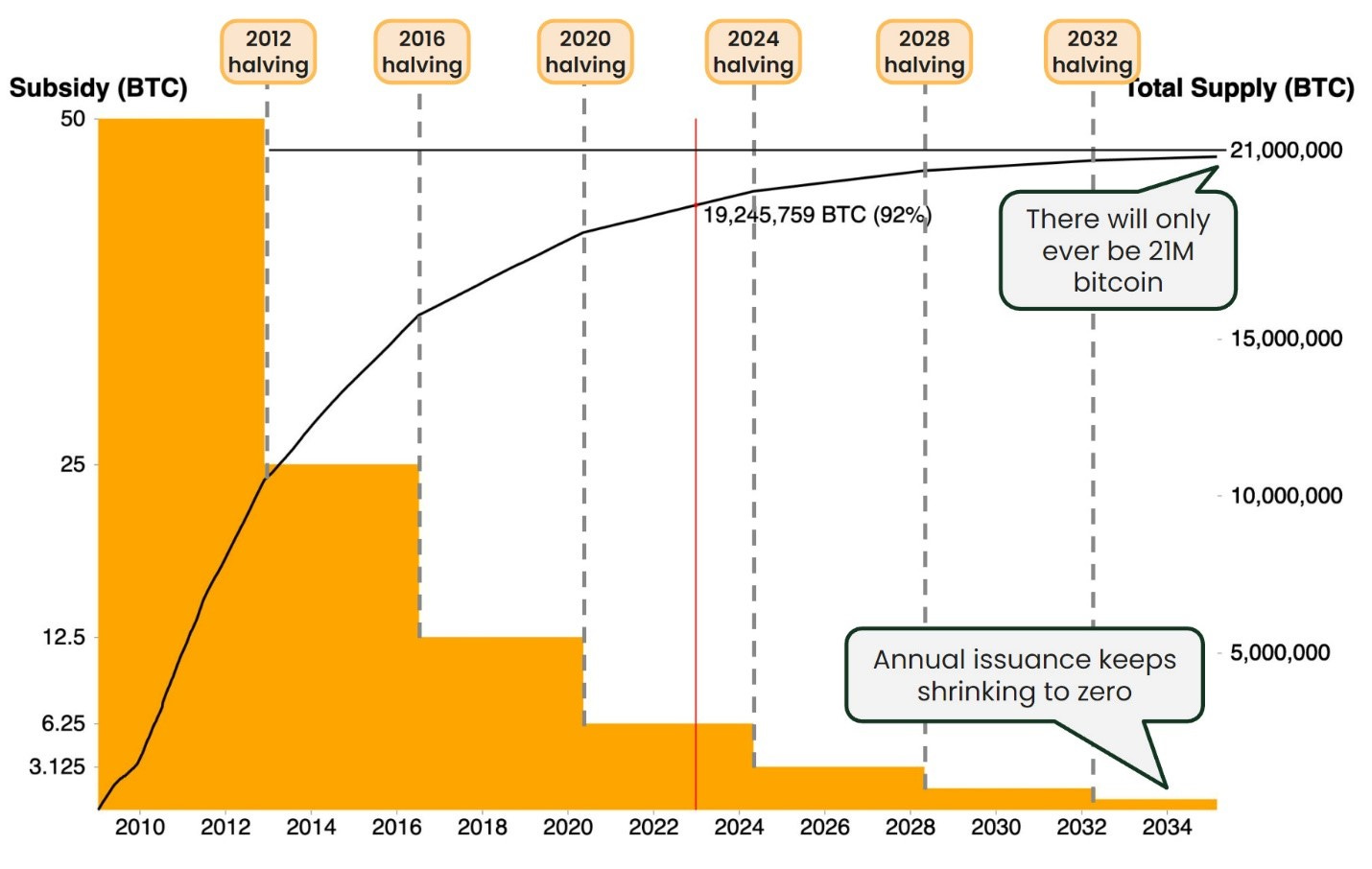

This is Bitcoin’s supply issuance schedule. What the hell does that mean? Well, the day that Bitcoin launched in January 2009… there were 0 Bitcoin in existence. Eventually, there will be a hardcapped, absolute maximum of 21M Bitcoin in existence. But how do you go from 0 to 21M?

