The decline of US hegemony & the changing monetary world order

The decline of US hegemony, the rise of BRICS, and what it means for the future of money

Before we get going:

If you haven’t heard, Twitter is clamping down on Substack links… so you may not see these articles in your Twitter feed anymore.

Get on the email list to receive my work — delivered straight to your inbox so you don’t miss it.

This includes these Bitcoin & Macro updates, previously reserved for investors in my fund — but now, delivered to Substack subscribers every weekend:

Thanks for your support! Okay, now on with our story…

A Silicon Valley Bank employee recently told me that in the few months leading up to SVB’s collapse, it felt like business as usual. There was a little more emphasis on bringing in new deposits, but that was it.

We think about bank runs as a switch that gets flipped overnight, filling customers with panic and a desperate need to get their money out as soon as humanly possible. But a run on the bank starts slow at first, gradually snowballing into an existential crisis. From the inside, you might not even notice that customer behavior has changed – that decades of accumulated faith & confidence is rapidly draining away.

In fact, it’s happening right now, right in front of your eyes. Have you noticed?

No, you’re not an employee at this bank. But you are on the inside – a beneficiary of a system. It’s easy to grow complacent with this system, because it has existed for our entire lives, and it manifests as abstract policy decisions made at echelons of power above and beyond national politics.

The system is US global hegemony. And the bank run has begun.

Bretton Woods III

We talk about US hegemony as a commonplace idea, but what exactly does it mean? A dictionary definition: “preponderant influence or authority over others – domination.” And that has been the reality of US global power since WW2, and especially in the three decades since the disintegration of the USSR. Domination has been the norm for so long that we have collectively slipped into the complacent trap of assuming it will always be so.

But the world changed a year ago.

From my February 2022 update:

“Putin's gambit: Force the hand of the US and its Western allies to engage in economic warfare in order to disrupt the USD trade for Russian oil... creating the justification for transitioning to selling oil on your terms (either to your new uncomfortable bedfellow, China, or to a West that is so dependent on Russian energy that they come back to the negotiating table - ideally, both).”

This was Putin’s principal goal with his incursion into Ukraine – any territory gained would be a secondary win. I went on to note that as of February 2022, Putin had already achieved his goal on this front: “Without a doubt, Putin received the economic Casus Belli he needed in order to justify disrupting the USD oil market: the West cutting off Russia from SWIFT and freezing its central bank foreign currency reserves.”

We can trace all of the accelerating geopolitical shifts of the last year back to that seismic event.

Here’s the perspective of Zoltan Polzsar, a prominent macroeconomic analyst at Credit Suisse, who neatly summarized the magnitude of the moment:

"Bretton Woods II was built on inside money, and its foundations crumbled a week ago when the G7 seized Russia’s FX reserves"

"We are witnessing the birth of Bretton Woods III – a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the Eurodollar system and also contribute to inflationary forces in the West."

"From the Bretton Woods era backed by gold bullion, to Bretton Woods II backed by inside money (Treasuries with un-hedgeable confiscation risks), to Bretton Woods III backed by outside money (gold bullion and other commodities)."

Not known for being a cryptocurrency believer, he finished the note with this final line: "After this war is over, “money” will never be the same again…and Bitcoin (if it still exists then) will probably benefit from all this."

In my February 2022 update, I summarized where we stood:

“The long and short of it all is that the violation of central bank foreign currency reserves will be looked back on as the demarcation point where the global monetary system (that was imposed on the world by the unipolar might of the United States in the early 70s)... ended. In its place, the international community will have to converge on a new de facto monetary system, as the hegemonic dominance of the United States yields to a multipolar balance of power based on commodities production and trade.”

BRICS and Multipolarity

When a single global superpower dictates terms to the rest of the world, everyone else gets the short end of the stick. This has been particularly vexing to countries on the rise and countries with value systems incompatible with Western democratic ideals.

