Bitcoin 2023: Conference recap & takeaways

The most important developments that happened in Miami at the world's biggest Bitcoin conference

Before we get going…

I’ve been writing these updates for investors in my hedge fund since 2017. Now I’m sending them weekly to my Substack subscribers.

To receive future posts like this, add your email to the free subscriber list:

Looking forward to sharing more of my Bitcoin analysis with you. Okay, now on with our story…

I may have been in Miami for the largest Bitcoin conference of the year, Bitcoin 2023, but my biggest takeaway was on the beach.

You never expect to be the guy who loses his wedding ring swimming off South Beach in Miami, but then, there you are.

As it turns out, ocean water is slippery. The tacky grip of my usual chlorinated swims lulled me into a false sense of confidence that my slightly-too-loose wedding band was just fine.

As I watched my new metal detector friend search the area fruitlessly, I couldn’t help but reflect on the classic trap I had just fallen into. My ring was a little too big. I knew I should have had it resized. And yet, I put off the inconvenience of that non-essential errand — even justified to myself that change was unnecessary. But I was wrong.

An ounce of prevention is worth a pound of cure.

In varying ways, everyone in the world knows we are in a time of change — the world going forward will be different vs. the way it has been. And we know that our portfolio composition needs to change accordingly. But how and when — these are questions we can never answer with total certainty.

In light of this, there is a huge pull to continue with the status quo — to do nothing, to lose the name of action, to put off learning about Bitcoin.

This simple inertia of human action, more than any other reason, is why most still haven’t included Bitcoin in their portfolio.

It’s hard to seek out the ounce of prevention well before you need it. But it doesn’t mean you don’t need it.

Beyond ruminating on how Bitcoin adoption is an exercise in overcoming human inertia (to learn about, acquire, and securely custody Bitcoin), there were a number of exciting developments from the year’s biggest Bitcoin conference.

Here are the top takeaways from the Bitcoin 2023 conference:

Robert F Kennedy, Jr.

RFK Jr. doesn’t stand a chance at winning the Presidency, but that doesn’t matter. What does matter is that politicians are courting Bitcoiners and aligning their platforms with Bitcoin’s mission.

In a landmark speech, RFK Jr. proclaimed his enthusiastic support for Bitcoin as an assertion of individuals’ right to “freedom of money,” on equal footing with the right to “freedom of speech.”

He then enumerated his 6-point Bitcoin platform that he intends to pursue as President:

Guarantee the right to own Bitcoin

Guarantee the right to run a Bitcoin node

Guarantee the right to use electricity as you choose

Ensure the US remains the global hub of Bitcoin

Deliver definitive clarity that Bitcoin is a commodity, not a security

Consider pardoning Ross Ulbricht (of Silk Road infamy, a Bitcoin-enabled online bazaar)

It was truly a remarkable milestone for Bitcoin — if you’re interested, here is the live broadcast footage of the 15-minute speech.

And if you’d like to hear my analysis of the historic speech on the broadcast immediately afterwards, here is that clip from the news desk.

While RFK Jr. doesn’t have a serious chance at winning the Presidency, a fringe challenger courting the Bitcoin voting bloc in 2023 suggests that Bitcoin has arrived as a policy consideration for national politics.

In 2027, perhaps the establishment candidates will also include Bitcoin policies in their platforms in an effort to win votes and donations from a growing contingent.

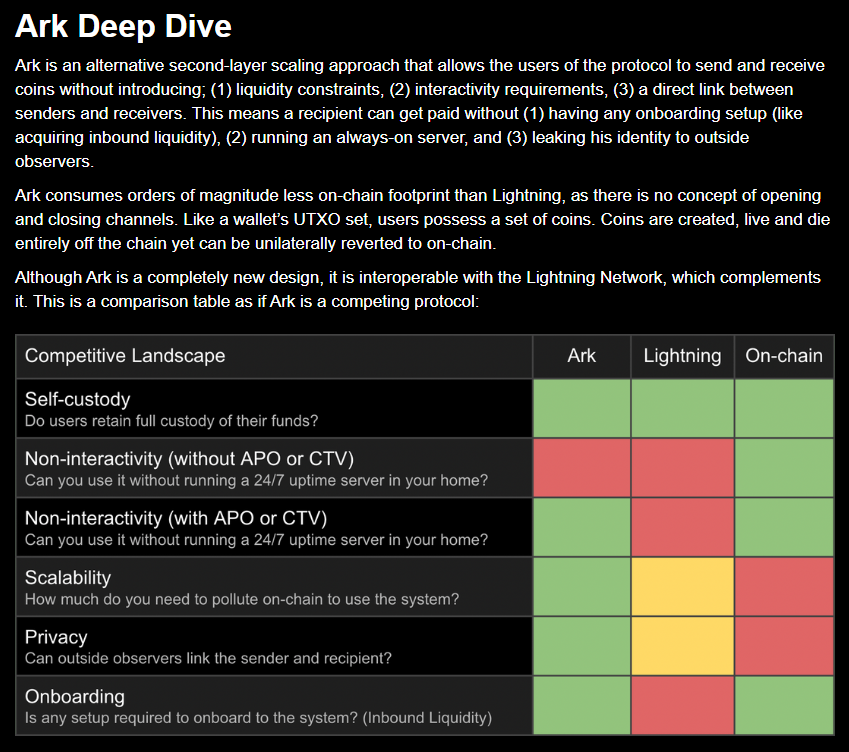

Ark steps forward as new Bitcoin Layer 2 protocol for transaction throughput scaling

While slightly under the radar, this was the most consequential announcement at Bitcoin 2023. Ark, previously under development with the placeholder name TBDXXX, is a new Layer 2 protocol for the Bitcoin network.