The creator of Bitcoin implemented a very clever method – rewarding Bitcoin to whoever provides computational security to the network (“mining”). Even more clever, he designed this system to release half as much Bitcoin every four years. This creates an incredible attribute of increasing scarcity – something that no other asset in the physical realm has ever had before. The result is an unthinkable property: Bitcoin gets more valuable over time.

The mechanical magic of this system plays out via the “halvings”. These are the moments in time when the supply issuance is cut in half – permanently. And it happens every four years. (See the dotted lines above.)

What’s incredible about this event is the supply/demand mechanics that it sets in motion. When new supply creation is cut in half, it creates a supply shock that upends the existing supply/demand price equilibrium. Suddenly there is not as much new supply going out into the market to meet demand. This supply shortage accumulates, day after day, and naturally buyers starts to raise their bids in order to find willing sellers.

As a result, the price starts to drift upwards. This is called price discovery, and it’s what happens in all markets when conditions change and the price tries to re-establish supply/demand price equilibrium.

Okay great, but what has this done to Bitcoin’s price in the past?

Bitcoin’s performance after past halvings

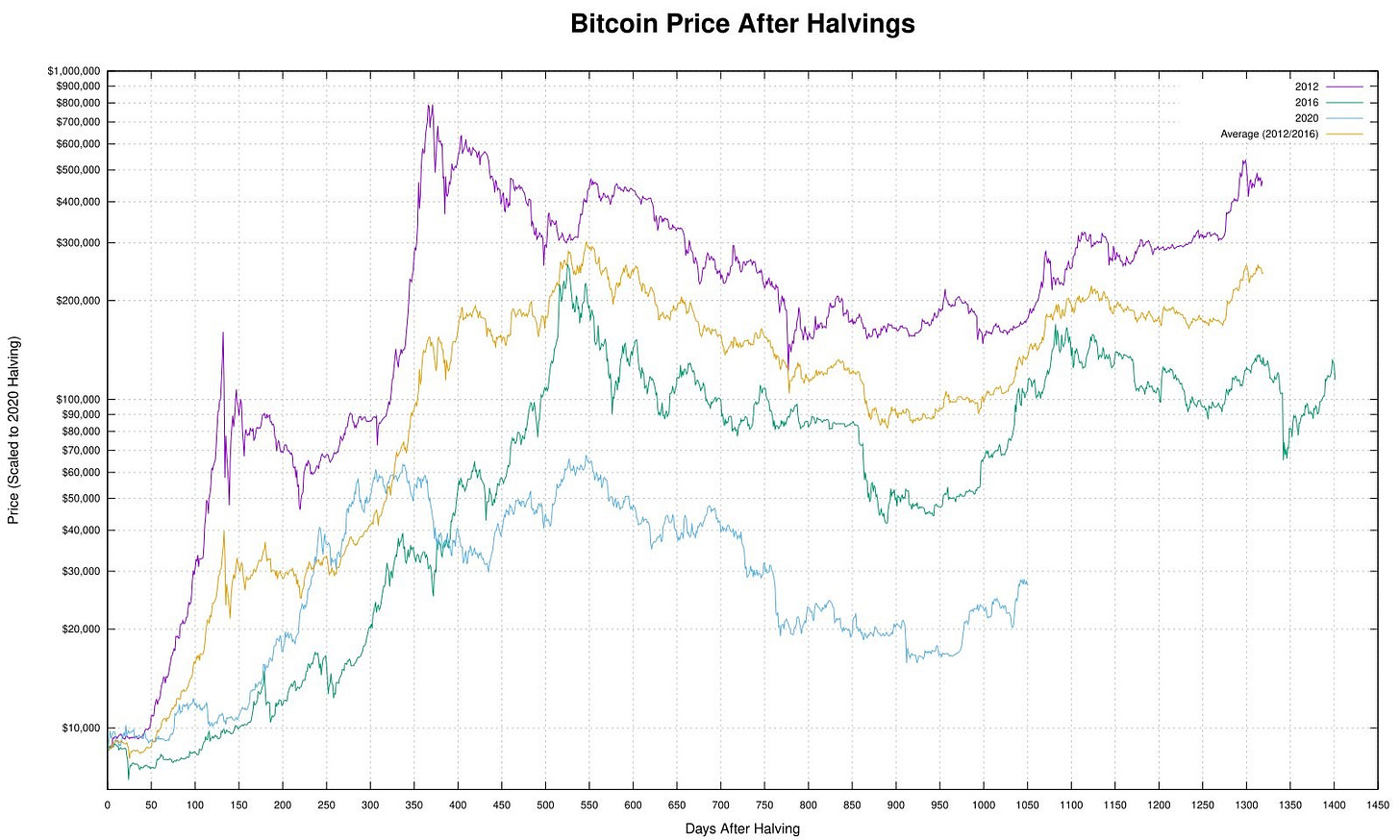

Well, Bitcoin has had three halvings in its 14-year lifetime – in 2012, 2016, and 2020. And in the 12-18 months that followed each of those events… Bitcoin has seen its major bull markets. (You likely first heard about Bitcoin during its crazy 2013 rally, then were surprised to see it happen again in 2017, and again in 2021.)

Here is what those rallies looked like (note: the y-axis here is logarithmic, meaning that the visual space between $1 and $10 is the same as $1,000 and $10,000):