Enter the BRICS coalition. Originally an informal acronym grouping of important emerging economies (Brazil, Russia, India, China, South Africa), the group has become a formal coalition of countries sick of taking directions from the G7 powers and the post-WW2 world order dominated by the USA.

It’s a coalition united not by shared values or geography, but by mutual self-interest. In particular, these countries are tired of having to use the US Dollar in international trade & weary of unfavorable trade deal terms for their exports.

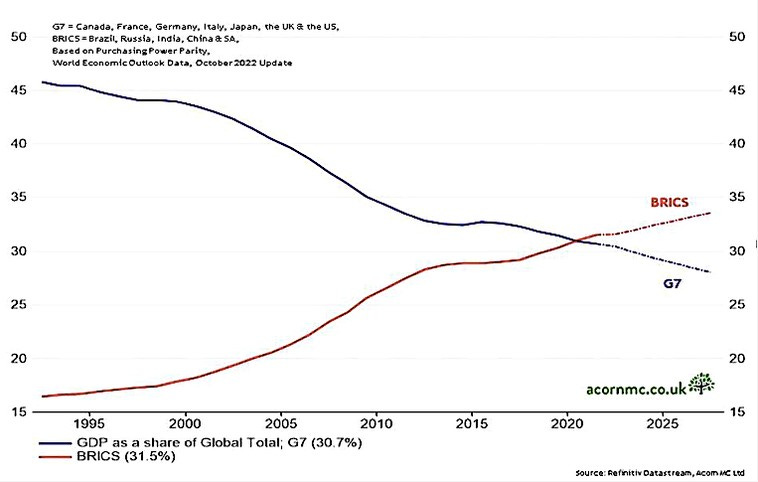

For years, the economic strength of the BRICS nations has grown relative to the G7 nations. Recently, the BRICS nations surpassed the G7 nations in GDP:

But the global status quo was established long before the BRICS nations became economic powerhouses. As such, to upend the G7’s control on world affairs and assert their interests, the BRICS nations needed a flashpoint – some jarring event to justify and catalyze changes to the world order.

And that’s what happened a year ago when the US froze Russia out of its foreign currency reserves and cut them off from the SWIFT banking system.

This marked the end of the Bretton Woods II global monetary system that has been in place since 1971 & the beginning of Bretton Woods III – an emerging era of commodity-based neutral reserve currencies. What has happened since?

A year of change

Lately, there have been a lot of unusual headlines. Events that individually raise an eyebrow, but collectively paint a picture of a world rapidly re-orienting away from American hegemonic power. Here are some of them:

Russia

Iran

India

Saudi Arabia

Mexico

Mexican President Obrador: United States cannot talk about human rights while Julian Assange is detained, cartel violence while it bombs the Nord Stream pipeline, or Democracy when it arrests opposition candidate Donald Trump

Can you imagine this kind of anti-American rhetoric from our closest neighbor a decade ago?

Mexico, Saudi Arabia agree to strengthen economic ties

As part of this, Mexican Foreign Minister Marcelo Ebrard said the country shares the vision and values of the BRICS group, stirring rumors that Mexico may try to cozy up to (or even attempt to join) BRICS

South Africa

Former President Mbeki: "When Russia is trading with China, there is no reason to use the Dollar, none."

Foreign Minister Pandor reports “huge” interest in joining BRICS. Letters on her desk: "Saudi Arabia is one," she said. "United Arab Emirates, Egypt, Algeria, and Argentina," as well as Mexico and Nigeria.

China

It has been a busy year for countries who have long chafed under the yoke of US supremacy. All of the above has happened since the US froze Russia’s foreign currency reserves and locked them out of the SWIFT system.

And it would be a mistake to assume that things will normalize from here. If anything, the G7’s impotence at effectively reprimanding these defiant actions will open the door further for more ambitious initiatives.