The current leading Layer 2 protocol is the Lightning Network, which is a protocol developed to allow the low-fee and near-instant transmission of Bitcoin on a layer above the main blockchain (the base layer). Many transactions can then be settled with a single net transaction on the Bitcoin blockchain.

This type of Layer 2 infrastructure is how Bitcoin will scale to handle the world’s transaction volume over time.

While there are a handful of protocols that could be termed Layer 2 besides the Lightning Network, none are intended to be true Layer 2 competitors — for example, several could be better termed as “custody protocols” (Fedimint, Cashu) or “sidechains” (Liquid).

Ark represents an exciting new alternative to the Lightning Network, a true Layer 2 solution that settles to the Bitcoin base layer.

Ark comes with its own tradeoffs – advantages and disadvantages – compared to the technical design of the Lightning Network. Time will tell how the potential of this promising new Layer 2 protocol pans out.

More broadly, Ark stands as an excellent example of the innovation and future potential of the Bitcoin network. Bitcoin’s design is to maintain a boring, highly secure base layer, while allowing for experimental and innovative protocols to be built on top of it (and settle via the Bitcoin base layer). Ark is Chapter 2 in this budding field of Bitcoin development, with hopefully many more to come.

Mempool.space announces Transaction Accelerator Marketplace

This announcement would be easy to overlook as inconsequential. It’s not particularly sexy or dramatic, but it’s immensely significant in the ongoing maturation of Bitcoin’s transaction fee market (which will be the basis of its long-term security and incentives to miners).

Luckily for me, I couldn’t miss this announcement. I heard about it directly from an excited Matt Odell between segments on the Bitcoin 2023 news desk. (In fact, I heard about it ~10 minutes before the announcement, as Matt was eager to share what Wiz from Mempool.space was about to reveal at the Open-Source Stage.)

Mempool.space has emerged as the best block explorer dashboard for monitoring the Bitcoin blockchain in realtime.

If you’ve never checked out the website before to marvel at what the activity on the Bitcoin blockchain looks like, take a look here: mempool.space

At Bitcoin 2023, Mempool.space announced a major new initiative – a transaction accelerator tool. (Click link for demo video)

When a Bitcoin transaction is sent with a low transaction fee attached, sometimes it can get stuck waiting to be selected for the next block because a bunch of higher fee transactions are added to the waiting pool (known as the “mempool”) right afterwards.

This new tool from Mempool.space will allow users to much more easily bump up the transaction fee they’re offering for a stuck transaction in order to move it forward in the queue.

More significantly, this new tool massively improves upon the way that transaction fees have been selected by users to-date.

The new tool allows for users to specify how quickly they want their transaction to be processed. Then, Mempool.space will collaborate with the major mining pools to place that transaction into a block and bill the sender after-the-fact for the amount.

Currently, users tend to simply overpay in order to confidently ensure a transaction will be processed by a certain time. This tool creates a more efficient fee market, which will be especially useful for b2b applications.

Overall, it’s a brilliant concept (that admittedly fractures the public mempool into public and private mempools) and shows another way in which Bitcoin infrastructure and network efficiency continues to incrementally improve over time.

