The U.S. National Debt black hole

Why the United States is dangerously close to the debt-spiral black hole & what it means for your financial future

It’s a funny bit of wisdom that we all learn at some point, along with the useful tidbits of everyday experience: look both ways before crossing the street, buckle your seatbelt, and be careful not to cross the event horizon when you’re near a black hole.

None of us will ever be in this predicament, and yet, we all somehow know this bit of sage advice. Don’t mess with the event horizon.

The event horizon is the point at which the gravitational pull of a black hole exceeds the speed of light. In other words, it’s the threshold beyond which nothing – not even light (the fastest thing in the universe) – can escape.

Therefore, we know that if we’re ever near a black hole… it’s very clear what threshold we must never cross.

But in this case, knowing the theoretical limit lulls us into a false sense of security. Because it’s the wrong invisible line to worry about. In reality, the relevant threshold is where the gravitational pull of the black hole exceeds the maximum speed of your spaceship — much, much less than the speed of light itself.

It’s not the speed-of-light event horizon that actually matters — it’s your relative event horizon (somewhere in the Ergosphere), beyond which your maximum effort to escape is still no match for the cosmic riptide pulling you in.

The United States’ fiscal position

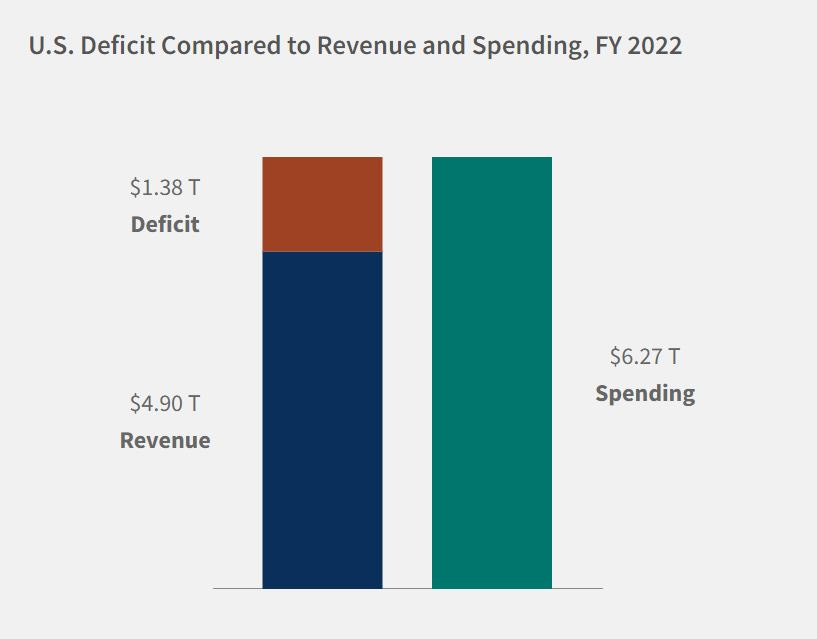

People like to make it more complicated than it is. A government’s finances are ultimately rooted in the same simple accounting rules as any individual’s personal budgeting. The two basic ingredients:

Revenue (money coming in)

Expenses (money going out)

When revenue exceeds expenses, an individual has “savings” — a government has a “surplus.”

When expenses exceed revenue, an individual has a problem — a government has a “deficit.”

A government has more leeway to solve this imbalance over time than an individual does. However, this lack of urgency causes the exact opposite result — budget deficits never seem like a serious and pressing crisis, so the problem doesn’t get fixed. In fact, the U.S. has normalized multi-trillion-dollar annual deficits over the last few decades:

I don’t know about you, but I didn’t even realize how bad the chronic deficit problem has gotten. That’s because you rarely hear about this in the public arena or see news organizations shine their spotlight on this topic.

The single biggest threat to the future prosperity of the United States and you’re reading about it on my humble Substack, not the New York Times.

Death, Taxes, and Superpowers Indulging in Deficit Spending

As you can see, for every year in the modern era, the U.S. has spent more money than it took in via taxes – this is “deficit spending.” Nobody bats an eye at this. Because the money comes from somewhere, and the bills get paid. So, what’s the problem?