This picture tells the whole story. But it’s a bit overwhelming, trying to make sense of all this data and the noise within it. So, let’s keep it simple – here’s all you need to know:

Each colored line is what happened to the price in the four years following the halving (in % terms relative to the price when that halving occurred)

As you can see, each colored line went up aggressively in the first 1/3 of the chart, down in the next 1/3 of the chart, and then back up (less aggressively) in the last 1/3 of the chart

That’s the pattern. It’s that simple.

People who aren’t knowledgeable about Bitcoin will dismiss a pattern like this as chance and think it foolish to expect it to happen again. (After all, “past performance is not indicative of future results.”) The thing is, in this case… it will happen again.

The halvings are written into stone in Bitcoin’s code. As long as Bitcoin remains alive, the next Bitcoin halving will absolutely happen in Spring 2024 (when the 840,000th block in Bitcoin’s blockchain is added, currently projected to happen on April 27, 2024). This isn’t chance – this is mechanics.

Understandably, this is a major sticking point for many people. How could this be? It sounds too good to be true – it sounds unlike anything we’ve ever known. How can an asset have a reliable bull market? The answer is increasing scarcity – the reason is the halvings.

And yet, 99% of people have never even heard about Bitcoin’s halvings. The fact that you are reading this means that you are now in that 1%. That’s called information asymmetry – you have an edge on the rest of the world.

I always find it beautiful that the people who find Bitcoin this early have some idiosyncratic combination of personal attributes and life experiences that brought them here. It’s worth thinking about what it is that brought you here, to learn about Bitcoin, while the rest of the world still believes it a joke – some passing fad. Whether you have a curious intellect, carry a distrust of the status quo, or are receiving a synchronicitous wink from the universe… you are here. Worth reflecting on.

