#65.1 - May 2023: First Republic Bank

First Republic Bank, government sweetheart deals, and the future of the ongoing banking crisis

Before we get going:

If you’ve enjoyed any of my articles or content on Twitter (@Croesus_BTC), be sure to subscribe to my Substack.

This is where I’ll be putting out all my work going forward — delivered straight to your inbox so you don’t miss it.

This includes these Bitcoin & Macro updates, previously reserved for investors in my fund. New update released every week — get on the email list to receive it:

Thanks for your support! Okay, now on with our story…

In case you’ve been living under a rock, First Republic Bank went under this week.

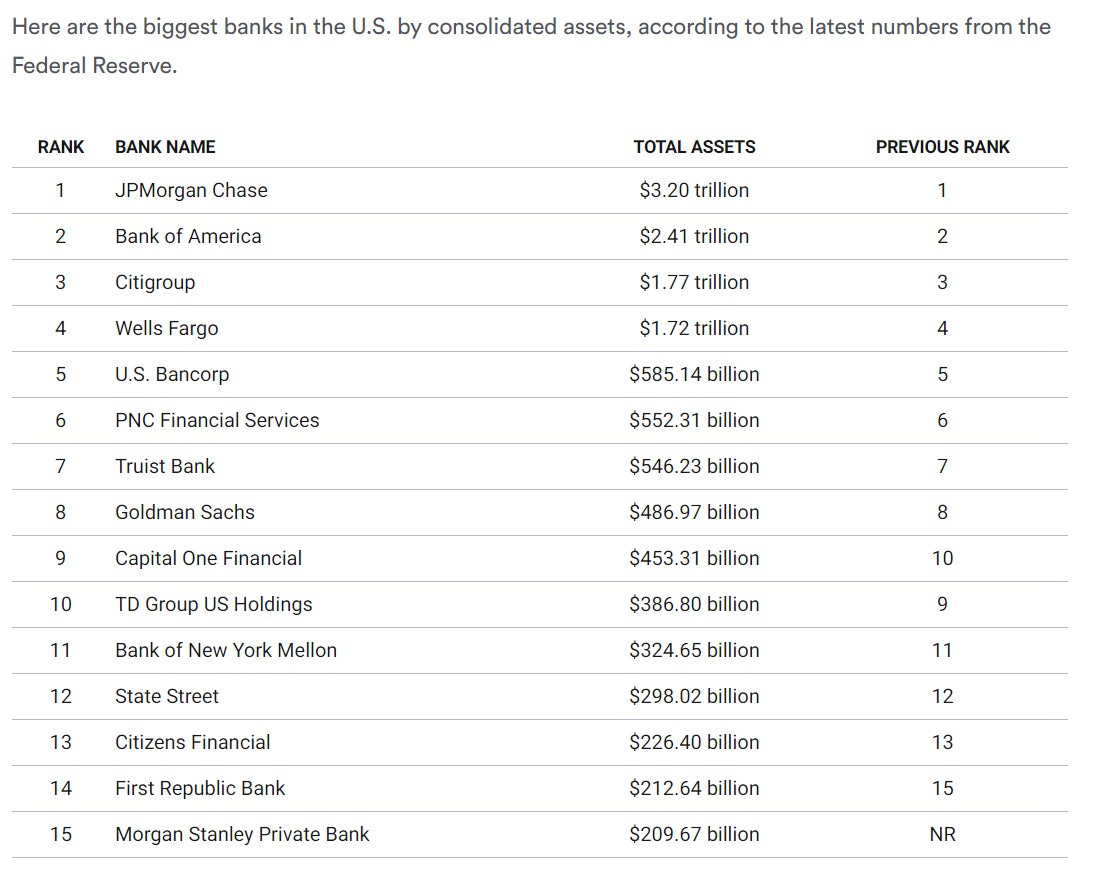

The first thing that you need to know is that this is a fairly large bank – slightly bigger than Silicon Valley Bank. This makes the First Republic Bank failure the second largest in history (behind WaMu in 2008).

It also means that 3 of the 4 largest bank failures in history have happened in 2023… with just 1/3rd of the year in the books.

News has been moving fast with this latest chapter in the ongoing banking crisis… here’s where we stand:

How First Republic Bank got into trouble

First Republic Bank (~$213B in assets) was the 14th largest bank in the United States, according to Bankrate:

First Republic Bank (FRB) ran into trouble as a result of the same structural forces straining the entire banking industry right now:

Large unrealized losses on underwater bonds purchased when yields were much lower than they are now, and

An exodus of deposits to higher yielding money market funds.