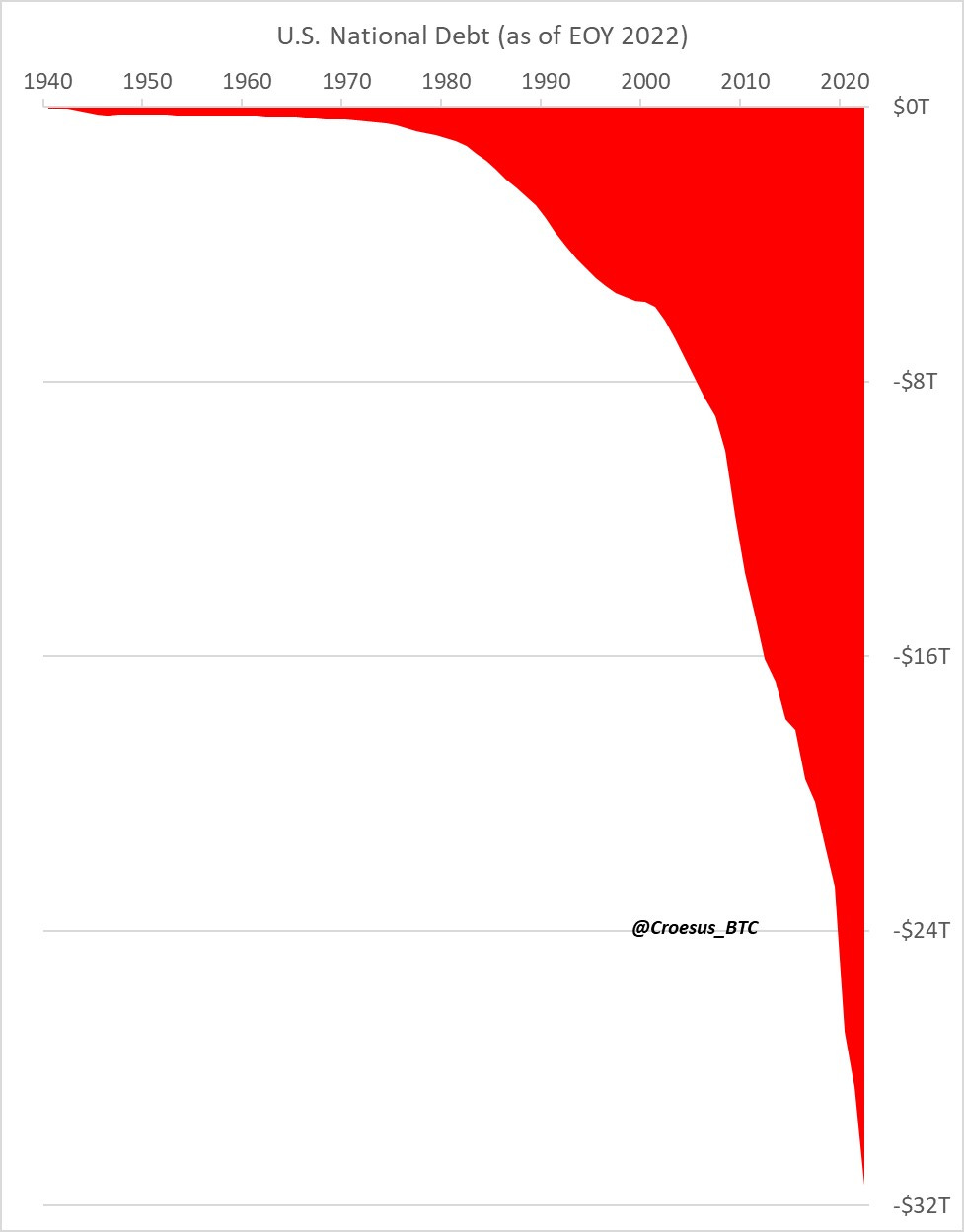

These yearly deficits don’t just disappear when the ball drops on New Year’s Eve. A deficit is actually just the one-year-change to the National Debt. “Deficit spending” is each incremental year’s addition to the massive hole that is the US National Debt.