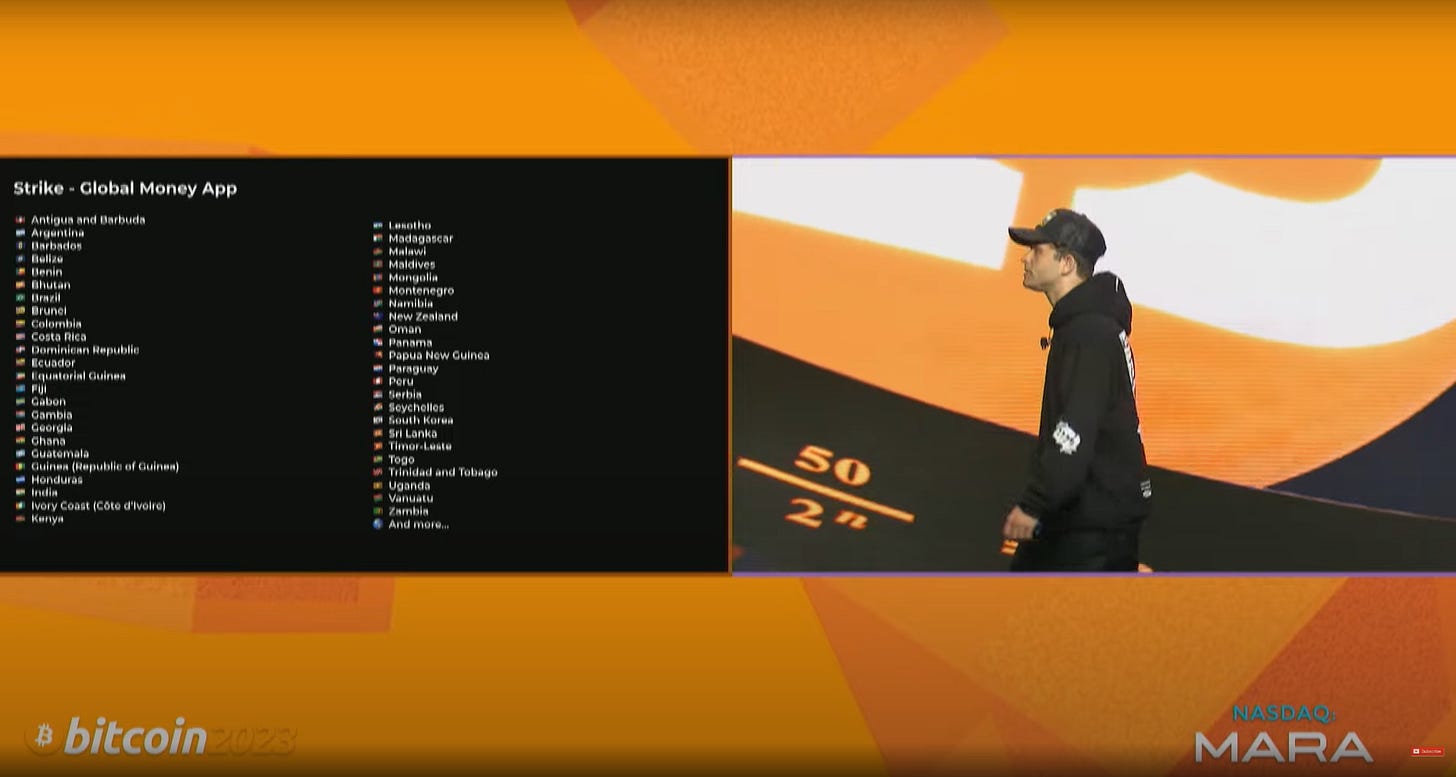

Strike expanding business – nothing remarkable, but this is how Bitcoin wins

One of the flashiest presentations and announcements was from Strike. The Bitcoin payments and remittances company proudly announced that it was moving its headquarters to Bitcoin-friendly El Salvador and that it would now be offering its service in dozens of new countries, comprising 3B of global population.

Overall, this was more hype than world-changing substance. But that’s okay, because in a different way, it’s exciting all the same.

Strike is a perfect example of how Bitcoin has been and will continue to reach more and more users. By leveraging this open payment network with superior properties vs. conventional payment rails, Strike has been able to grow a larger business and reach more users in more countries.

It’s a story of entrepreneurship and growth, based on leveraging Bitcoin’s native properties, and that’s enough. This trend can and will continue as entrepreneurs everywhere look to disrupt traditional payments companies by utilizing the free and open Bitcoin network.

GBTC, FTX, and custody hot topics

One somewhat surprising aspect of this year’s conference was the prevalence of discussion about GBTC, FTX, and Bitcoin custody. It has been 7 months since FTX’s collapse, but the wounds were still fresh for many in the Bitcoin ecosystem.

Similarly, a hot topic was the continued obstinance of Grayscale Bitcoin Trust in considering opening up the trust for Bitcoin redemptions. Instead, as redeemGBTC leader David Bailey rightly said during the “GBTC: What Went Wrong?” session, Grayscale has been behaving “as if GBTC is a personal annuity.”

(Grayscale collects 2% of the BTC in the GBTC Trust every year in management fees and won’t allow customers to withdraw their Bitcoin from the Trust, so this will continue indefinitely.)

As a result of the pain inflicted by FTX and the ongoing GBTC drama, many speakers and attendees wanted to talk about custody.

At Onramp Bitcoin, we are creating part of the next-generation of custody infrastructure, by combining best-in-class multi-party custody with a Trust setup that enables in-kind redemptions to allow clients the option to transition to self-custody.

I was fortunate enough to have the opportunity to join the Bitcoin 2023 news desk to talk about Onramp (clip here) and how it fits in to the theme of the Bitcoin ecosystem getting stronger through entrepreneurial improvements on earlier products.

As a speaker at the conference, I also had access to the VIP area reserved for Whale Pass holders (a $10,000 ticket). For paid subscribers, let’s dig into the major takeaways from the Whale Area:

Legendary investor Bill Miller’s current thoughts on Bitcoin in portfolios

Why author Michael Lewis doesn’t understand Bitcoin

Why Bitcoin OGs will lose fortunes with Ordinals

Keep reading with a 7-day free trial

Subscribe to Once-in-a-Species to keep reading this post and get 7 days of free access to the full post archives.