#66.2 - SEC crypto crackdown & macro calamity brewing

Bitcoin vs. altcoins, the SEC comes calling for Coinbase & Binance, and recession looms

Some weeks in the cryptocurrency landscape, it feels like all you can do is marvel at the chaos unfolding. The last week has certainly been one of those.

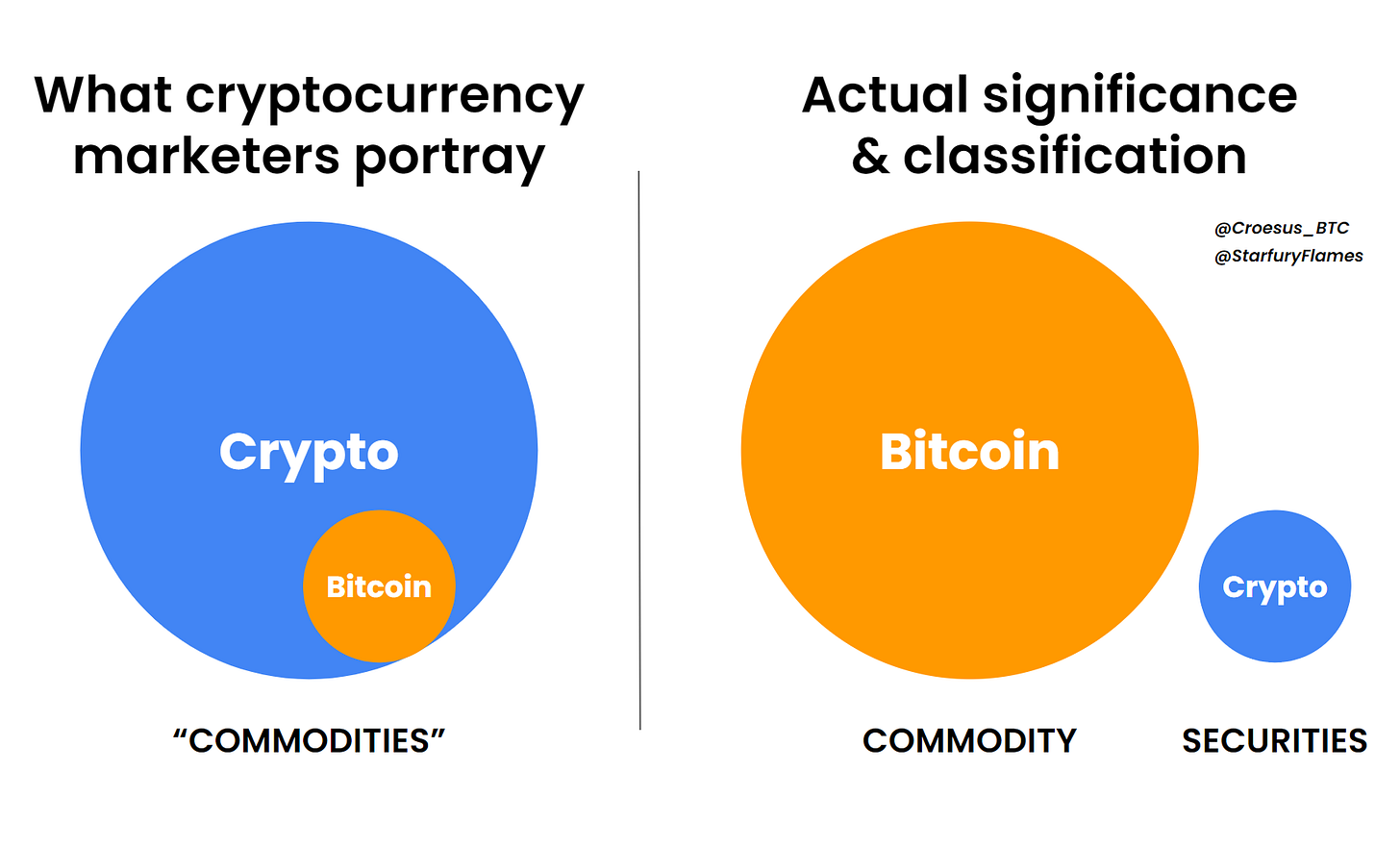

Before diving into the SEC’s splashy legal actions, it’s worth reiterating an important distinction: Bitcoin and “crypto” are two different things.