Viewing this data in terms of how it accumulates year-over-year creates a considerably scarier image than the routine ~$1T annual deficit ritual:

Freaked out yet? Well, unfortunately, you should be. Especially if you are counting on the strength of the US Dollar in your financial calculations (e.g., saving for retirement).

The problem is that the United States has been allowed to run up a tab, simply because it can.

Until 1971, the US Dollar was backed by gold. This meant that any spending needed to ultimately be paid in gold. When Nixon ended the gold standard in 1971, we entered an era of unbacked fiat dollars.

Since dollars aren’t backed by anything, the government can create them out of thin air when needed. (Yes, it’s more complicated than that, but that obfuscation is deliberate to keep you none the wiser.) The long and short of it is that when the US Gov runs a budget deficit, they borrow money from countries, companies, and individuals by promising to pay that debt back with interest.

It’s a lot easier to run up a credit card bill when you can print money to pay it off.

And that is why the hockey-stick curve in the National Debt graph happened in the years following 1971.

Debt spirals and black holes

The problem with an escalating National Debt is one of simple math. Since WW2, the rest of the world has been happy to lend America money in exchange for a few percent of interest as that debt is repaid. This worked great for everyone, so long as America was the world’s superpower with an unparalleled and gleaming economy. But we got accustomed to that cheap, easy debt and we normalized borrowing year after year. Now we’re running $1T+ in additional debt every year like it’s no big deal.

Unfortunately, the only normal thing here is this is how superpowers always lose their primacy, as explored in last week’s Bitcoin & Macro update.

This unraveling comes from the combination of forces that create a negative flywheel. When a superpower borrows too much, a few things happen:

Their financial position worsens (they have a lot of debt)

People and countries begin to view them as higher risk borrowers (interest rates go up)

They have to spend more on interest expense (now that they have higher interest rate debt)

They have to print even more money to pay the added interest expense (making all of the above incrementally worse, little by little)