In my last update on the banking crisis, we looked at how First Republic Bank was facing the flywheel effect of an ongoing bank run.

In collaboration with federal regulators, JPMorgan led a group of large banks that deposited $30B into FRB in March. This was a concerted effort to stem the growing concern about whether or not deposits could be relied upon in the nation’s fractional reserve banks.

This put an end to concerns about FRB’s solvency (meaning, whether or not the bank had enough liquid assets to meet its obligations)… however, it did not improve FRB’s profitability.

Buying time through industry & government aid

The deposit injection bought FRB time. With the immediate concerns about FRB’s solvency extinguished, the bank was able to focus on utilizing the various assistance programs made available by the government:

$14B in aid from the newly-created Bank Term Funding Program (BTFP)

$64B in borrowing from the Federal Reserve discount window

$28B in borrowing from the Federal Home Loan Bank

But, it wasn’t enough. Spooked by the uncertain future of FRB, depositors fled en masse. First Republic’s deposits shrank by a whopping 41% in the first quarter of 2023, when Wall Street analysts had only expected a 23% decline.

As a result, First Republic’s market capitalization fell from ~$20B at the start of the year to ~$1B last week.

The problem with finding an acquirer

What First Republic (and the rest of the banking industry) needed was an acquisition to put an end to saga and restore confidence in the stability (and solvency) of the fractional reserve banking system.

However, there was a problem. Because FRB’s balance sheet was full of unrealized losses on low-yield bonds and mortgage-backed securities, any acquirer would have to mark-to-market the value of these assets, under mergers & acquisitions accounting rules.

In the case of First Republic, this meant a big accounting hole:

$4.8B in unrealized losses on held-to-maturity bonds

$19B in unrealized losses on mortgage-backed securities

To make matters worse, taking on FRB’s assets and adding them to an acquirer’s balance sheet would force the bank to shore up its own equity position in order to maintain regulatory requirements in terms of asset-to-equity ratios.

All in all, as summarized by an analyst at Autonomous Research, “It might cost you $30B of capital to buy the bank for free.”

A sweetheart deal between old friends

In 2010, the government passed the Dodd-Frank bill – the most meaningful financial oversight regulations since Sarbanes-Oxley. In the angry wake of the Great Financial Crisis, Dodd-Frank explicitly prohibited any future bank bailouts. Fast-forward just 13 years and what’s to be done when regulators wish to grant a bank bailout that’s not allowed?

Well, the solution is easy. No, it’s not to simply follow the law and allow that bank to implode on its own… that kind of free-market capitalism could incite panic! Instead, the answer is to craft a sweetheart deal.

The government can’t bail out a failing bank… but it can offer incentives to a big bank to induce an acquisition! In other words, the government can backstop the sale of a bank — essentially a bailout of the impaired assets packaged in a different manner — just don’t call it a bailout.

Enter JPMorgan — the largest bank in the United States, and arguably the closest ally of banking regulators. (After all, who organized the $30B deposit injection for FRB in March? JPMorgan.)