One is the invention of a system of digital scarcity — a free and open protocol put into motion and controlled by no leadership team. The other is a vast collection of startups leveraging cryptocurrency technology to bypass traditional venture capital financing in favor of early-stage direct public offerings with absurd valuations based purely on hype.

In short, one is a digital commodity, the other is a bunch of startup companies.

Here comes Gary

For years, SEC Chairman Gary Gensler has grown increasingly clear in his view that while Bitcoin is a commodity, nothing else in crypto enjoys that regulatory distinction.

In fact, Coinbase CEO Brian Armstrong recently indicated that this message has become quite definitive in the last few years, “we kinda got this information from the SEC that ‘well actually, we kinda think that everything other than Bitcoin is a security.’”

As such, the only surprising thing about the SEC bringing lawsuits against Coinbase and Binance for selling unlicensed securities on their platforms… was how long it took for it to finally happen.

Coinbase lawsuit

Last week, the SEC charged Coinbase with acting as an unregistered crypto security broker. In its accompanying press release, the SEC specified, “Since at least 2019, Coinbase has made billions of dollars unlawfully facilitating the buying and selling of crypto asset securities.”

In further language, the SEC enumerated its legal issues with the well-known crypto exchange: “Coinbase intertwines the traditional services of an exchange, broker, and clearing agency without having registered any of those functions with the Commission as required by law.”

CEO Brian Armstrong responded by saying that Coinbase is “proud to represent the industry in court to finally get some clarity around crypto rules.”

This last statement is a bit funny to me, as the linked video above makes it evident that the SEC has already provided the desired clarity: everything other than Bitcoin is a security. Of course, this guidance is extremely inconvenient to Coinbase’s business model, so they will do everything they can to fight the SEC in court with the best lawyers that a multi-billion-dollar company fighting for its life can muster.

Binance lawsuit

To complete the shock-and-awe week of lawsuits, the SEC leveled charges against the largest crypto exchange in the world: Binance.

You may not have heard of Binance before (while Coinbase had a Superbowl commercial everyone saw, Binance focuses its marketing in crypto enthusiast channels), but their ascent has been stunning. When Bittrex encountered regulatory difficulties in 2017, Chinese-run Binance stepped in to fill the void in the market, just as the bull market brought a massive influx of speculative interest in the long tail of cryptocurrencies available. Binance positioned themselves as the marketplace where every coin under the sun was listed. With a blistering product development cadence, Binance quickly became the largest and most feature-rich exchange serving the broader cryptocurrency market.

A major part of Binance’s strategy was deliberately exploiting regulatory ambiguity. Binance regularly changed its official headquarters, adopting an “everywhere and nowhere” identity. This likely added complexity to regulators’ case against the international globetrotting company, but the SEC wouldn’t be deterred for long.

On June 5th, the SEC filed 13 charges against Binance and its related entities, ranging from operating as unregistered “exchanges, brokers, dealers, and clearing agencies” to “misleading investors” with undisclosed trading against customers.

The legal proceedings will play out over the coming weeks and months, and will probably amount to some combination of steep fines and either stringent restrictions on operating in the US or an outright ban. It’s also possible that we’ll also see criminal charges against Binance leadership as the SEC lays out its accumulated evidence.

Coinbase may have an existential legal fight ahead, but Binance is in much more trouble. And frankly, this heat is entirely deserved, and Binance knows it. As the compliance lead for Binance commented in chat logs obtained by the SEC, “we are operating a fking unlicensed securities exchange in the USA bro.”

Macro calamity brewing

For paid subscribers, the other major story that I wanted to focus on this week is the growing body of evidence that the US is on the brink of a deflationary crunch and major economic crisis, despite the stock market doing well recently.

Let’s dig into the confluence of ominous data and what to keep an eye on to stay a step ahead…

Keep reading with a 7-day free trial

Subscribe to Once-in-a-Species to keep reading this post and get 7 days of free access to the full post archives.