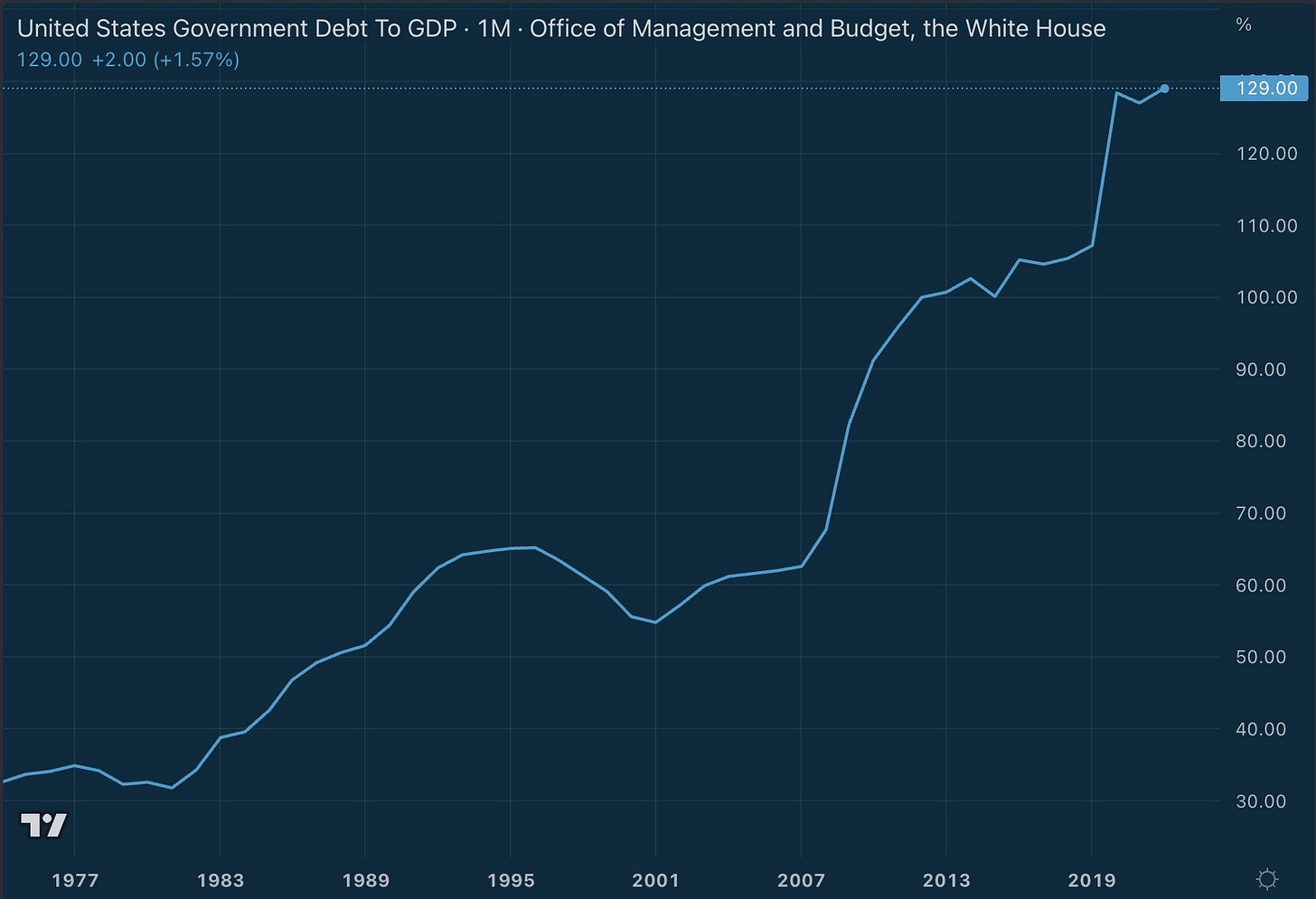

This is why, since 1800, in 51 out of 52 cases where a country’s debt-to-GDP ratio reached 130%, the country eventually defaulted. The only exception is current Japan, who is frankly in the final stages of circling the drain (e.g., central bank asset purchases and yield curve control).

Where is the US now? 129% debt-to-GDP.

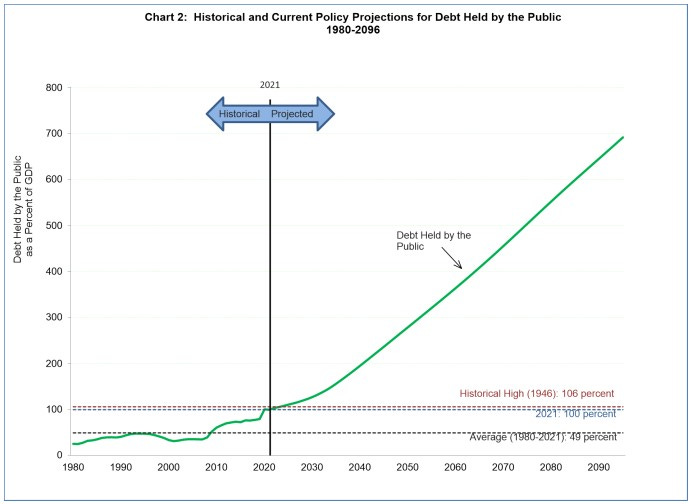

What’s more, US Gov officials fully expect this trend to continue. In fact, more alarming than that, they don’t seem to even realize that this is a five-alarm crisis. Here is an actual projection published by the U.S. Treasury Department:

But luckily, there are actions that can be taken to solve this crisis. Let’s take a look at what can be done & evaluate the public appetite and political will for this medicine…

Spending cuts

The first lever that could be used to rein in the deficit problem is spending cuts. Every American family knows what this feels like to do. We’ve all had some point where we’ve taken a look at our annual expenses and figured out where we can tighten the belt – maybe you cut back on vacations, stopped buying new things, or swapped the BMW for a Toyota.