The Changing World Order

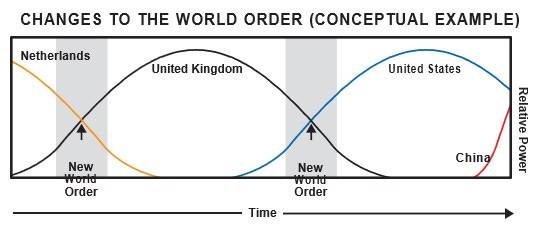

In 2020, Ray Dalio (founder of Bridgewater Associates, the world’s largest hedge fund) released his excellent “The Changing World Order.” In it, he articulates how national superpowers rise and fall based on the inevitable lifecycle of their internal characteristics.

Rising powers invest in themselves and incentivize growth, which turns them into dominant powers that become complacent and can’t resist cheap debt, which turns them into declining powers that accelerate their downfall by printing money when nobody will lend to them anymore.

And this lifecycle is nothing new. It has been a consistent thread through history:

In Dalio’s view, the above data can be summarized in terms of the rise and fall of the dominant global power like this:

The implication here is quite clear – in Dalio’s opinion, we are living in the decline of American power and the rise of China. That is certainly happening in many ways – specifically as China encourages the BRICS coalition to cast-off American influence, clearing the path for China to assert its interests (in Taiwan, for example).

Historically, the dominant sovereign power’s currency has always become the global reserve currency. This is a natural outcome of the dominant country’s currency being the most stable and trustworthy — chiefly important qualities for the international community seeking a suitable reserve currency. And it’s this “exorbitant privilege” of global reserve currency status that truly elevates the dominant global power up to hegemonic superpower.

However, Dalio makes a major oversight in concluding that this will happen again. China’s currency will not become the global reserve currency.

Now let’s dig in to:

What Ray Dalio gets wrong here

What the Changing World Order means for your portfolio

Why Bitcoin will play a major role in the new world order

What Ray Dalio gets wrong

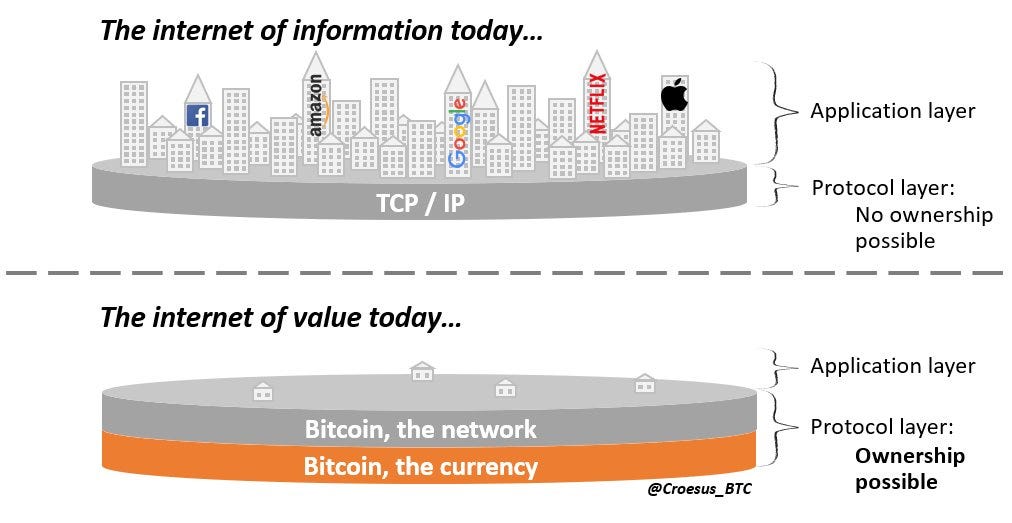

For the first time in history, there is a super-sovereign ascendant power: the Internet. And it has its own currency: Bitcoin.

As Twitter founder Jack Dorsey puts it, “Bitcoin is the native currency of the Internet.”