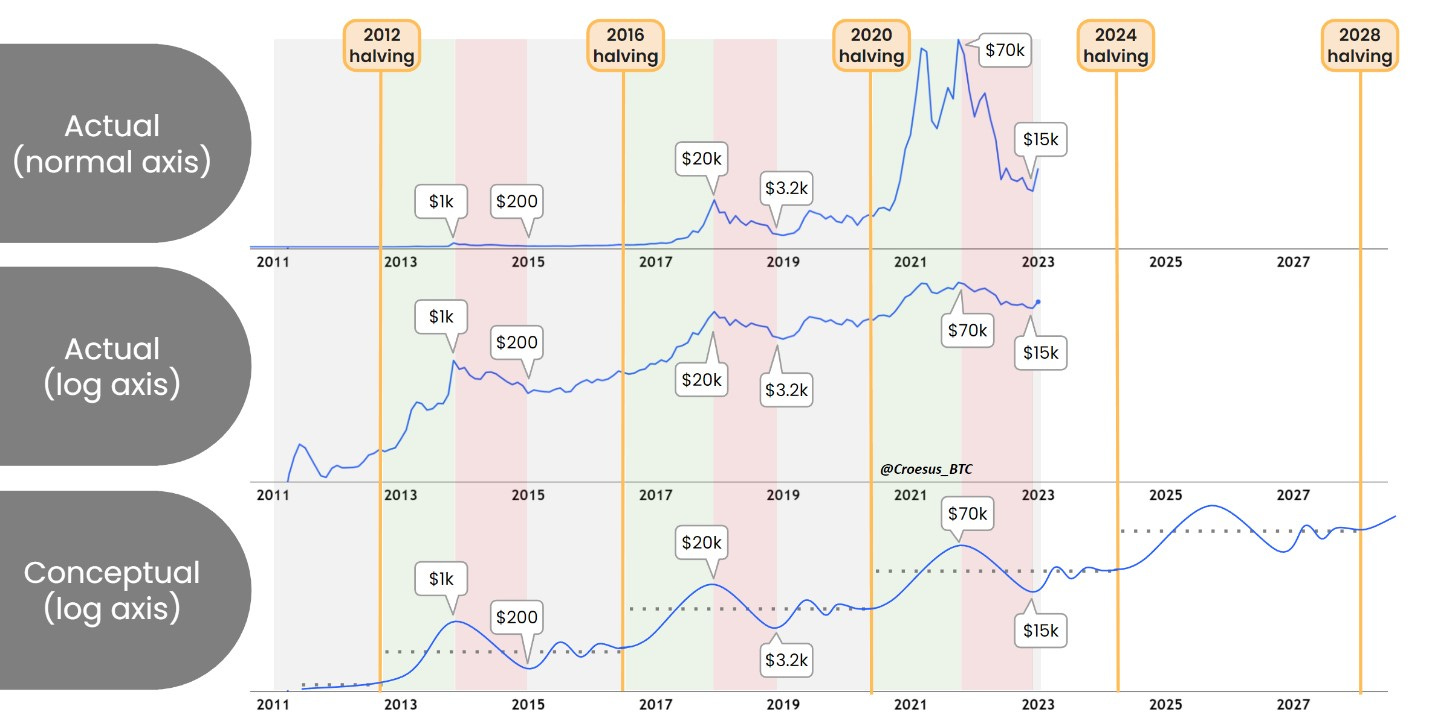

At any rate, if we were to synthesize Bitcoin’s price history into a conceptual trend, it would look like this:

One of the challenges about Bitcoin is that there’s so much noise. Everyone has an opinion, but almost nobody knows what they’re talking about (remember: you’re already in the 1% most-informed people about Bitcoin).

On top of that, the price action is also full of noise. Any given day, week, or month, Bitcoin’s price can move seemingly at random – up, down, or sideways. This short-timeframe price action is the result of news events, hidden moves by huge players, or large players screwing over as many small traders as possible. And yet, this noise is what everyone spends their time trying to predict. Forget about it. Short time frames are just noise.

But zoom out enough to get the halvings into view, and there it is – the signal underneath the noise (see the “Conceptual” representation in the chart above).