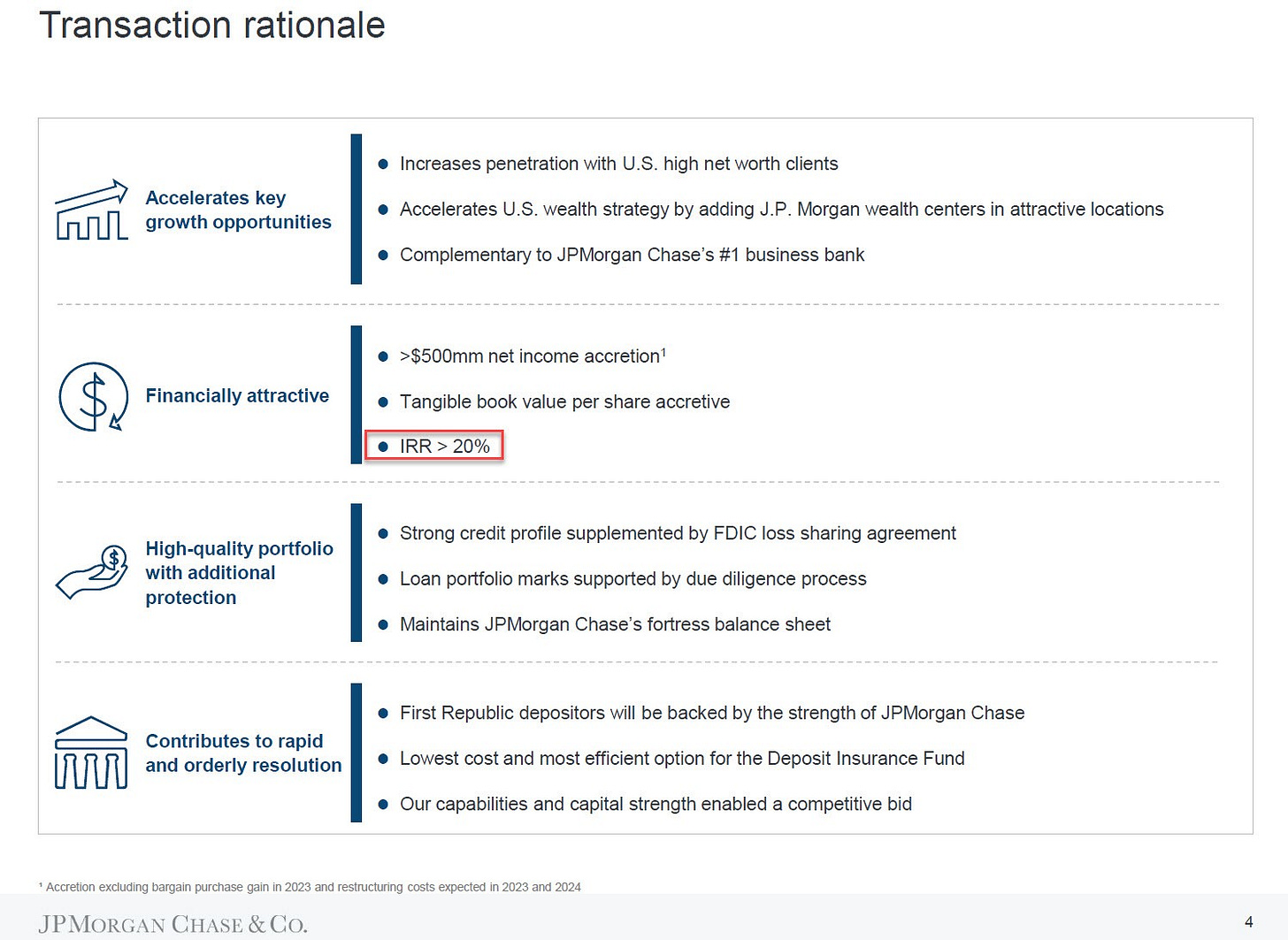

But JPMorgan is only interested in deals that add value to their organization. Is this a worthwhile deal? According to a JPM presentation on what the large bank gains from the deal:

The big number that jumps out here is 20% Internal Rate of Return. How did a deal that would lose $30B for any buyer turn into a deal that generates a 20% IRR?

To make it palatable to acquire First Republic, the government offered some attractive incentives that most of the media coverage seems to have missed. These include:

Loss sharing agreements on most of the loans inherited from FRB

Most notably, 80% loss coverage on real-estate loans for 5-7 years

A $50B fixed-rate loan from the FDIC for 5 years

A government spokesperson declined to share the interest rate with the public (my guess: it’s below market rates)

This deal has allowed JPMorgan to position itself as a savior, with CEO Jamie Dimon saying “our government invited us and others to step up, and we did.” But make no mistake, this is a deal whose terms were sweetened by government backstops and incentives.

80% of losses on the assumed loans will be “shared” by the government, meaning they are funded ultimately by the taxpayer. Similarly, the $50B FDIC loan at an undisclosed fixed rate is risk borne ultimately by the taxpayer, in order to fatten the deal enough for JPMorgan to expect a 20% IRR on what would have been massively unattractive without taxpayer-funded incentives.

Without a doubt, this is privatized gains and socialized losses (just like in the 2008 Great Financial Crisis), just repackaged in a way that makes it harder for the public to understand how they are ultimately paying the bill.

What’s more, the government side-stepping Dodd-Frank’s prohibition on bailouts by using the nation’s largest bank as its partner is a scary new precedent. Going forward, this could signal a greater interconnection between government and the “too big to fail” banks, at the expense of the increasing erosion of free market competition.

That’s the full update on First Republic Bank. Share it over email or Twitter:

Now let’s take a look at what’s next for the banking crisis:

Credit contraction

Ongoing deposit exodus to MMFs

The pain ahead

What the government response will be

Keep reading with a 7-day free trial

Subscribe to Once-in-a-Species to keep reading this post and get 7 days of free access to the full post archives.