We are living in the digital age. As established earlier, currencies gain reserve currency status as a result of being the most stable and trustworthy option for parties to mutually settle on for international trade. That’s all. It’s not a trophy that the world’s superpower gets to claim; it’s a natural game theoretic outcome based on the shared preferences of parties involved in international trade.

The historical pattern of the rise and fall of national currencies as the preferred reserve currency of the world is not an iron rule. Instead, it is an outcome of the strongest nation having the most trustworthy currency. But now, would-be reserve currencies must also contend with a non-sovereign currency whose trustless design guarantees the rights of all holders.

Through the innovative application of decentralized networking and cryptographic math, this digital currency more perfectly serves the interests and needs of counterparties involved in international trade. All that’s stopping Bitcoin’s widespread use is that it’s still very early in its growth and maturation as an asset, which results in unpalatable volatility for reserve currency purposes.

Over the coming decade, companies and governments all over the world will have to choose between the following options:

A CCP-administered CBDC backed by oil or gold supposedly held by China

A US Dollar undergoing high inflationary debasement

A non-sovereign, hardcapped supply, digital gold with perfect trustlessness and verifiability

What multipolarity means for your portfolio

For the last 40 years, commodities have underperformed financial assets like stocks and real estate. This trend was fueled in large part by a 40-year downtrend of interest rates (which drives up valuations for financial assets where discount rates impact the present value of future cash flows).

These cheap interest rates were fueled in large part by international demand for the stability and low-risk returns of US Treasuries. That era is over. Nobody is buying US Treasuries anymore.

And as we’ve seen in the above analysis, the world is moving fast towards a multipolar world. In a multipolar world, there is no singular reserve asset that offers stability and low-risk returns, like US Treasuries have afforded over the last 40 years.

Except there is something new that gets more stable every four years & offers reliable returns (even if that fact is not widely understood): Bitcoin.

Why Bitcoin will play a major role in the new world order

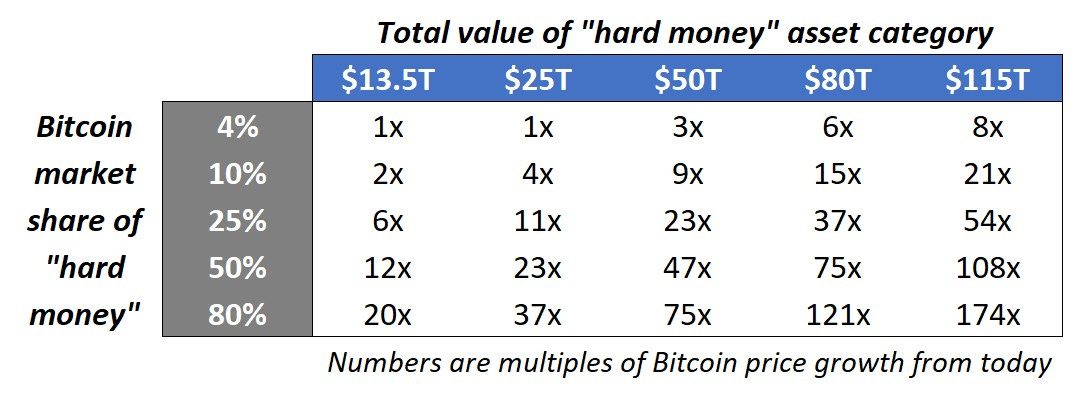

In a previous update, I made the case that just as “hard money” was valued at parity with the world’s equities in 1980 (following the stagflation of the 70s and the strong performance of gold during that inflationary era), the same could happen over the coming decade.

If this plays out, the total value of “hard money” (gold + Bitcoin) could grow from $13.5T today to $115T. This could mean remarkable growth for Bitcoin, depending on its relative share of the “hard money” category in the future:

For these higher multiple scenarios to happen, it will require that individuals, companies, and countries increasingly recognize that Bitcoin’s design of increasing scarcity delivers reliable returns every four years. For that to become inescapably clear, all that’s needed is for another halving or two to play out, causing the supply shock to manifest as positive price appreciation.

