#63.4 - March 2023: BTFP is the start of Quantitative Easing

My honest thoughts on the state of the market

I’ve been writing a monthly Bitcoin update for investors, friends, and family every month for the last 5 years - actually, 63 months, to be exact.

Subscribe - for free - to receive these updates and my other Bitcoin content directly to your inbox:

After the splashy headlines, there’s the reactionary measures. On the surface, it may feel like not much is happening right now with comparatively dull headlines (vs. the last few weeks), but that’s because minimizing panic is the objective. Making things sound uneventful is a primary goal – but make no mistake, all is not well. This week, we will look at what has been happening under the surface since the calamity of Silvergate, Silicon Valley, Signature, First Republic, and Credit Suisse.

First, it’s worth reiterating that something like this was inevitable. As explored in last week’s update, it was the Fed’s rate hikes from ~0% to 5% over the last year that put tremendous strain on the financial system. It was only a question of what would break and when.

Back in the August 2022 update for Paid subscribers, I summarized my expectations: “the Fed is going to pretend to be Volcker (hike rates) until something breaks in the credit markets and liquidity seizes up, at which point they will have no choice but to launch the latest round of printing on a bigger scale than ever before - my guess is sometime in 1H 2023.”

Well, here we are. With bank balance sheets weakening and bank runs forcing banks to realize heavy losses from simply holding long-dated US Treasuries (the “risk free” asset for the world), the Fed has had to step in with its latest program to help prop up the banking system. The Bank Term Funding Program (BTFP) is not technically a bailout of banks (it is not handing cash directly to the banks to add equity to their balance sheets), but it is still very much a bailout by any practical measure.

What the BTFP does is promise to pay banks “face value” for the bonds that are currently heavily underwater – to ensure that the banks experience no losses on these assets. Officials have been quick to proclaim that the BTFP will not cost a single taxpayer dollar – this is technically true, but completely disingenuous, because the BTFP will be paid for with dollars printed out of thin air. Which means, the BTFP will be paid for via the sneaky dilution of all existing dollars, which manifests via more inflation. So, take a look at your bank account balance and subtract ~1% of purchasing power from it – thanks for your contribution to the BTFP to *definitely not* bailout the banks, again.

Of course, we can’t blame the Fed for launching the BTFP – they don’t really have a choice at this point. Their hand was forced, as a result of interest rates being hiked from ~0% to 5% over the last year. The party responsible? You guessed it… the Fed.

So, what’s happening under the surface this week that you should know about?

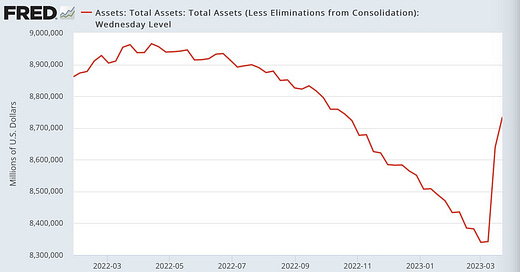

With the BTFP, QT is over and QE is back on. The Fed added $300B to its balance sheet a week ago, and ~$100B over the last week. This means that in just two weeks, they have offset roughly 2/3 of the balance sheet reductions they achieved during 15 months of QT.

Because of stress in the system, some non-G7 central bank just borrowed $60B (the maximum allowed) from FIMA, the Fed’s program for foreign repo. This means that the Fed is lending to foreign central banks in an effort to support the entire global banking system.

Overall, this means that the Fed actually provided more financial stimulus to the banking system this week vs. the previous week. I was surprised to learn this, as the Fed’s balance sheet increased by a smaller amount this week. But, in terms of total liquidity provided to the system (balance sheet increase + loans provided), this week was bigger.

This week, the Fed went ahead with a small interest rate hike this week (0.25%). In my update last week, I highlighted that this could happen: “the Fed could still try to raise rates and stay tough on inflation (while appearing in control), when in reality they have switched back to money printing and QE is the law of the land. We shall see if they try to play that card at the next Fed meeting – if they do, it will only be for optics, and the market is already pricing in interest rates 100 bps (1%) lower by EOY 2023.”

This 0.25% rate hike amounts to exactly that kind of theater – the Fed gets to look like they’re still in control. But the market knows it’s just for show. At this point, the market is pricing in a 92% likelihood that there won’t be an additional hike at the next Fed meeting.

In other words, right now is likely the peak Fed interest rate. The only question is how many months before rate cuts begin later this year.

Meanwhile, officials are trying to instill confidence in the banking system… but managing to do the opposite. On Thursday, Treasury Secretary Yellen stated, “I am prepared for additional deposit actions if warranted.” This caused bank stocks to immediately tumble, as the market interpreted this to mean that banks are still in bad shape and might need more help.

On Friday, Yellen convened an unscheduled meeting of the Financial Stability Oversight Council (FSOC). The same day, German Chancellor Olaf Scholz proclaimed, “the banking system is stable in Europe.”

Reminder that just days earlier, European mega bank Credit Suisse was absorbed by UBS in a fire sale. Clearly, all is not well. And this is especially true given that an even bigger European bank is currently showing signs of major distress.

Let’s take a closer look at:

What banking giant could be the next domino to fall in this ongoing banking crisis

Which American financial services giant could be in trouble too

What systemic driver shows that the banking crisis is far from over

This analysis has previously been reserved for investors in my fund, but now I’m making it available to Paid subscribers on Substack as well.

Consider upgrading to a Paid subscription OR try a 7-day free trial to give it a look.

Keep reading with a 7-day free trial

Subscribe to Once-in-a-Species to keep reading this post and get 7 days of free access to the full post archives.