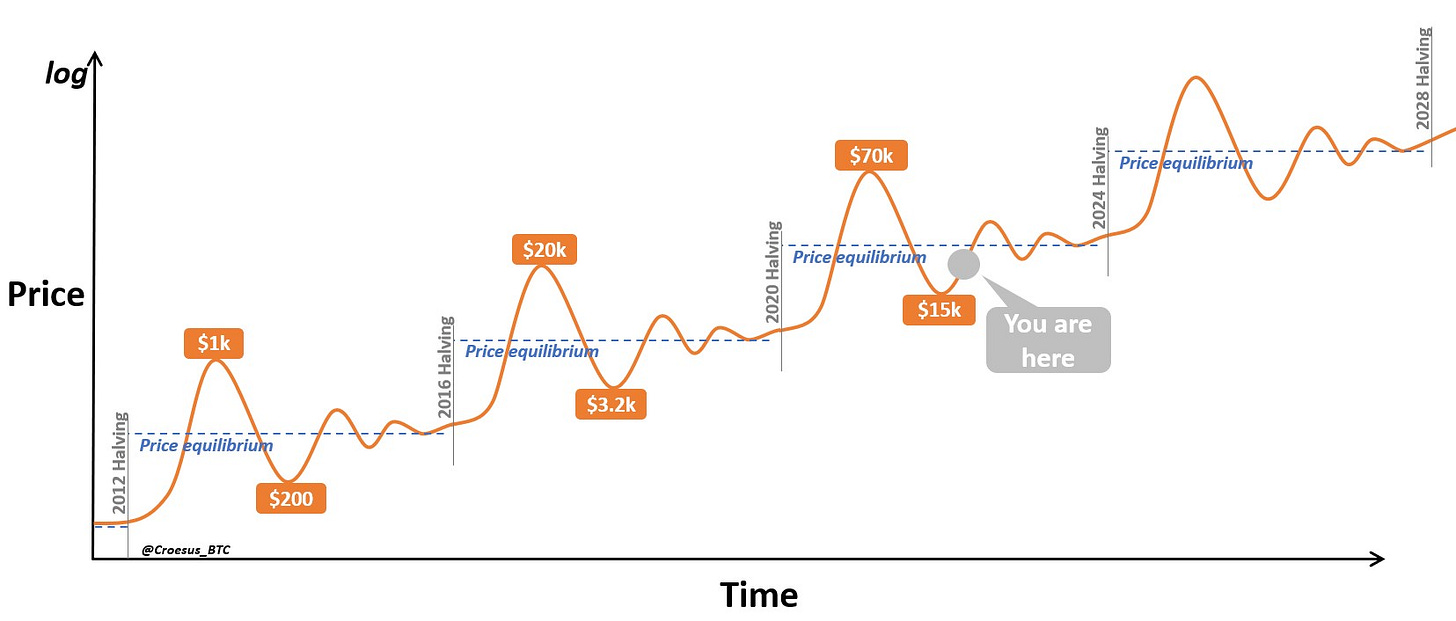

Now comes the important part. If the above representation is an accurate distillation of the hard-and-fast supply/demand mechanics at the heart of Bitcoin’s design… what does it mean for right now?

Bitcoin’s price may never be this low again

Nothing is completely certain, but if my understanding of this asset is correct, right now is the window in time immediately after the 4-year-cycle bottom, which means several big things:

The bottom is in, the psychology of fear has subsided

We are still below the supply/demand “price equilibrium” that Bitcoin will gravitate towards

It’s possible we’re already above it, but in my opinion, more likely than not that we are still below this cycle’s price equilibrium.

The current Bitcoin price is lower than you “should” ever see again

Of course, when you layer the short-timeframe price noise on top of the signal, it’s anyone’s bet whether that remains true

If the above is correct, Bitcoin’s price could settle somewhere in the $30-45k range over the next year. Nothing super exciting, but still substantially higher than where the price is today.

And then, unceremoniously and unapologetically… the Spring 2024 halving will arrive in just over a year.

In the months that follow, the price will do the only thing it can when there’s more demand than supply… and the whole speculative bubble process will play out again. I think it’s likely that we will see $100k Bitcoin, quite possibly even $200k Bitcoin within the next two years.

What’s certain is that the buzz will be back - the world will be trying to figure out why this Bitcoin thing is booming again. (While continuing to ignore the supply/demand mechanics that are right in front of them.) Only then will your friends and family start thinking about buying some Bitcoin. Don’t be one of them.

Now is your chance to position yourself in advance – this is the moment you’ve been waiting for.

They’ll say you got lucky.

Did you find that Bitcoin analysis informative? You have a choice now:

Leave this page & forget how to find my work again, OR

Sign up for this free weekly Bitcoin newsletter to receive posts like this. My goal is to help you understand why Bitcoin could be the key to growing your wealth this decade: 👇👇👇

Awesome content again Jesse. Always love reading, and already look forward to the next one.

Wow Croesus you're the man.

Thank you for all your work