Nobody loves these austerity decisions, but they are a part of being fiscally responsible – they are a part of surviving.

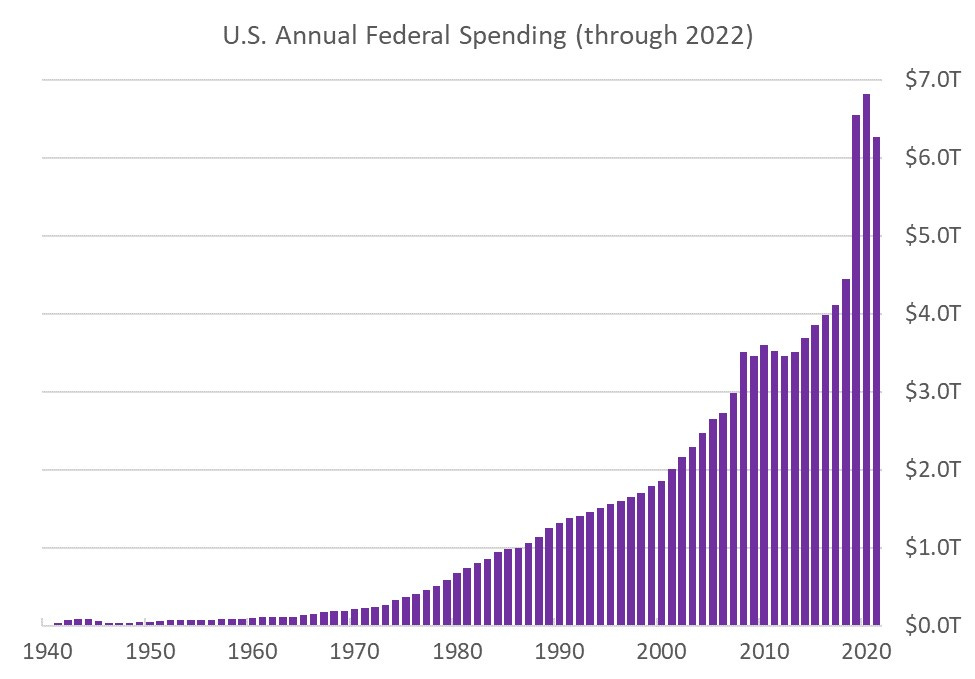

And yet, there has never been much political appetite or will to implement meaningful austerity at the Federal Government level in the United States. In fact, here’s the chart of annual US Gov spending – consistently up-and-to-the-right:

The truth is, spending cuts are very politically unpopular. It’s a true “tragedy of the commons” scenario — every politician is incentivized to “bring home the bacon” for their constituents and donors by increasing government spending year after year… even if this behavior ensures the long-term decline of U.S. financial health and geopolitical standing.

It won’t be austerity that gets us out this mess — clearly, the incentives at work for all stakeholders in the political system (politicians, electorate, and donors) prohibit meaningful change on this front.

Higher taxes

The next lever that can be used to balance the Federal budget is increasing tax revenue. Raising tax rates is a popular topic in the political arena — so long as they are targeting folks on the other side of the aisle.

This generates a lot of fighting and each side taking turns screwing over the other with some new taxes. And the thing about new taxes is they quickly become expanded & permanent.

Did you know that until 1913, there was no income tax in the United States? And when it was introduced, it received popular support because it was “just for the rich.” In fact, it only applied to the top 3% of earners. The lowest earners in this wealthy group faced a meager 1% income tax, while those earning $500k or more were subject to a 6% income tax rate.

It's easy to see how the bottom 97% would have supported such a measure. Fast-forward a century and how has that worked out for everyone?

The US Gov has raised and will continue to raise taxes to improve its fiscal position. The problem is that politicians can’t keep from spending all of it (and more) as soon as they do. Over the last few decades, revenue has grown, and yet spending growth has outpaced it anyway.