There have only been three halvings in Bitcoin’s history, which currently makes it a bit of a stretch to confidently say that Bitcoin’s halvings cause price appreciation. But, that picture will get a lot clearer when five cycles have played out – never repeating exactly, but always rhyming.

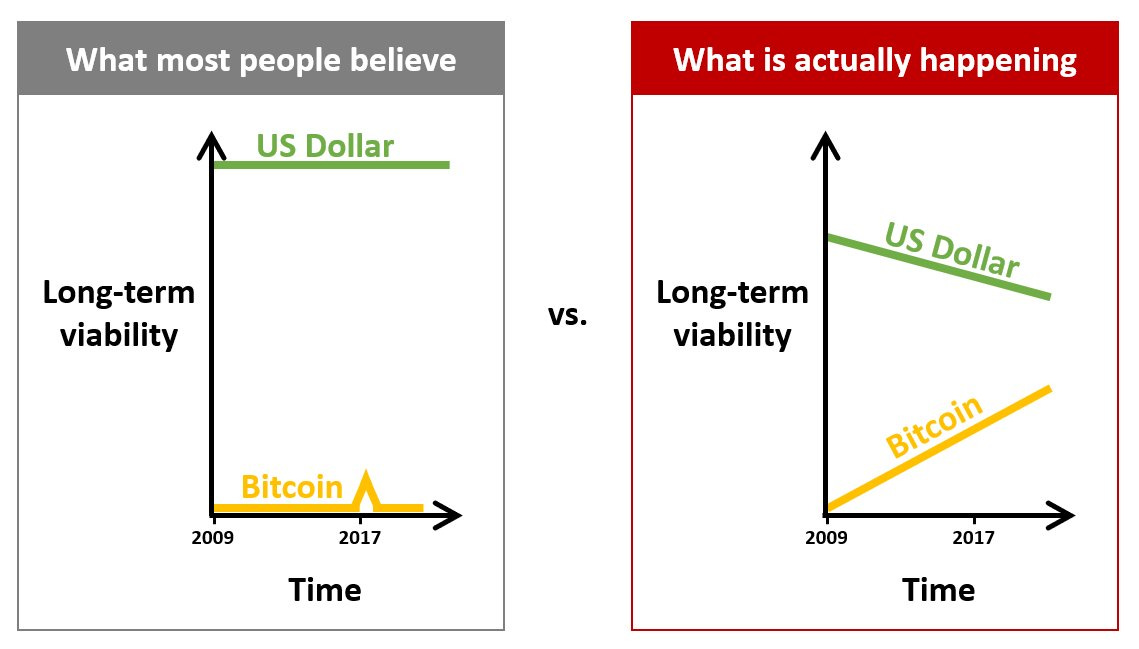

In Summer 2020, I put out the following conceptual visualization of what’s going on. The trends remain on track. Yet 99%+ of people have yet to figure out what’s happening.

Decide how to position yourself before they do.

Did you find that analysis informative? You have a choice now:

Leave this page & forget how to find my work again, OR

Sign up for this free weekly Bitcoin & Macro newsletter to receive posts like this. My goal is to help you understand why Bitcoin could be the key to growing your wealth this decade: 👇👇👇

Fantastic piece. There's is very hard line of demarcation in the world of macro analysis: those who see the world as it is plus they understand Bitcoin (like Jesse), and then there are those who see the world as it is but omit Bitcoin from their framework (like Steve Hanke, Brent Johnson, Erik Townsend, & even the amazing Jeff Snider). The second group has more knowledge and experience than I will ever have, but without Bitcoin in their calculations I have never been able to accept their conclusions.

If Bitcoin is the missing ingredient in one's analysis, then there's no way to accurately see the future. Bitcoin alters the trajectory of all paths forward in global money.

But Jesse gets all this, and his vision is crystal clear.

"non-sovereign currency whose trustless design guarantees the rights of all holders"

hits so hard