No, neither spending cuts nor tax increases will solve the U.S. National Debt crisis. But something else could… let’s dig in to:

what it is

how extreme it would have to be

whether it can be successfully achieved

what it means for your financial future

Inflate the debt away

From the government’s perspective, the single greatest advantage of a monetary system based on unbacked currency is the ability to print more of it as needed. There is no direct cost for this. Instead, there is an indirect cost to all existing holders of that currency. When new dollars are printed, the purchasing power of all pre-existing dollars gets spread across the new total number of dollars. This dilution robs currency holders of their purchasing power and transfers that purchasing power to the government.

This is the hidden tax: inflation.

The reason that inflationary money printing is such a powerful tool for governments is because they can raise taxes unilaterally (without formally requesting approval through legislation). It also allows deeply indebted governments to “soft default” on their debt by letting inflation run hot.

This causes the price of everything to increase significantly, meaning that nominal GDP has grown. However, the size of the national debt has not grown in lockstep. In this way, you can shrink the debt-to-GDP ratio not by paying down the debt, but by shrinking the purchasing power of the dollars owed.

In other words, inflate the debt away.

Of course, this is a desperate, last-ditch act. By pursuing an inflationary “soft default,” a country destroys their creditworthiness. Nobody wants to lend money to a country with a track record of paying back much less purchasing power than they originally borrowed.

What it would take

An even bigger problem in successfully inflating the debt away is tricking the bond market into believing that it’s not actually happening. Unfortunately for U.S. policymakers, this is an essential ingredient for success. That’s because we have free markets. If bond holders believe that the U.S. intends to slash the purchasing power of dollars, the bond market will reprice these promissory contracts for future dollars accordingly.

Therefore, it’s absolutely imperative for policymakers to successfully gaslight the bond market into thinking that high inflation is off the table… while secretly manifesting high inflation. Of course, policymakers won’t be able to keep up the charade for long.

In Luke Gromen’s opinion, what the U.S. would have to do is compress all of the inflation necessary to shrink the purchasing power of the National Debt into just a few years… and that would require 100-300% annual inflation during that shock-and-awe campaign.

Any more than a few years and the bond market will have fully wised up, causing a tremendous sell-off of bonds and the destruction of our entire debt-based economy.

So basically, how can the U.S. still get out from under its massive National Debt burden before interest expense ensures a deadly debt spiral?

Only through an extreme action of deception and tactical hyperinflation compressed into a few short years of stunning wealth confiscation from dollar holders and bond holders.

It’s technically possible still.

But the escape velocity necessary to pull away from the gravitational pull of this black hole is much greater than the political will and capabilities needed to actually pull it off. As a nation, we haven’t even managed to balance our checkbook in 22 years.

Which is why, when it comes to the United States’ fiscal position, we have already passed the relative event horizon… even though most people think we’re still in the safe zone.

This story is playing out everywhere

The remarkable thing about our modern monetary era is that every single country in the world is operating on an unbacked fiat currency. And collectively, the debt position for the world is even worse than it is in the United States. Which means that every country is closer to the debt-spiral black hole than the U.S. is.

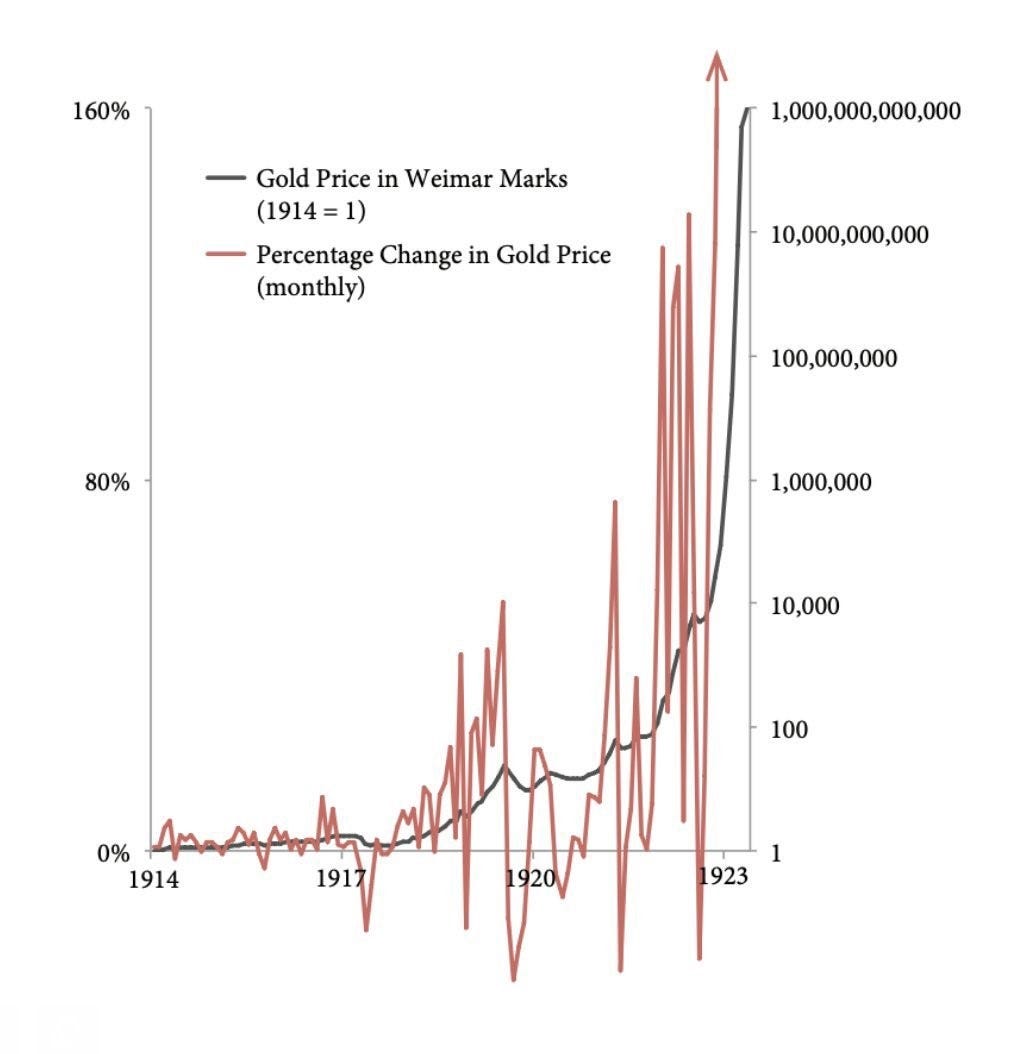

As the gravitational pull of the debt spiral accelerates, the only way to stave off default will be printing more money. Incidentally, printing more money will ensure eventual collapse, but only after the vicious cycle of money printing causing hyperinflation and even more money printing.

In that sense, the end result for all fiat currencies (meaning, every currency in the world) will be Weimar Germany-style hyperinflation.

Forget escape velocity – find the escape pod

Of course, you don’t have to be trapped by the hyperinflationary pull of the debt-spiral black hole. You don’t need the established monetary system to achieve escape velocity – you just need to find the escape pod.

You can opt out of hyperinflation by choosing to store your value in “hard money.” Historically, this meant gold — now, it means gold + Bitcoin.

You may have once thought that Bitcoin was internet Monopoly money; perhaps now it’s time to reconsider whether it’s actually your escape from the debt-spiral black hole.

Did you find that Bitcoin analysis informative? You have a choice now:

Leave this page & forget how to find my work again, OR

Sign up for this free weekly Bitcoin newsletter to receive posts like this. My goal is to help you understand why Bitcoin could be the key to growing your wealth this decade: 👇👇👇

Share this post via email or Twitter:

Excellent post mate! I guess an alternate ending to this story might be the gov't introduction of CBDC as replacement for broken dollar in a "great reset". It seems they're already going hard after bitcoin as a potential competitor for CBDC via Operation Chokepoint, no?

Another absolute banger Jesse - my conviction gets stronger every time!